As we looked at in our previous article, the range market condition is often one of the more ignored conditions by new retail traders, and that’s generally due to the perception of capped potential. After all, if I’m trading a range and look to buy at support, then I should sell at resistance, right? Which would mean my maximum gain would be the distance between support and resistance.

In actuality this doesn’t necessarily have to be true because there are numerous ways to go about trading ranges or mean-reversion.

Recommended by James Stanley

The Fundamentals of Range Trading

The general gist of trading ranges is that the trader is looking to buy at or around support in anticipation of prices rising or looking to sell at or near resistance with the intention of prices falling. And to be sure, that move can be capped by the other side of the market. But, there could also be greater continuation potential.

Consider for a moment, a trader looking to sell at resistance after prices have been range-bound; and when price does fall to support, the trader merely begins to scale-out of the position by closing a portion. There’s even the option of moving a stop to break-even at this point so that, worst case scenario, the market reverses – they still have some element of protection.

But – if the trader anticipates further falls, they can keep the remaining position open in anticipation of a breakdown through support. And if that does happen, well then the trader has held the range-based short entry into a fresh bearish breakout.

Foundational Trading Knowledge

Find Your Trading Style

Recommended by James Stanley

Using Price Action to Find Support and Resistance

As we look at in our price action sub-module, support and resistance from prior price movements can be helpful for traders and this is especially true for range-bound market conditions. With a range, the trader is, in essence, looking for support or resistance to hold as mean-reversion shows in that market. And one of the more common ways of finding support is by looking for areas on the chart that have already produced inflections.

The trader can then wait for evidence that buyers have entered around support or sellers around resistance, and this can be illustrated by candlestick wicks.

USD/CAD Four-Hour Chart

Chart prepared by James Stanley; USD/CAD four hour chart Jan 2022 – March 2022

One of the simpler methods that can be explained in this space is using an additional indicator to look for possible entries after the condition has been defined. So, as we looked at earlier with ADX, if ADX is below 20, the trader can then look for mean reversion entries. This should eliminate many reversal-like scenarios (since reversals are counter-trend movements) and it should also help to filter out trends.

Recommended by James Stanley

Trading Forex News: The Strategy

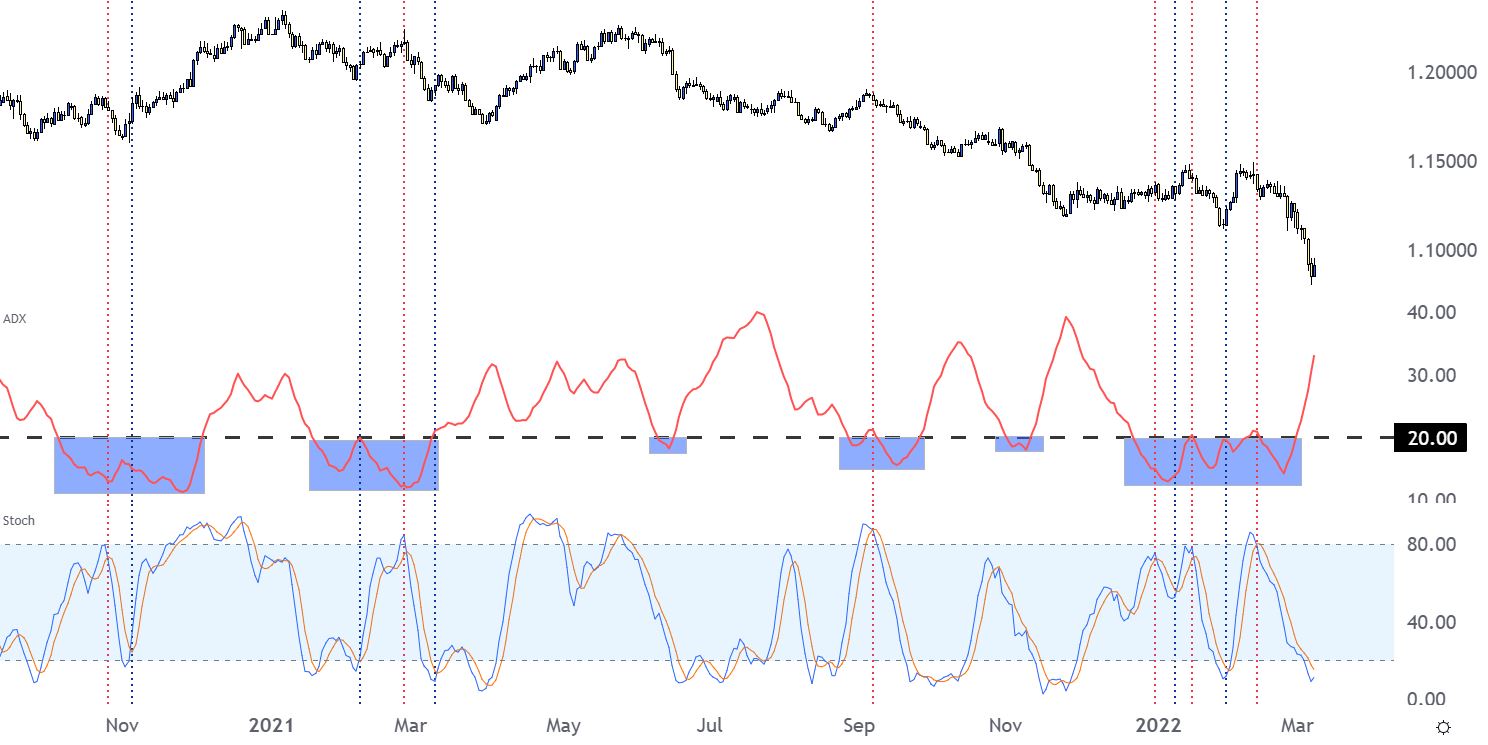

On the below chart, I’ve attempted to illustrate how such a strategy can look. There’s two indicators on the bottom portion of the chart: On top we have the Average Directional Index and below that we have slow stochastics, as we looked at in our section on technical indicators.

The logic would be set so that if ADX is below 20, the trader can then look at taking signals from an indicator such as stochastic or CCI. On the below chart, I’ve identified bullish signals via stochastic crossovers with a blue line and bearish signals with a red line. When ADX goes back above 20, no signals are investigated.

EUR/USD Daily Chart

Chart prepared by James Stanley

Range Trading Summary

As you can see from the above graphic, such simple logic can help traders to locate and find ranges along with some usable information as to how they can work with them.

But, again, to reiterate, one of the more attractive reasons for range trading in general is the ability to manage risk, so that if support or resistance are broken, the trader knows relatively early that they strategy that they’re working with, well, it wouldn’t appear to be working.

Range trading is often ignored by new traders because these aren’t the market environments that one can dream on. If a range is going to hold, upside is going to be capped. And while there are ways that this can be harnessed, it’s not the Bitcoin-like movement that many are looking for when it comes to terms of volatility. But, for professional traders seeking out consistency and manageable risk protocols this can be a benefit, which is why experienced traders may seek out these ‘less entertaining’ market environments.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals