Euro weakens broadly after ECB kept monetary policies unchanged. While president Mario Draghi delivered not much new in the press conference, he did acknowledged that downside risks are materializing. Recovery in EUR/USD and EUR/JPY now look rather short-lived. Meanwhile, Dollar is mixed after CPI data offered nothing for Fed to shift from its patient stance. Yen is popped up by falling treasury yields in Germany in US.

Sterling is firmer in range as EU’s decision on another Brexit extension is awaited. European Council President Donald Tusk is proposing a “flextension” of up to one year while UK can leave any time it’s ready. It’s reported that German Chancellor Angela Merkel prefers extension of “several months”. Francs is said to be pushing for conditions to make sure UK can’t disrupt EU businesses. We’ll know the answer by the end of the day. But in any case, it’s highly unlikely for UK Prime Minister Theresa May to get an extension just till June 30.

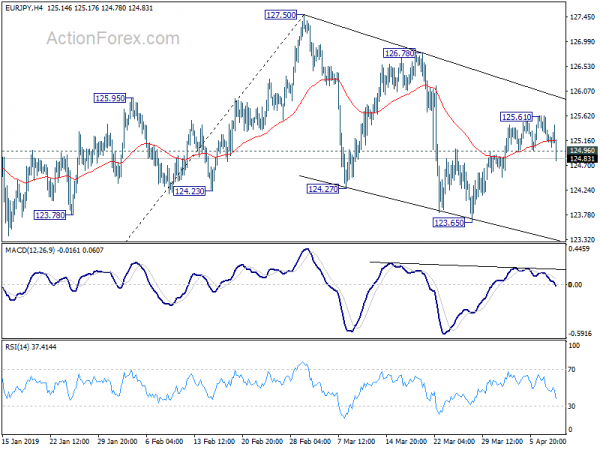

Technically, EUR/JPY’s break of 124.96 minor support suggests that recovery from 123.65 has completed. More importantly, the choppy decline from 127.50 is possibly still in progress for another low below 123.65. EUR/USD will have 1.1210 minor support in sight after recovery lost steam. Break will put 1.1176 key support back into focus. EUR/AUD could also be heading to 1.5714/21 support zone and break will resume larger decline.

In other markets, US stocks open mixed but 10-year yield is back under pressure again. In Europe, FTSE is down -0.07%. DAX is up 0.53%. CAC is up 0.27%. German 10-year yield is down -0.243 at -0.032, deeper in negative. Earlier in Asia, Nikkei dropped -0.53%. Hong Kong HSI dropped -0.13%. China Shanghai SSE rose 0.07%. Singapore Strait Times rose 0.06%. Japan 10-year JGB yield dropped -0.0101 to -0.055.

US: Headline CPI accelerated to 1.9%, but core slowed to 2.0%

Dollar turns mixed in early US session after March CPI release. Headline CPI accelerated to 1.9% yoy, up from 1.5% yoy and beat expectation of 1.8% yoy. However, core CPI slowed to 2.0% yoy, down from 2.1% yoy and missed 2.1% yoy.

ECB Draghi: Persistence of uncertainties is leaving markets on economic sentiment

Euro weakens broadly today even though ECB delivered little news with the rate decision and press conference. The main refinancing rate is kept at 0.00%. Marginal lending facility rate and deposit rate are kept at 0.25% and -0.40% respectively. Also, forward guidance is unchanged. ECB expects to keep key interest rates at present level “at least through the end of 2019”. No detail of the TLTRO III is provided as they will be released at one of the next meetings.

President Mario Draghi’s overtone in the post meeting conference is dovish. He noted that incoming data “confirms slower growth momentum extending into the current year.” “Global headwinds continue to weigh on euro area growth developments”. Also, “persistence of uncertainties, related to geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets, is leaving marks on economic sentiment.”

Meanwhile, risks surrounding growth outlook remain “tilted t the downside”. They’re “on account of the persistence of uncertainties related to geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets.” Draghi also urged “other policy areas” to contribute more decisively to raise longer-term growth potential and reducing vulnerabilities. Those include structure reforms and fiscal policies.

UK GDP grew 0.2% in Feb, 0.3% in rolling three-month period

UK GDP rose 0.2% mom in February, down from January’s 0.5% mom but beat expectation of 0.0% mom. Index of services rose 0.1% mom, while index of production rose 0.6% mom. Manufacturing rose 0.9% mom. Construction rose 0.4% mom. Agriculture dropped -1.3% mom. Rolling three-month growth rate (Dec to Feb) was unchanged at 0.3%. Services contributed 0.29%, production 0.02% and construction -0.04%.

Commenting on today’s GDP figures, Head of GDP Rob Kent-Smith said: “GDP growth remained modest in the latest three months. Services again drove the economy, with a continued strong performance in IT. Manufacturing also continued to recover after weakness at the end of last year with the often-erratic pharmaceutical industry, chemicals and alcohol performing well in recent months.”

Also from UK, in February, industrial production rose 0.5% mom, 0.1% yoy versus expectation of 0.1% mom, -0.8% yoy. Manufacturing production rose 0.9% mom, 0.6% yoy, versus expectation of 0.2% mom, -0.7% yoy. Construction output rose 0.4% mom versus expectation of -0.3% mom. Visible trade deficit widened to GBP -14.1B.

Kuroda: BoJ seeking to create positive economy cycle, not just rise in inflation

Speaking to the parliament, BoJ Governor Haruhiko Kuroda said the central bank isn’t seeking to push up inflation alone. Instead, it’s aiming at creating to situation where wage and employment conditions improve with corporate profits too. That is, creating a “positive economy cycle”.

Meanwhile, Kuroda added the 2% inflation target helps in long-run currency stability. But for now, inflation is likely hover around 1% since wages growth is not fast enough yet.

Separately, Finance Minister Taro Aso also told the parliament that pushing up inflation alone “won’t do any good” without improvement in people’s livelihoods.

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 125.14; (P) 125.33; (R1) 125.79; More….

EUR/JPY’s break of 124.96 minor support suggests that rebound from 123.65 has completed. Intraday bias is turned back to the downside for 123.65 support first. Break there will resume whole fall from 127.50 and target 61.8% retracement of 118.62 to 127.05 at 121.84. On the upside, though, above 125.61 will resume the rebound to 126.78/127.50 resistance zone.

In the bigger picture, EUR/JPY is staying well inside medium term falling channel from 137.49 (2018 high). It’s also held below 55 week EMA (now at 127.53). Thus, down trend from 137.49 might still extend lower. Break of 118.62 will target 109.03/114.84 long term support zone. On the upside, however, break of 127.50 will solidify the case of medium term bullish reversal. Rise from 118.76 should extend to 133.12 key resistance instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Mar | 1.30% | 1.00% | 0.80% | 0.90% |

| 23:50 | JPY | Machine Orders M/M Feb | 1.80% | 2.90% | -5.40% | |

| 00:30 | AUD | Westpac Consumer Confidence Apr | 1.90% | -4.80% | ||

| 06:00 | JPY | Machine Tool Orders Y/Y Mar P | -28.50% | -29.30% | ||

| 08:30 | GBP | Visible Trade Balance (GBP) Feb | -14.1B | -12.5B | -13.1B | |

| 08:30 | GBP | Industrial Production M/M Feb | 0.60% | 0.10% | 0.60% | 0.70% |

| 08:30 | GBP | Industrial Production Y/Y Feb | 0.10% | -0.80% | -0.90% | -0.30% |

| 08:30 | GBP | Manufacturing Production M/M Feb | 0.90% | 0.20% | 0.80% | 1.10% |

| 08:30 | GBP | Manufacturing Production Y/Y Feb | 0.60% | -0.70% | -1.10% | -0.70% |

| 08:30 | GBP | Construction Output M/M Feb | 0.40% | -0.30% | 2.80% | |

| 08:30 | GBP | GDP M/M Feb | 0.20% | 0.00% | 0.50% | |

| 08:30 | GBP | Index of Services 3M/3M Feb | 0.40% | 0.40% | 0.50% | |

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | CPI M/M Mar | 0.40% | 0.40% | 0.20% | |

| 12:30 | USD | CPI Y/Y Mar | 1.90% | 1.80% | 1.50% | |

| 12:30 | USD | CPI Core M/M Mar | 0.10% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y Mar | 2.00% | 2.10% | 2.10% | |

| 14:30 | USD | Crude Oil Inventories | 7.0M | 2.6M | 2.8M | |

| 18:00 | USD | FOMC Meeting Minutes | ||||

| 18:00 | USD | Monthly Budget Statement (USD) Mar | -194.7B | -234.0B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals