The South African Reserve Bank (SARB) plays an integral role in the economic framework of South Africa. Its foundations, mandate, unique shareholder structure, and policy decisions significantly influence the trajectory of the South African Rand (ZAR).

THE BIRTH OF THE SOUTH AFRICAN RESERVE BANK (SARB)

Established on June 30, 1921, the SARB is the oldest central bank in Africa. The idea for its creation was born out of the need for an independent monetary authority that could stabilize the nation’s currency, which was experiencing fluctuations due to the economic aftermath of World War I.

For Tips and Tricks to Navigate Economic Data Releases, Download Your Complimentary Guide Below

Recommended by Zain Vawda

Introduction to Forex News Trading

In its early years, the SARB was privately owned, but it was nationalized in 1945, bringing it under the control of the South African government. Since its inception, the SARB has played a crucial role in the country’s economic policy. It has witnessed and weathered the Great Depression, World War II, the apartheid era, and the transition to a democratic government.

SHAREHOLDERS OF THE SOUTH AFRICAN RESERVE BANK (SARB)

Unlike most central banks, the SARB is a publicly owned entity. It has over 650 shareholders who hold a certain number of shares. However, to prevent undue influence, the SARB’s shareholders have limited rights which are limited by law. They cannot exercise power over the bank’s policy decisions, which remain the exclusive domain of the Governor and the Monetary Policy Committee.

No shareholder or group of associated shareholders may own more than 10,000 shares individually. Furthermore, non-residents and their associates may not hold more than 40% of the total issued shares. The shareholders have limited rights, which primarily include the right to elect a minority of the directors and receive a limited dividend.

THE MANDATE OF THE SOUTH AFRICAN RESERVE BANK (SARB)

The SARB’s mandate is outlined in the Constitution of the Republic of South Africa. The primary objective of the SARB, as stipulated in Section 224(1), is to “protect the value of the currency in the interest of balanced and sustainable economic growth.” The bank achieves this through its monetary policy, which aims to maintain price stability. Moreover, the SARB has the responsibility to oversee the South African financial system’s stability. It’s also tasked with issuing banknotes and coins, acting as the banker for the government, providing banking services for commercial banks, and managing the country’s gold and foreign exchange reserves.

Learn from the Best and Take a Look at What Traits Successful Traders Share in the Free Guide Below.

Recommended by Zain Vawda

Traits of Successful Traders

DIVIDENDS

The SARB, like other central banks, operates to fulfill its mandate rather than to make a profit. However, its private shareholders are entitled to dividends. The dividends are limited by law to 10 cents per share per annum, which results in a total dividend payout of just R200,000 ($~14,000 as of September 2021) each year given that there are two million issued shares. Any profits made by the SARB beyond this amount are paid to the South African government.

IMPACT OF POLICY DECISIONS ON THE SOUTH AFRICAN RAND (ZAR)

The SARB’s policy decisions significantly impact the ZAR’s value. The primary tool the SARB uses to control inflation and stabilize the ZAR is the repo rate, the rate at which it lends money to commercial banks.

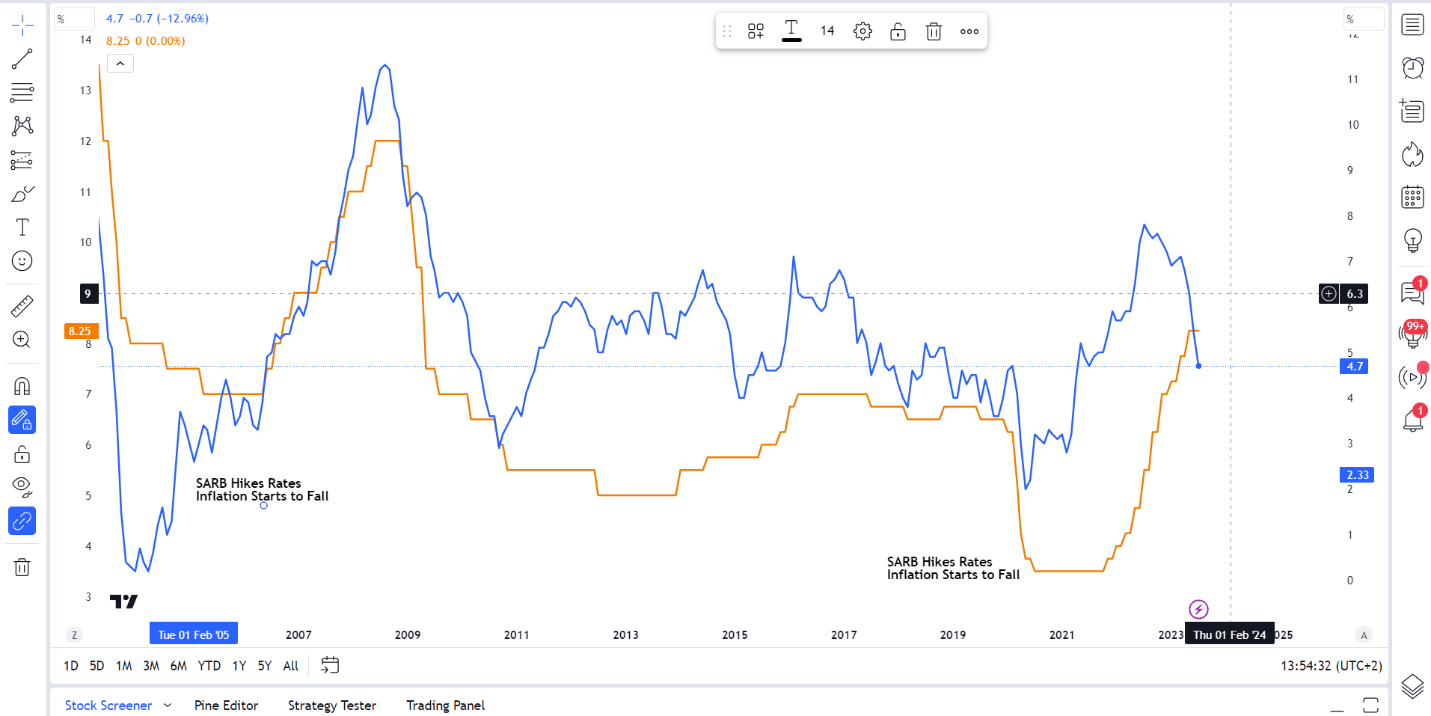

For instance, if inflation is above the SARB’s target range, it might increase the repo rate. This makes borrowing more expensive and reduces spending, which in turn, lowers inflation. However, this can also slow economic growth and increase the value of the ZAR as higher interest rates attract foreign investors seeking better returns on their investments.

Conversely, if the SARB lowers the repo rate, it stimulates economic growth by making borrowing cheaper, which encourages spending and investment. But this can lead to increased inflation and a weaker ZAR as it may drive away foreign investors looking for higher interest returns.

The Chart Below Provides an Excellent Example of the Relationship Between Interest Rate Hikes and its Effects on Inflation.

SA Interest Rate vs SA Inflation

Source: TradingView, Chart Created by Zain Vawda

The SARB thus faces a delicate balancing act in its monetary policy decisions. It must maintain price stability and protect the ZAR’s value while fostering balanced and sustainable economic growth.

CONCLUSION

The South African Reserve Bank’s role in the country’s economic framework is pivotal. Its unique history and shareholder structure, combined with its mandate to protect the currency’s value, make it a key player in the South African economy. The policy decisions it makes not only influence the direction of the ZAR but also the broader economic health of the nation. Understanding the SARB’s role and the impact of its policies is essential for anyone interested in the economic landscape of South Africa.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals