New Zealand Dollar rises sharply and broadly today as boosted by consumer inflation data. Other than that the forex markets are pretty directionless. Despite being sold off yesterday after retail sales, Dollar recovers broadly today as corrective trading continues. The greenback is in tie with Canadian Dollar as the strongest ones. Yen and Swiss Franc are trading lower as Asian markets turned mixed despite another day of decline in the US. After all the Brexit headlines, Sterling is trading mixed together with Euro and Australian Dollar.

In other markets, US equities closed slightly lower as recovery attempt lost momentum. DOW lost -0.35%, S&P 500 dropped -0.59% and NASDAQ dropped -0.88%. Treasury yields recovered with 10 year yield rose 0.022 to 3.163 but stayed well off recent high at 3.248. At the time of writing, Nikkei is trading up 0.27%, Singapore Strait Times down -0.41%, Hong Kong HSI down -0.19% and China Shanghai SSE down -0.15%.

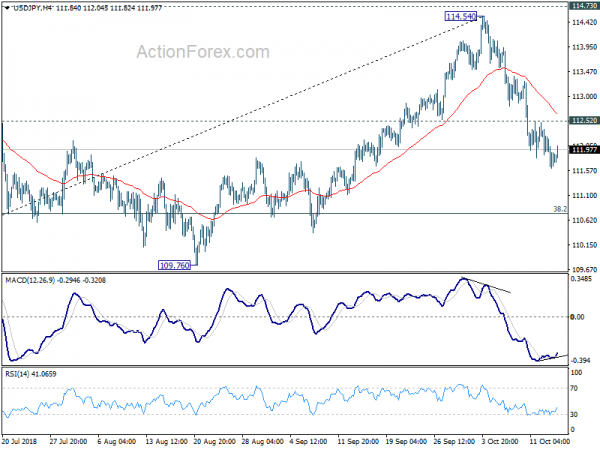

Technically, while EUR/USD rebounded from 1.1534 minor support, it’s upside was limited below 1.1610 temporary top. Range breakout is still awaited. Despite yesterday’s recovery, More downside is still mildly in favor in GBP/USD. USD/JPY is starting to lose some downside momentum as seen in 4 hour MACD. And focus could turn back to 112.52 minor resistance should today’s recovery extends.

New Zealand Dollar surges after CPI beat expectations

New Zealand CPI rose 0.9% qoq in Q3, and beat expectation of 0.7% qoq. Annual rate accelerated to 1.9% yoy, up from 1.5% yoy in Q2, and beat expectation of 1.7% yoy. StatsNZ noted that the 1.9% annual increase in CPI was mainly due to the housing and household utilities group (3.1% yoy). The group was influenced by higher prices for construction, rents, local authority rates, electricity, and property maintenance services. though for the quarter, increases in fuel prices edged out housing. Transport prices rose 2.4% qoq, driven by petrol prices which is up 5.5% qoq.

Trimmed-mean CPI, which exclude extreme price movements – ranged from 1.8 to 1.9 percent for the year, which is roughly equivalent to the 1.9 percent overall rise in the CPI. CPI ex-petrol rose 1.2% yoy, CPI ex-food rose 2.3% yoy, CPI ex-household energy and vehicle fuels rose 0.9% yoy.

RBA minutes: USD appreciation raised risks for emerging economies, but helpful to Australia

In the minutes of October 2 meeting, RBA noted that global economic conditions had continued to be positive for Australia, despite risks including trade policies. Also, elevated energy and bulk commodity prices supported its terms of trade. Broad based appreciation of the US dollar “had raised risks for some economies, particularly the more fragile emerging market economies”. But the “resultant modest depreciation of the Australian dollar was likely to have been helpful for domestic economic growth.

Domestically, RBA maintained that GDP growth would be “above potential over the following two years”. Forward-looking indicators of labour demand continued to point to above-average growth”. And wage growth is expected increase “gradually”. However, subdued household income growth remained an “important source of uncertainty for the outlook for consumption and inflation.”

Overall, RBA also maintained that ” the next move in the cash rate was more likely to be an increase than a decrease.” However, “since progress on unemployment and inflation was likely to be gradual, they also agreed there was no strong case for a near-term adjustment in monetary policy.”

UK May: Not far apart with EU; EU Tusk: No-deal Brexit more likely than ever

UK Prime Minister Theresa May told the parliament yesterday that they’re not “far apart” with the EU. And she urged not to let the disagreement on Irish backstop “derail the prospects of a good deal” and leave the UK with no-deal Brexit. But at the same time, she insisted that Northern Ireland must not be treated differently from the rest of the UK.

European Council President Donald Tusk, however, warned that the remaining 27 states “must prepare the EU for a no-deal scenario, which is more likely than ever before.” And he added the Brexit negotiation has “proven to be more complicated than some may have expected.”

May will meet other EU leaders in Brussels at the summit on Wednesday and hopes to resolve a few “critical issues”. EU leaders will then listen to the recommendation by chief negotiator Michel Barnier for the way forward.

Italian cabinet approved budget, drama with EU begins

Italian cabinet approved the 2019 budget that would boost budget deficit from the current 1.8% of GDP to 2.4% next year. The key measures include basic income for the poor and tax cuts for the self-employed. Retirement age was also lowered and there is partial amnesty offered to settle tax disputes. Prime Minister Giuseppe Conte hailed after the cabinet meeting that “this budget keeps the government’s promises while keeping public accounts in order.” Economy Minister Giovanni Tria also talked down the potential clash with the EU and said “the idea that this budget can blow up Europe is totally unfounded.”

But no matter what Italy says, the drama with EU will now formally begin. After formally receiving the budget, European Commission will have a week, by October 22, to identify “particularly serious non-compliance with the budgetary policy obligations” of a state. By October 29, the Commission will have to decide whether to reject the draft budget as non-compliant, with written explanations. The showdown will come on November 5 in the Eurogroup of finance ministers meeting. And Italy is expected to submit a revised budget on November 19.

Elsewhere

China CPI accelerated to 2.5% yoy in September, PPI dropped to 3.6% yoy, both matched expectations. UK employment data will be a major focus in European session. Eurozone will release trade balance and German ZEW economic sentiment. Later in the day, Canada will release international securities transactions. US will release industrial production and NAHB housing index.

USD/JPY Daily Outlook

Daily Pivots: (S1) 111.51; (P) 111.88; (R1) 112.13; More..

USD/JPY recovers mildly after dropping to 111.62. But as long as 112.52 minor resistance holds, deeper fall is expected. Current decline is seen as correcting whole rise from 104.62. Deeper fall would be seen to 38.2% retracement of 104.62 to 114.54 at 110.75. We’ll look for bottoming signal above 109.76 key support. On the upside, considering mild bullish convergence condition in 4 hour MACD, above 112.52 minor resistance will indicate completion of the pull back and bring retest of 114.54 high.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 0.90% | 0.70% | 0.40% | |

| 21:45 | NZD | CPI Y/Y Q3 | 1.90% | 1.70% | 1.50% | |

| 00:30 | AUD | RBA Minutes | ||||

| 01:30 | CNY | CPI Y/Y Sep | 2.50% | 2.50% | 2.30% | |

| 01:30 | CNY | PPI Y/Y Sep | 3.60% | 3.60% | 4.10% | |

| 08:30 | GBP | Jobless Claims Change Sep | 4.5K | 8.7K | ||

| 08:30 | GBP | Claimant Count Rate Sep | 2.60% | |||

| 08:30 | GBP | ILO Unemployment Rate 3Mths Aug | 4.00% | 4.00% | ||

| 08:30 | GBP | Average Weekly Earnings 3M/Y Aug | 2.40% | 2.60% | ||

| 08:30 | GBP | Weekly Earnings ex Bonus 3M/Y Aug | 2.80% | 2.90% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | 15.0B | 12.8B | ||

| 09:00 | EUR | German ZEW Economic Sentiment Oct | -12.3 | -10.6 | ||

| 09:00 | EUR | German ZEW Current Situation Oct | 72 | 76 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | -9.2 | -7.2 | ||

| 12:30 | CAD | International Securities Transactions (CAD) Aug | 12.65B | |||

| 13:15 | USD | Industrial Production M/M Sep | -0.10% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Sep | 78.00% | 78.10% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 68 | 67 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals