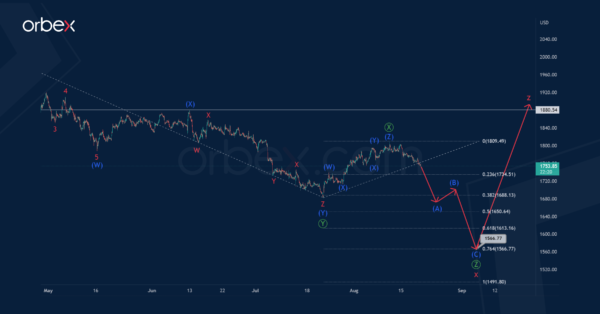

The internal XAUUSD structure suggests a global correction pattern, which takes the form of a cycle triple zigzag.

On the current chart, we see the structure of the bearish cycle intervening wave x, which looks completed in the form of a primary triple zigzag Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ.

Perhaps, after the completion of the cycle wave x, the market turned around and began to move up. That is, the initial part of the cycle wave z is being built now. It can take the form of a primary standard zigzag Ⓐ-Ⓑ-Ⓒ, as shown in the chart.

The price of gold in the wave z may rise to the price mark of 1980.51. At that level, it will be at 76.4% of previous actionary wave y of the cycle degree.

In an alternative scenario, a continuation of the downward price movement in the cycle wave x is expected. Wave x is also a triple zigzag Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ, but the final primary wave is still under development.

A downward movement of XAUUSD is expected in the near future. The primary wave Ⓩ may take the form of an intermediate zigzag (A)-(B)-(C).

The final of the correction pattern zigzag (A)-(B)-(C) is possible near 1566.77. At that level, it will be at 76.4% of primary wave Ⓨ.

After reaching this level, we can expect a market reversal and the beginning of a cycle wave z.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals