Net reactions of the global markets to Fed’s 75bps rate hike were rather negative. Global stocks ended generally lower after initial recovery. Additionally, SNB delivered a surprised 50bps rate hike while BoE’s 25bps had a hawkish undertone with three members wanted more. BoJ stayed calm and kept interest rate unchanged while maintaining the 10-year JGB yield cap at 0.25%.

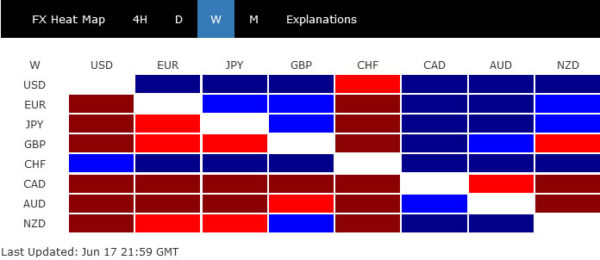

In the currency markets, Swiss Franc was overwhelmingly the strongest one. Dollar followed as second but there was clearly some hesitation towards the end, in particular against Euro. Canadian Dollar was the worst as dragged down additionally by falling oil prices. Australian Dollar was also weighed down by overall risk averse sentiment.

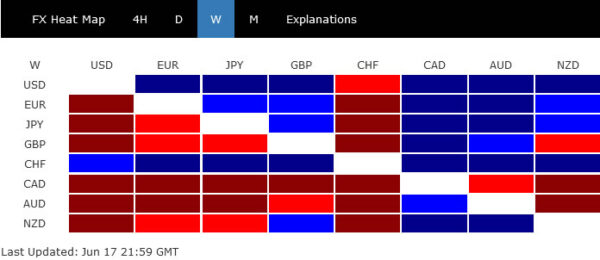

Could DOW defend 30k cluster support level?

DOW extended the correction from 36952.65 to close at 29888.78 last week, losing 30k handle. Ideally, it’s a zone for bottoming, with 38.2% retracement of 18213.65 to 36952.65 at 29794.35, and 29568.57 resistance turned support (2020 pre-pandemic high). Also, it’s now reasonably close to 55 month EMA (now at 38563.61) which should provide strong support.

However, break of gap resistance at 31144.91 is needed to be the first sign of bottoming. Or risk will stay heavily on the downside. Sustained trading below 29794.35 could bring even deeper fall to long cluster level at 25308/71 (61.8% retracement of 18213.63 to 36952.56 at 25371.94, 38.2% retracement of 6469.95 to 36952.56 at 25308.25).

Near term upside potential in 10-year yield limited

10-year yield surged to as high as 3.483 last week but retreated to close at 3.239. Another rise cannot be ruled out yet but upside potential should be limited for now. 161.8% projection of 0.398 to 1.765 from 1.343 at 3.554 should limited upside to bring consolidations. Indeed, break of 3.167 support should confirm that a near term correction has started for 55 day EMA (now at 2.848). However, firm break of 3.554 could bring another round of upside acceleration to 200% projection at 4.077.

Dollar index lost momentum quickly after up trend resumption

Dollar index also resumed recent up trend and hit as high as 105.78, but quickly lost momentum and retreated. Some more consolidations would likely be seen in the near term, but downside should be contained by 55 day EMA (now at 102.16) to bring rally resumption. Current up trend should target 61.8% projection of 72.69 to 103.82 from 89.20 at 108.43 at a later stage. But to do so, risk aversion will need to continue while 10-year yield should extend up trend, while EUR/USD will need to break through 1.0339 support.

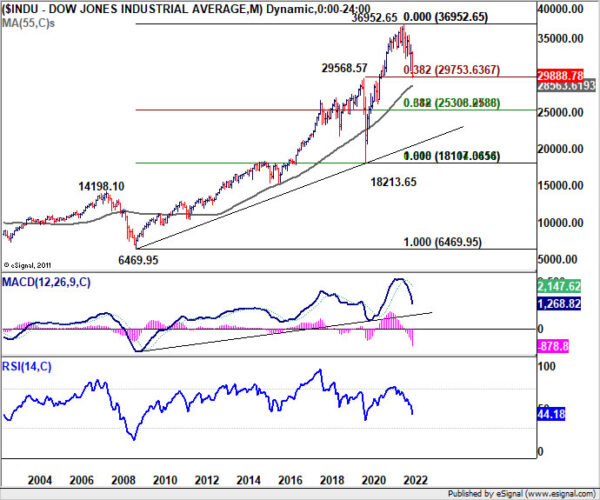

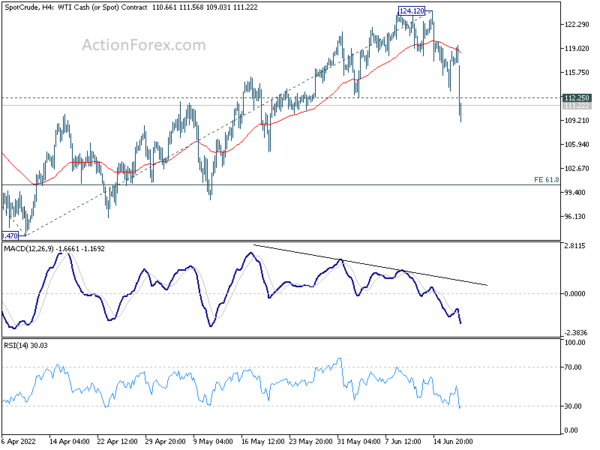

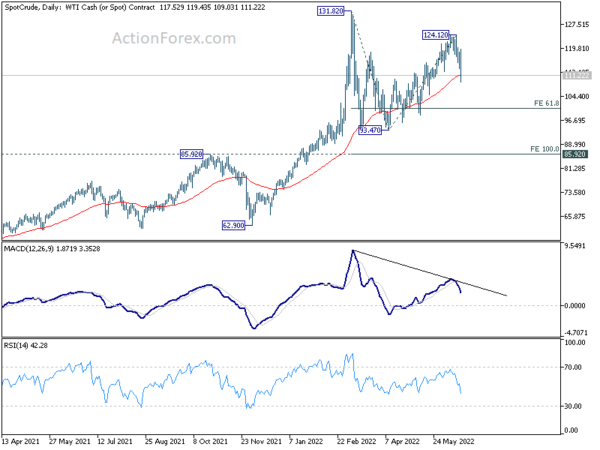

WTI crude oil in third leg of pattern from 131.82

The steep decline in oil price last week could be offering some hope to inflation outlook and risk sentiment ahead. WTI’s break of 112.25 support argues that a short term top was already formed at 124.12. The whole rebound from 93.47 might be finished too. Sustained trading below 55 day EMA (now at 111.18) will affirm this case. Fall from 124.12 would then be seen as the third leg of the pattern from 131.82 high. Deeper decline should then be seen to 61.8% projection of 131.82 to 93.47 at 124.12 at 100.41 first. Firm break there could bring downside acceleration through 93.47 to 100% projection at 85.77, which is close to 85.92 resistance turned support.

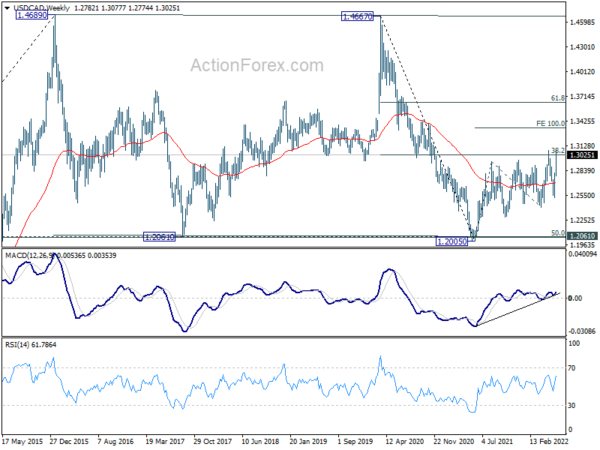

USD/CAD is breaking through 1.3 key resistance

But of course, the reversal in oil price could also be seen as a result of lower demand due to dimmer economic outlook. That is, it’s part of risk-aversion trades. If that’s the case, Canadian Dollar could be double hit. USD/CAD has already breached 1.0375 resistance last week. Sustained trading above 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022 will suggest that it’s reversal whole down trend from 1.4667. Further rally would be seen to 100% projection of 1.2005 to 1.2947 from 1.2401 at 1.3343. The dynamics between oil, stocks and Loonie is worth a close watch in the next two weeks.

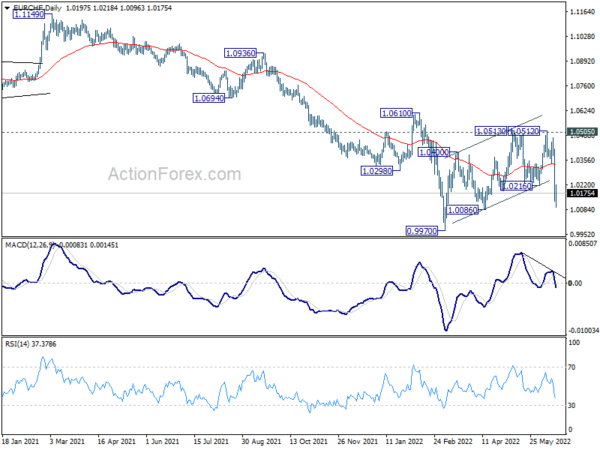

EUR/CHF Weekly Outlook

EUR/CHF’s sharp decline last week and break of 1.0216 support suggests that corrective rebound from 0.9970 has completed after failing 1.0505 long term resistance, as well as 55 week EMA. Initial bias stays on the downside this week. Break of 1.0086 support will affirm this bearish case and bring retest of 0.9970 low. On the upside, above 1.0232 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.0513 resistance holds.

In the bigger picture, as long as 1.0505 support turned resistance (2020 low) holds, long term down trend from 1.2004 (2018 high) is expected to continue. Next target is 100% projection of 1.2004 to 1.0505 to 1.1149 at 0.9650. However, firm break of 1.0505 will suggest medium term bottoming, and bring stronger rebound towards 1.1149 structural resistance.

In the long term picture, capped below 55 month EMA, EUR/CHF is seen as extending the multi-decade down trend. There is no prospect of a bullish reversal until some sustained trading above the 55 month EMA (now at 1.0846).

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals