The financial markets have responded rather well to Fed’s rate hike overnight. The close in major US indexes was strong while Asian stocks also follow higher. Yen is clearly pressured and is extending recent decline, following rally in benchmark treasury yields. On the other hand, Australian and Canadian Dollar are strong. Dollar and Euro are mixed for now, together with Sterling, awaiting BoE rate hike.

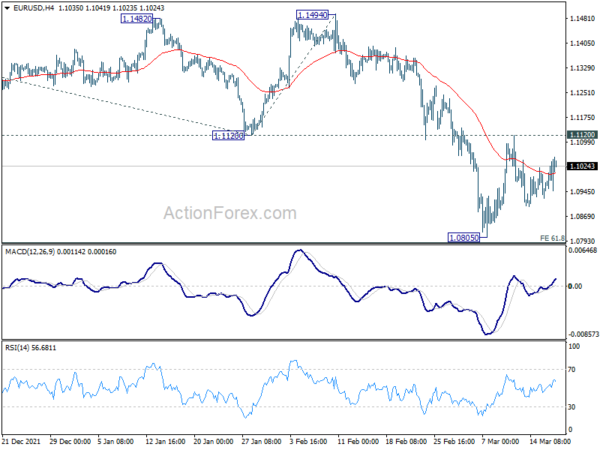

Technically, EUR/USD traders are still refusing to make up their mind as range trading continues. For now, with 1.1120 support turned resistance intact, downside break out through 1.0805 low is expected, for resuming whole down trend from 1.2348. However, strong break of 1.1120 will be an initial sign of bullish trend reversal, and would bring rebound to 1.1494 structural resistance. But for now, it’s unlikely to happen either way soon.

In Asia, at the time of writing, Nikkei is up 3.49%. Hong Kong HSI is up 5.86%. China Shanghai SSE is up 2.24%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield is up 0.0011 at 0.205. Overnight, DOW rose 1.55%. S&P 500 rose 2.24%. NASDAQ rose 3.77%. 10-year yield rose 0.028 to 2.188.

S&P 500 eyes 34179 resistance after post FOMC rebound

Markets responded rather well to Fed’s rate hike, statement and new economic projections. In short, Fed raised federal funds rate target by 25bps to 0.25-0.50%. In the updated dot plot, 12 of the FOMC participants expected federal funds rate to reach 1.75-2.00% by then end of 2022, that is, 1.50% above the current level. The end point of current tightening cycle was also raised from 2.1% to 2.8%, and pulled ahead to 2023. Balance sheet runoff could start at a “coming meeting”, that is, May.

Suggested readings on Fed

Major stock indexes closed sharply higher overnight. S&P 500 is now having 34179.07 near term resistance in radar. Firm break there will argue that the pull back from 36952.65 has completed with three waves down to 32272.64 already. Stronger rally would then be seen be seen back to retest 36952.65 high.

The strong support from 23.6% retracement of 18213.65 to 36952.65 at 32530.24, which is a rather bullish sign from long term perspective. Even though break of 36952.65 high is not expected at the first attempt. The range for consolidation could have been set already.

BoJ Kuroda: Too early to debate specifics on stimulus exit

BoJ Governor Haruhiko Kuroda told the parliament today, “it will take more time to achieve our 2% inflation target in a stable manner, so it’s too early to debate specifics on how to exit from easy policy.”

Core consumer inflation in Japan is generally expected to climb up in the months ahead, with prospect of hitting the 2% target. But Kuroda talked down the significance of such development. “I don’t think Japan is in a condition where inflation stably hits 2%, even when the impact of cellphone fee cuts taper off and energy prices rise further,” he said.

Kuroda just reiterated that BoJ will consider stimulus exit when 2% inflation is achieved. And, “in doing so, we will guide monetary policy to ensure markets including those for Japanese government bonds remain stable.”

Australia employment rose 77.4k in Feb, unemployment rate dropped to 4%

Australia employment grew 77.4k in February, nearly double of expectation of 40.0k. Full-time jobs rose 121.9k while part-time jobs dropped -44.5k. Employment was around 202k above pre-Delta high of June 2021.

Unemployment rate dropped from 4.2% to 4.0%, better than expectation of 4.1%. That’s the lowest level since August 2008. Participation rate rose 0.2% to 66.2%. Monthly hours worked rose 8.9%, or 149m, to 1813m hours.

From New Zealand, GDP grew 3.0% qoq in Q4, below expectation of 3.2% qoq.

AUD/JPY uptrend resumes, follows CAD/JPY

AUD/JPY rises to as high as 87.05 today, following broad based selloff in Yen. The break of 86.24 high confirms resumption of larger up trend from 59.85 (2020 low). The next near term target is 161.8% projection of 78.77 to 84.27 from 80.34 at 89.23, which is close to 90.29 long term resistance.

In the bigger picture, the whole down trend from 105.42 (2013 high) has completed with three waves down to 59.85. The support from 55 week EMA was a medium term bullish sign, and argues that AUD/JPY is reversing the whole down trend from 105.42. Sustained break of 90.29 would confirm this case and target 105.42 again.

CAD/JPY’s picture is similar. It’s now extending the up trend from from 73.80, (2020 low). Break of 100% projection of 87.42 to 92.16 from 89.21 at 93.95 should pave the way to 161.8% projection at 96.87 next.

The down trend from 106.38 (2014 high) has completed with three waves down to 73.80. 91.62 key resistance has been taken out already (corresponding to 90.29 in AUD/JPY). Further rally is now expected as long as 89.;21 support holds, towards 106.48 high.

BoE to continue tightening today, GBP/CHF extending rebound

BoE is widely expected to raise the Bank rate again by 25bps to 0.75% today. The main focus is the voting. Last time, a slim majority of five MPC members won the vote and hiked only 25bps. Four members had indeed voted for a 50bps hike.

With Russia invasion of Ukraine, inflation would likely stay higher for longer, and might even peak above BoE’s own projection of 7.25% in April. Policy makers are clearly getting more alerted on the outlook and some might push for front-loading the rate hikes. But others could prefer to wait for new economic projections in May before acting more aggressively. The voting would reveal the balance inside MPC.

Here are some previews:

GBP/CHF rebounded quickly after war triggered selloff. A short term bottom is in place at 1.2112 and further rally is expected as long as 1.2255 minor support holds. But a strong break of 1.2598 resistance is needed to confirm completion of the down trend from 1.3070. Otherwise, medium term outlook will be neutral at best, with prospect of another fall through 1.2112.

Elsewhere

Swiss will release trade balance in European session while Eurozone will release CPI final. Later in the day, US will release jobless claims, housing starts and building permits, Philly Fed manufacturing survey and industrial production.

USD/JPY Daily Outlook

Daily Pivots: (S1) 118.25; (P) 118.69; (R1) 119.19; More…

USD/JPY’s rally resumed after brief consolidation and hits as high as 119.11 so far. Intraday bias is back on the upside. Next near term target is 100% projection of 109.11 to 116.34 from 114.40 at 121.63. On the downside, break of 117.68 support is now needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Sustained break of 118.65 (2016 high) will pave the way to 125.85 (2015 high) and raise the chance of long term up trend resumption. This will remain the favored case as long as 113.46 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q4 | 3.00% | 3.20% | -3.70% | -3.60% |

| 23:50 | JPY | Machinery Orders M/M Jan | -2.00% | -2.20% | 3.60% | 3.10% |

| 00:30 | AUD | Employment Change Feb | 77.4K | 40.0K | 12.9K | 28.3K |

| 00:30 | AUD | Unemployment Rate Feb | 4.00% | 4.10% | 4.20% | |

| 07:00 | CHF | Trade Balance (CHF) Feb | 4.20B | 3.18B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 5.80% | 5.80% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 2.70% | 2.70% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 0.75% | 0.50% | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 9–0–0 | 9–0–0 | ||

| 12:30 | USD | Initial Jobless Claims (Mar 11) | 221K | 227K | ||

| 12:30 | USD | Housing Starts Feb | 1.70M | 1.64M | ||

| 12:30 | USD | Building Permits Feb | 1.87M | 1.90M | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Mar | 15 | 16 | ||

| 13:15 | USD | Industrial Production M/M Feb | 0.50% | 1.40% | ||

| 14:30 | USD | Natural Gas Storage | -71B | -124B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals