The moves in the financial markets are so far rather indecisive. While US stocks rebounded overnight, Asian indexes turned softer. Dollar and Yen are recovering slightly after yesterday’s selloff. Commodity currencies are retreating. European majors are mixed. While Euro and Sterling advanced against the greenback, there is no follow through buying so far.

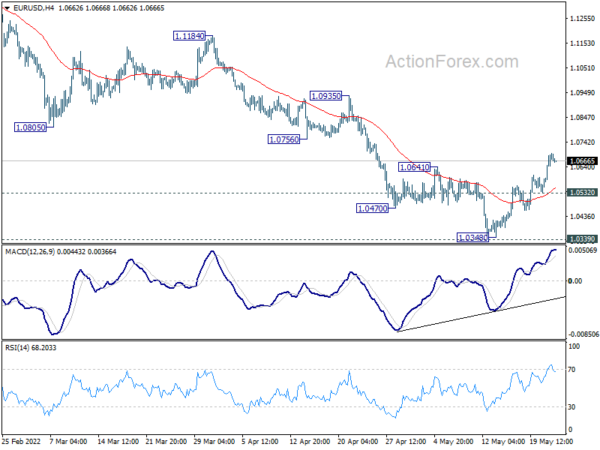

Technically, EUR/USD should have at least made a near term bottom at 1.0348, ahead of 2017 low. To secure further buying in Euro, 1.0359 minor resistance in EUR/CHF and 138.33 resistance in EUR/JPY need to be taken out too. Or, to confirm Dollar’s broad based reversal, 1.2637 resistance in GBP/USD and 1.2712 support in USD/CAD need to be violated. Let’s see which way it goes, or both.

In Asia, at the time of writing, Nikkei is down -0.80%. Hong Kong HSI is down -1.55%. China Shanghai SSE is down -1.24%. Singapore Strait Times is up 0.09%. Japan 10-year JGB yield is down -0.0088 at 0.232. Overnight, DOW rose 1.98%. S&P 500 rose 1.86%. NASDAQ rose 1.59%. 10-year yield rose 0.072 to 2.859.

Fed Bostic: A pause in September might make sense

Atlanta Fed President Raphael Bostic said yesterday that he backed the plan of raising interest rate by 50bps in June and July. But a “pause” in September is also in his baseline view.

“I’m at 50 basis points as long as the economy proceeds as I think it’s going to,” Bostic said. “If inflation starts moving in a different direction than it is right now, I’d have to be open to us moving more aggressively. I do want to make it clear that nothing is off the table. As we go through the months, we will see how it plays out.”

“I have got a baseline view where for me I think a pause in September might make sense,” Bostic told reporters Monday following a speech to the Rotary Club of Atlanta. “After we get through the summer and we think about where we are in terms of policy, I think a lot of it will depend on the on-the-ground dynamics that we are starting to see. My motto is observe and adapt.”

Fed George: Interest rate to be in neighborhood of 2% by Aug

Kansas City Fed President Esther George said, “I expect that further rate increases could put the federal funds rate in the neighborhood of 2% by August, a significant pace of change in policy settings”. Then, “evidence that inflation is clearly decelerating will inform judgments about further tightening.”

“The inflation we are now experiencing is obviously both too high and too broad to dismiss. The central bank’s job is to prevent persistent imbalances from feeding into inflation and unmooring inflation expectations,” she said. “By influencing interest rates, the Federal Reserve primarily affects the demand side of the imbalance. The evolution of its efforts alongside other factors will affect the course of monetary policy, requiring continuous and careful monitoring.”

Japan PMI manufacturing dropped to 53.2 in May, services rose to 51.7

Japan PMI Manufacturing dropped slightly from 53.5 to 53.2 in May, below expectation of 53.8. PMI services rose from 50.7 to 51.7. PMI Composite ticked up from 51.1 to 51.4.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said:

“”Private sector firms reported that the reduced impact of COVID-19 had lifted services activity, most notably in the tourism sector as pandemic-related restrictions were eased further. That said, the renewed introduction of lockdown measures across China and economic sanctions placed on Russia amid the Ukraine war had exacerbated supply chain disruptions, with greater reports of material shortages and severe delivery delays.

“As a result, there was a further intensification in price pressures across the private sector, as firms reported series-record rises in both input and output prices. Moreover, uncertainty regarding the outlook for price and supply conditions dampened business confidence, which was at its softest since August 2021.”

Australia PMI composite dropped to 52.5 in Apr, still a solid expansion

Australia PMI Manufacturing dropped from 58.8 to 55.3 in May. PMI Services dropped from 56.1 to 53.0. PMI Composite dropped from 55.9 to 52.5. All are 4-month lows.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence said:

“The expansion of the Australian economy continued in May at a solid pace… Although manufacturing output was affected by issues of COVID-19 disruptions and poor weather conditions, manufacturing demand remained robust, which had been a reassuring sign.

“Persistent supply chain constraints continue to pose challenges for firms in the private sector, both in terms of input acquisition and price fluctuations. Anecdotal evidence also suggested that firms are concerned with the rising interest rate outlook and the effect on their businesses, all of which are worth monitoring moving ahead.”

New Zealand retail sales dropped -0.5% qoq in Q1, ex-auto sales flat

New Zealand retail sales volume (with price effects removed) dropped -0.5% qoq in Q1, much worse than expectation of 0.4% qoq. Ex-auto sales volume was flat, below expectation of 0.4% qoq. Total value of retail sales rose 0.5% qoq.

12 of the 16 regions showed higher sales values. By region, the largest changes in sales values were in: Auckland – up 3.6% (NZD 387m); Waikato – up 4.2% (NZD 109m); Canterbury – up 1.9% (NZD 70m); Wellington – up 2.3% (NZD 63m).

Looking ahead

PMI from Eurozone, UK and US are the main focuses for today. US will also release new home sales.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2742; (P) 1.2796; (R1) 1.2824; More…

Intraday bias in USD/CAD stays neutral for the moment. Also, with 1.2712 support intact, further rally is still mildly in favor. On the upside, break of 1.3075 will resume the rise from 1.2401. Sustained trading above 1.3022 fibonacci level will carry larger bullish implications. Next target will be 100% projection of 1.2005 to 1.2947 from 1.2401 at 1.3343. On the downside, however, break of 1.2712 support will indicate rejection by 1.3022 key fibonacci resistance, and bring deeper decline back to 1.2401 support.

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness. Break of 1.2005 will resume the down trend from 1.4667 and that carries larger bearish implications too.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q1 | -0.50% | 0.40% | 8.60% | 8.30% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q1 | 0.00% | 0.40% | 6.80% | |

| 23:00 | AUD | Manufacturing PMI May P | 55.3 | 58.8 | ||

| 23:00 | AUD | Services PMI May P | 53 | 56.1 | ||

| 00:30 | JPY | Manufacturing PMI May P | 53.2 | 53.8 | 53.5 | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Apr | 8.51B | 17.32B | ||

| 07:15 | EUR | France Manufacturing PMI May P | 55.1 | 55.7 | ||

| 07:15 | EUR | France Services PMI May P | 58.6 | 58.9 | ||

| 07:30 | EUR | Germany Manufacturing PMI May P | 54.1 | 54.6 | ||

| 07:30 | EUR | Germany Services PMI May P | 57.2 | 57.6 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 54.9 | 55.5 | ||

| 08:00 | EUR | Eurozone Services PMI May P | 57.5 | 57.7 | ||

| 08:30 | GBP | Manufacturing PMI May P | 55.1 | 55.8 | ||

| 08:30 | GBP | Services PMI May P | 57.3 | 58.9 | ||

| 13:45 | USD | Manufacturing PMI May P | 57.9 | 59.2 | ||

| 13:45 | USD | Services PMI May P | 55.3 | 55.6 | ||

| 14:00 | USD | New Home Sales Apr | 750K | 763K |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals