We’ve looked at the importance of candlestick wicks in a few of our articles in the price action sub-module already. Wicks highlight reactions, and as traders, those reactions can be key because they may clue us into what might happen around that next corner. In the field of analysis, there are only probabilities and if something ‘big’ happened today, there’s a chance that it may still matter tomorrow, and this really incorporates the essence of incorporating wicks or reactions into a trader’s price action approach.

Not all wicks are created equal, however, and long wicks can be especially interesting as their highlighting a strong reaction during that candle. But, there’s a particular type of wick that I wanted to address in this article as it can be an attractive point of reference for those looking for reversals. But, before we talk about why it sets up or how to use it, let’s take a look at one.

The candle that I’m referring to is the last candle on the right side of this daily chart of GBP/USD:

GBP/USD Daily Chart

Chart prepared by James Stanley; GBP/USD daily chart, Dec 2020 – Feb 2021

Notice how that candle has a long upper wick, with a relatively small body located towards the lower portion of the formation?

So, basically, this day started as a continuation of the prior trend, and during this candle’s formation, traders got really excited, and bid the pair up to a fresh high. But that excitement couldn’t last for long as prices were rejected after crossing the 1.4200 level, which then erased the bulk of that day’s gain.

That formation is known as a ‘pin bar.’ The pin is short for Pinocchio, and it’s meant to show when the market may have been a little bit too excited. Like Pinocchio’s nose grows when he tells a lie, the market reverses that exuberance quickly when buyers get ahead of themselves, and this produces a one-side candle that sticks out from prior price action.

It’s that ‘sticking out’ that’s important here – as the idea is that prices have run into a longer-term or bigger picture area of resistance that could change the flow. This is illustrated by the extended wick sitting atop price action – and that’s highlighting the reaction that may have some more room to run.

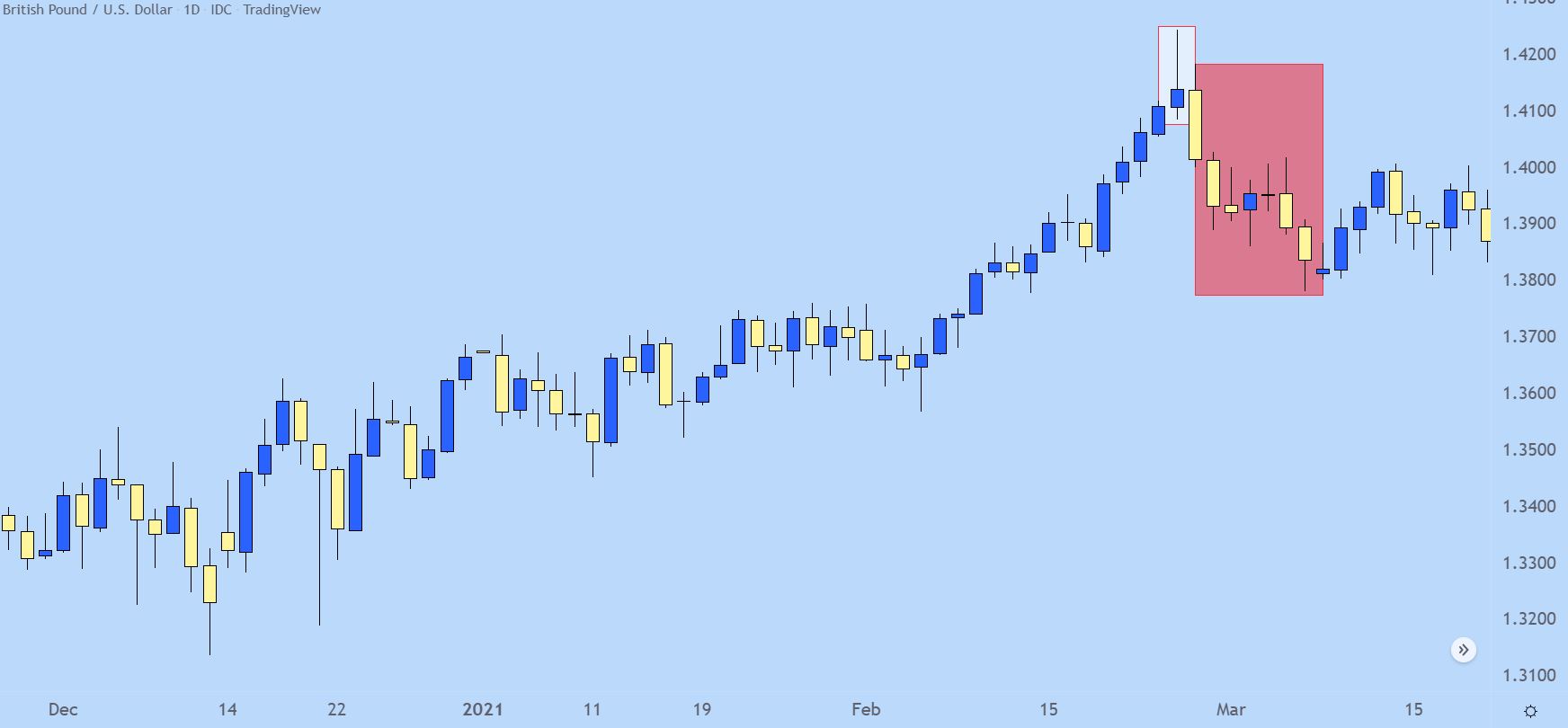

On the below chart, I take a look at what happened after that.

GBP/USD Daily Price Chart

Chart prepared by James Stanley; GBP/USD daily chart, Dec 2020 – Mar 2021

In the above example the market continued to reverse. The pin bar was merely the early sign that sellers had come in after that high was hit, which then led to a couple weeks of continued bearish pressure.

On an additional note, that same price level that started the reversal came back into the equation a few months later. And, again, it served as resistance but this time, buyers were unable to recover. This does illustrate how price action wicks can serve as key markers of support and resistance, and it also illustrates how pin bars can give an early look at levels that could carry weight in a market, as the very thing that created the long wick on the first test – sellers showing resistance at that level – can remain for subsequent tests and, in-turn, remain as resistance.

GBP/USD Daily Price Chart

Chart prepared by James Stanley; GBP/USD daily chart, Dec 2020 – May 2022

RECOMMENDATIONS

We have created innovative HIGH GAIN PROFIT robot,

We recommend our BEST ROBOT FOREXVPORTFOLIO v11, which is already being used by traders all over the world, successfully making unlimited profits over and over again.

For beginners and experienced traders!

You can WATCH LIVE STREAMING with our success forex trading here

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals