Yen’s selloff resumes as another week starts on rising treasury yields while Asian stocks are mixed. European majors are also under some selling pressure, with Euro, Sterling and Swiss Franc steady among themselves. Meanwhile, Australian Dollar is performing well together with Dollar, trailed by Canadian and New Zealander. Gold dips notably on Dollar strength and oil price turns softer too. Bitcoin and ethereum ride on buying over the weekend and break through near term resistance.

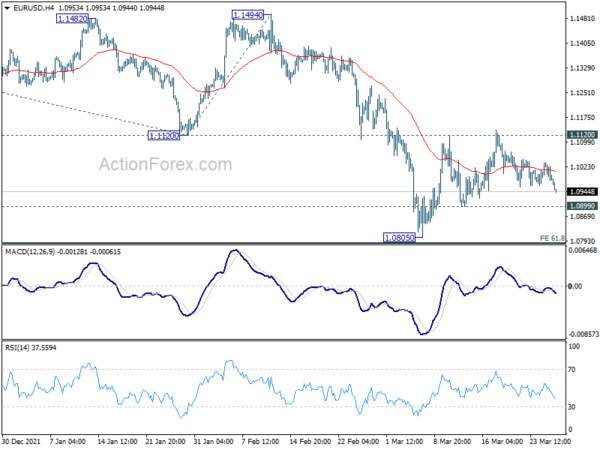

Technically, EUR/USD is extending near term pull back and it’s heading back towards 1.0899 minor support. Break there should confirm completion of rebound from 1.0805 and bring retest of this low. Also, this should confirm rejection by 1.1120 support turned resistance, and thus, should set the stage for larger down trend resumption. To solidify Euro’s weakness, EUR/CHF should also break through 1.0184 support to extend the fall from 1.0400 to retest 0.9970 low.

In Asia, at the time of writing, Nikkei is down -0.58%. Hong Kong HSI is up 1.11%. China Shanghai SSE is down -0.07%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is up 0.146 at 0.255.

Australian NAB quarterly business confidence dropped to 14, still optimistic growth picture

Australia NAB Quarterly business confidence dropped from 19 to 14 in Q1. Current business conditions dropped from 14 to 9. Business conditions for the next three months dropped from 29 to 21. Business conditions for the next 12 months dropped from 36 to 34. trading conditions dropped from 19 to 12. Profitability conditions dropped from 13 to 7. Employment conditions dropped from 9 to 8. Capex plans for the next 12 months dropped from 34 to 33.

“Overall, the survey continues to paint an optimistic picture on growth – including the potential for a pickup in business investment. This comes despite global events and still some disruption from the virus. That said, the challenges for both business and policy makers remain clear with price pressures continuing to build.”

AUD/NZD extending rally, AUD/CAD to follow

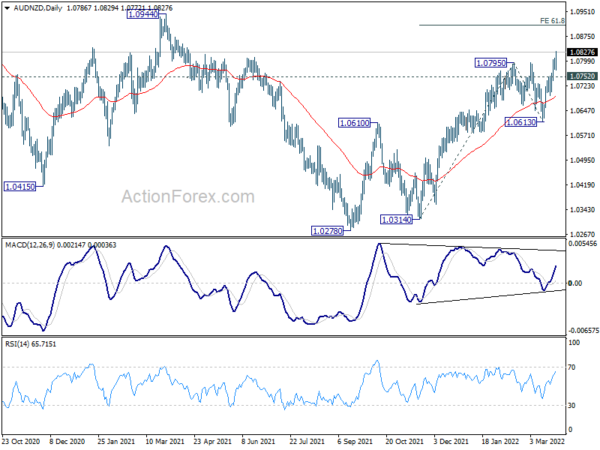

Aussie is outperforming other commodity currencies in the past two weeks. AUD/NZD’s rally extends today to as high as 1.0825 so far. The break of 1.0795 resistance confirms resumption of whole rise from 1.0278. Near term outlook will stay bullish as long as 1.0752 support holds, next target is 61.8% projection of 1.0314 to 1.0795 from 1.0613 at 1.0910.

More importantly, the strong support from 55 week EMA suggests some underlying medium term bullishness. The break of channel resistance from 1.1042 also argues that the correction from there has completed with three waves down to 1.0278. Rise from 0.9992 (2020 low) is likely resuming through 1.1042 towards 1.1289 long term resistance.

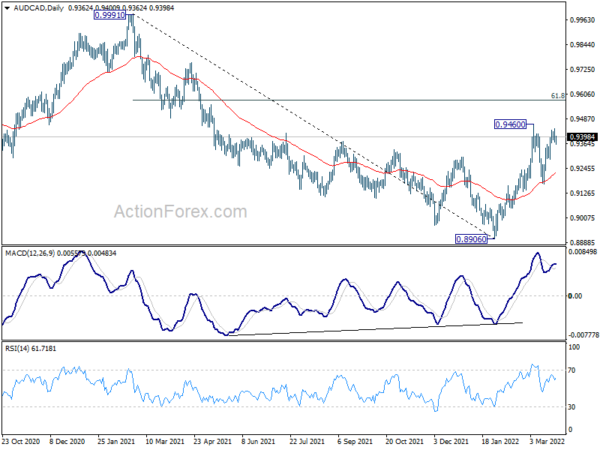

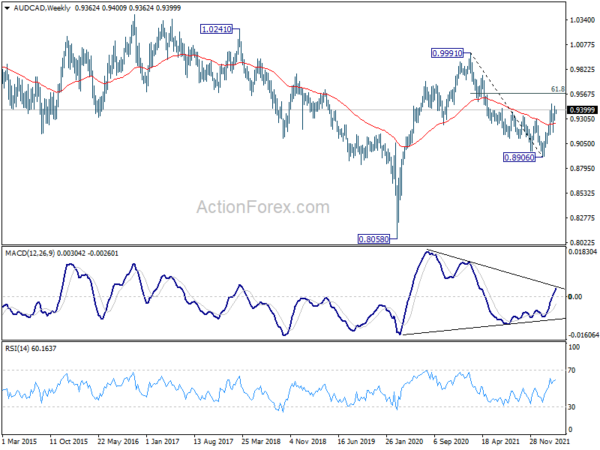

Meanwhile, AUD/CAD is still capped below 0.9460 short term top for now. But the strong support from 55 day EMA gives upside breakout a favor. Break of 0.9460 will resume the rebound from 0.8960 to 61.8% retracement of 0.9991 to 0.8906 at 0.9577. Sustained break there will further affirm the case that correction from 0.9991 has completed at 0.8906. Also, in this case, the larger rise from 0.8058 (2020 low) should be ready to resume through 0.9991 at a later stage.

Bitcoin surges and 50k handle is key

Bitcoin surged over the weekend and broke through 45842 near term resistance. The development confirms resumption of whole rebound from 33000. Near term outlook will stay bullish as long as 44432 support holds. Next target is 100% projection of 33000 to 45842 from 37550 at 50392.

For now it’s too early to conclude the trend in bitcoin is reversing. Rejection by 50392 will argue that rebound from 33000 is merely a correction, and bring down trend resumption through this low at a later stage. But sustained break of 50392 could trigger upside acceleration and solidify trend reversal. So, the level around 50k handle is key.

US NFP, ISM and PCE inflation to highlight the week

US economic data will take center stage this week, with non-farm payroll, ISM manufacturing and PCE inflation featured. Most importantly, markets will look into wages growth to solidify the bet on a 50bps rate hike by Fed in May. Elsewhere, Eurozone CPI flash, Japan Tankan survey, Canada monthly GDP and China PMIs will catch most attention.

Here are some highlights for the week:

- Monday: US goods trade balance, wholesale inventories.

- Tuesday: BoJ summary of opinions, Japan unemployment rate; Australia retail sales; Germany Gfk consumer sentiment, import prices; UK mortgage approvals, M4 money supply; US house price index, consumer confidence.

- Wednesday: New Zealand building permits, ANZ business confidence; Japan retail sales; Germany CPI flash; Swiss KOF economic barometer; US ADP employment, Q4 GDP final.

- Thursday: Japan industrial production, housing starts; Australia building approvals; China PMIs; Germany retail sales, unemployment; UK GDP final; Swiss retail sales; France consumer spending; Eurozone unemployment rate; Canada GDP; US personal income and spending, jobless claims, Chicago PMI; Canada GDP.

- Friday: Australia AiG manufacturing; Japan Tankan survey, PMI manufacturing final; China Caixin PMI manufacturing; Swiss CPI, PMI manufacturing; Eurozone PMI manufacturing final, CPI flash;UK PMI manufacturing final; US non-farm payrolls, ISM manufacturing, construction spending; Canada PMI manufacturing.

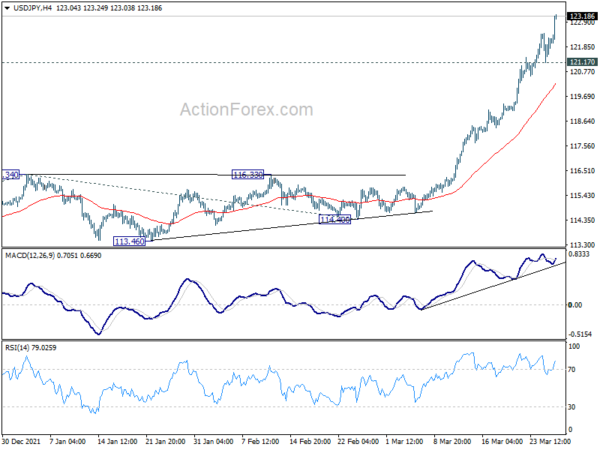

USD/JPY Daily Outlook

Daily Pivots: (S1) 121.37; (P) 121.90; (R1) 122.63; More…

USD/JPY’s rally continues today and intraday bias remains on the upside. Current up trend should target 161.8% projection of 109.11 to 116.34 from 114.40 at 126.09, which is close to 125.85 long term resistance. On the downside, below 121.17 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, up trend from 98.97 (2016 low) in in progress for retesting 125.85 (2015 high). Sustained break there will confirm long term up trend resumption. Next target will be 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04. This will now remain the favored case as long as 116.34 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | USD | Goods Trade Balance (USD) Feb P | -106.0B | -107.6B | ||

| 12:30 | USD | Wholesale Inventories Feb P | 1.30% | 0.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals