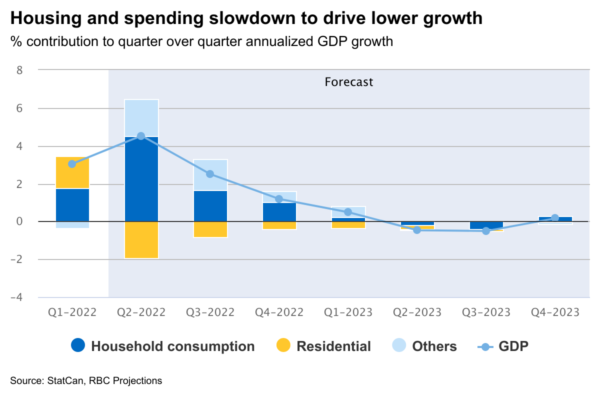

Canadian GDP likely rose in the second quarter—but the trend is unlikely to last. We expect annualized growth jumped to 4.5% from the 3.1% reported in Q1. Spending on services (particularly in the travel and hospitality sectors) surged higher following winter lockdowns. And an increase in equipment imports suggests businesses ramped up capital investment as acute labour shortages made boosting output a challenge. Strong domestic demand also sent imports surging in Q2, with net trade likely to be a sizable drag on quarterly growth despite a strong export gain.

Still, there are clear signs that growth is slowing. Residential investment plunged in the second quarter as aggressive Bank of Canada interest rate hikes pushed home resale markets sharply lower. Most of the increase in Q2 GDP came earlier in the quarter, with momentum losing steam over May and June. We expect June output edged up 0.1% (in line with Statistics Canada’s early estimate a month ago) after a flat reading in May and 0.3% rise in April. And early reports are pointing to another month of little output growth in July. Manufacturing activity remains strong despite a sharp decline in petroleum prices in July. And activity in the oil and gas sector continues to improve on higher prices, with drilling activity continuing to edge higher over the summer.

But housing markets have continued to soften, and the post-lockdown surge in travel and hospitality spending appears to have plateaued. The Bank of Canada and other global central banks (including the U.S. Fed) will continue to hike interest rates aggressively near-term to tame inflation. Against that backdrop, we continue to expect growth to slow substantially over the second half of this year, and for the economy to slip into a moderate recession in 2023.

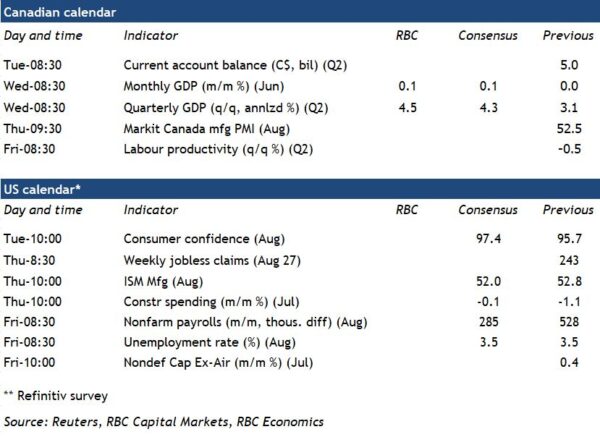

Week ahead data watch:

U.S. unemployment is expected to hold steady at 3.5% in July, its lowest level since before the pandemic. Labour markets remain extremely tight, but weekly jobless claims have been ticking higher.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals