U.S. Highlights

- The U.S. Federal Reserve raised interest rates for the first time since 2018, and signalled it is prepared to raise rates substantially in order to contain inflation.

- Oil prices were down this week as renewed lockdowns in China raised worries about demand. Uncertainty on the outlook is very high given Russia’s war in Ukraine, and we have marked down our own economic forecast released this week.

- U.S. economic data continued to show resilience through February, with another jump higher in housing starts. Retail sales also showed people spending more on dining out, boding well for the expected pick up in services spending.

Canadian Highlights

- The heat from the Canadian economy just won’t let up. CPI is now at a 30-year high and elevated commodity prices should continue to this trend at least over the next month.

- Housing statistics continue to show incredible strength, with sales, listings, and prices all increasing in February.

- With Canadians spending more on housing-related items, other essentials, and durable goods, retail sales data grew 3.2% in January.

U.S. – The Fed Amps Up its Fight Against Inflation

There was a lot going on for markets this week: The Fed’s first interest rate hike since 2018, a busy economic data calendar, and the ongoing war in Ukraine. The most notable financial market move was the tumble in commodity prices, which has buoyed sentiment on equity markets worried about the impact on the global economy from sky-high energy costs. However, part of the reason for lower oil prices is not so positive. China has brought in new Covid lockdowns to restrain growth in cases, which is expected to dampen demand for energy.

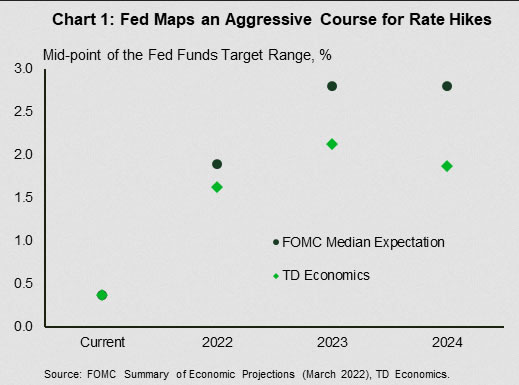

As was widely expected, the Fed raised its policy rate 25 basis points to a range of 0.25-0.50%. What surprised markets was the sharp move up in the number of hikes Fed members expect. The median expectation of Fed members is for the midpoint of the range of the funds rate to be 2.8% at the end of next year, up from 1.6% in December, and above its long-run expectation of 2.4%. The Fed is behind the curve on containing inflation, and it needed to demonstrate that it is prepared to act quite aggressively to contain it and preserve its credibility.

Whether we actually see that many rate hikes is another matter. The Fed’s rate hike projections are not always born out. In September 2018, when it was in the middle of raising rates, it projected the funds rate would reach 3.1% by the end of 2019, above its estimate of the long-run rate of 3%. Instead, the Fed only raised rates to 2.5% before having to cut rates back to 1.75% as inflation was weaker than expected and the yield curve inverted – a classic signal that markets were starting to price in a recession.

Our latest forecast also downgraded economic growth, upgraded inflation, and raised the number of rate hikes expected. However, we expect fewer hikes than the Fed (Chart 1). Our forecast for economic growth is a bit softer than the Fed, and is consistent with our view that fewer rate hikes are required.

Rate hikes take time to slow economic growth, but borrowing rates like mortgages, have already moved up. The average 30-year mortgage rate moved above 4% for the first time since 2019. Even so, home builders ramped up the pace of housing starts in February to 1.769 million units, coming in ahead of market expectations, and the highest monthly reading of the pandemic (see report). However, building permits were down for both single and multi-unit projects, pointing to some giveback in March. The U.S. housing market could certainly use some new supply with the existing home market drum tight, as we discussed in our recent report.

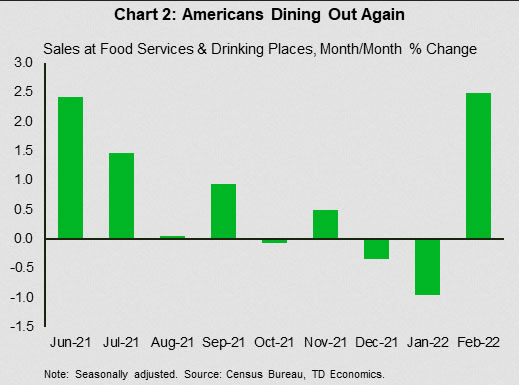

February retail sales were another sign of strength in the U.S. economy. January sales were revised upwards substantially, suggesting consumer spending is looking a bit stronger in Q1. There were also signs that consumers are shaking off their caution and heading back out to restaurants and bars, as fears of the Omicron variant subsided. Sales at food services and drinking places jumped up a healthy 2.5% in February (Chart 2) after falling through December and January. Overall, between higher rates, higher energy prices and, dwindling fiscal support, we expect the pace of growth in U.S. economy to slow through 2022. However, we expect low unemployment and pent-up demand to support a solid 2.3% pace through the year.

Canada – Canadian Data Continue to Show Signs of Overheating

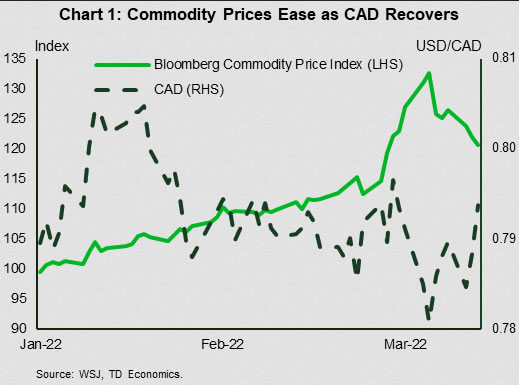

Sentiment turned positive this week, with broad equity markets posting their first weekly gains since Russia invaded Ukraine. Declining commodity prices were a positive catalyst, with oil prices down around 5% and European natural gas down around 25%. For Canadian markets, the commodity-heavy TSX still eked out a modest gain, while the loonie rose back above 79 U.S. cents (Chart 1). A moderation of geopolitical risks alongside positive economic data saw government bond yields in Canada rise to their highest levels since 2018.

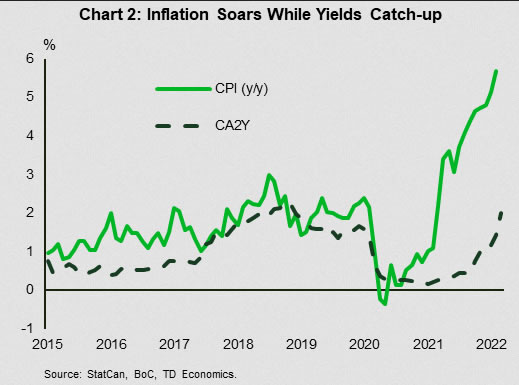

The improvement in sentiment has refocused investors on the strength of the Canadian economy. The data out this week reinforced that positive narrative. Top of the list, consumer price inflation accelerated to a 30-year high of 5.7% year-on-year (y/y) in February. Though energy and food prices led the move higher, even excluding these two components, price growth was up 3.9% y/y, well exceeding the pace of wage gains.

Though higher inflation is likely to weigh on consumer spending in the months ahead, the retail sales data for January were robust. The data showed a 3.2% gain on the month, driven by spending on motor vehicle/parts, furniture, electronics, and building materials. With the unemployment rate below its pre-pandemic level, pent-up demand had Canadians ready to spend. How long the spending spree can continue will depend on how quickly income can catch up to inflation.

Canadian housing data continued to show the impact of past monetary stimulus, as existing home sales climbed 4.6% month-on-month (m/m) in February, while the average price of homes sold and the MLS index (a like-for-like home price measure) were up 2.3% and 3.5% on the month, respectively. Thankfully, there are some signs of balance returning to the housing market with new listings jumping 24% on the month, bringing the sales-to-listings ratio to 75.3% – the lowest since last autumn. Supply may also lend a hand as housing starts were up over 7% in February, rising to 247 thousand units. More inventory should help to slow price gains, though this won’t come online in time for the spring buying season, which is just starting up now.

The economic data this week reinforced our view that the Bank of Canada will have to be aggressive in raising rates at its upcoming policy meetings. With inflation likely to remain above 3% through this year, the central bank is expected to lift the overnight rate to 2% over the next 12 months, up from 0.5% today. This has bond yields moving up, with the Canada 2-year and 10-year yield reaching 1.9% and 2.2%, respectively. Expect more to come as the Bank sets out to hike rates at the fastest annual pace since the mid-1990s.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals