Market sentiments have generally stabilized, with no further escalation in Middle East tensions so far. Asian stocks are trading generally higher. US indices closed with slight gains after reversing initial losses. Focus should now be turned back to economic data. The currency markets is relatively mixed for today. New Zealand Dollar is the stronger one, followed by Sterling and then Dollar. Swiss Franc, Yen and Australian Dollar are the weaker ones.

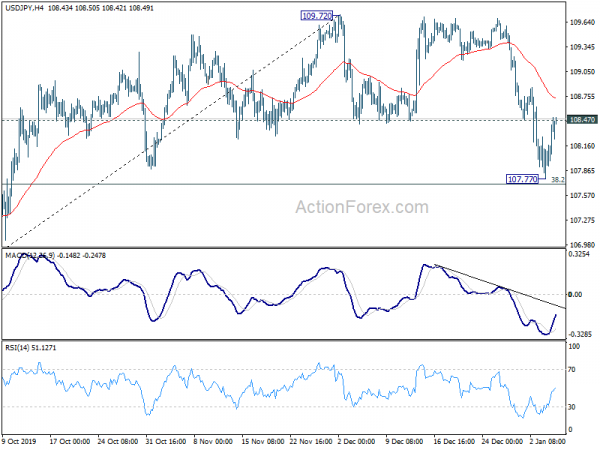

Technically, USD/JPY’s breach of 108.47 minor resistance suggests that fall from 109.72 has completed at 107.77. Support ahead of 107.70 fibonacci level argues that price actions from 019.72 is merely a corrective pattern and stronger recovery could be seen. EUR/JPY also recovered strongly ahead of 119.99 support, maintaining near term bullishness. At this point, both USD/JPY and EUR/JPY point to more downside in Yen at a later stage. We’ll see.

In Asia, Nikkei is currently up 1.32%. Hong Kong HSI is up 0.48%. China Shanghai SSE is up 0.36%. Singapore Strait Times is up 0.73%. Japan 10-year JGB yield is up 0.0205 at -0.009. Overnight, DOW rose 0.24%. S&P 500 rose 0.35%. NASDAQ rose 0.56%. 10-year yield rose 0.023 to 1.811, back above 1.8 handle.

US Defense Secretary Esper denies leaving Iraq

It’s widely reported that the US military prepared a letter informing Iraq about pulling American troops out of the country. That followed Iraqi parliament’s vote on Sunday to call for all foreign troops to leave. But the news was quickly denied by top US officials overnight.

Defense Secretary Mark Esper told reports that “there’s been no decision whatsoever to leave Iraq.” And, “that letter is inconsistent of where we are right now.” Army General Mark Milley added the reported letter was “poorly worded, implies withdrawal. That’s not what’s happening.”

China won’t adjust global quota on wheat, corn and rice for US trade deal

China’s Vice Agriculture Minister Han Jun told Caixin media that the country is not going to adjust overall annual quota for the three staple food despite the US-China trade deal phase one. The annual quotas are 9.64 million tonnes for wheat, 7.2 million tonnes for corn and 5.32 million tonnes for rice.

“This is a global quota. We will not adjust for one country,” Han said. “China imports wheat, corn and rice from the international market, mainly to moderate the domestic surplus”. Han’s comments were in line with some expectations that China has to cut imports from other markets to accommodate the agreed increase in US agricultural products.

Chinese Vice Premier Liu He has scheduled to travel to Washington from January 13 to 15, to sign the phase one trade deal with the US.

Looking ahead

Swiss CPI, Eurozone CPI and retail sales will be featured in European session. Canada will release trade balance and Ivey PMI later in the day. US will release trade balance, ISM services and factory orders.

USD/JPY Daily Outlook

Daily Pivots: (S1) 107.93; (P) 108.22; (R1) 108.66; More..

USD/JPY’s break of 108.47 minor resistance suggests temporary bottoming at 107.77, ahead of 38.2% retracement of 104.45 to 109.72 at 107.70. The development also argue that price actions from 109.72 are merely a corrective pattern. Intraday bias is now back on the upside for 4 hour 55 EMA (now at 108.73). Sustained break will pave the way to retest 109.72 high. On the downside, firm break of 107.70 will pave the way to 106.48 cluster support (61.8% retracement at 106.46).

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). Recovery from 104.45 also failed to sustain above 55 week EMA (now at 109.02). Overall outlook remains bearish and fall from 118.65 is in favor to extend through 104.45 low. This will now stay as the favored case as long as 109.72 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Dec | 3.20% | 3.60% | 3.30% | |

| 07:30 | CHF | CPI M/M Dec | 0.00% | -0.10% | ||

| 07:30 | CHF | CPI Y/Y Dec | 0.00% | -0.10% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec P | 1.30% | 1.00% | ||

| 10:00 | EUR | Eurozone CPI – Core Y/Y Dec P | 1.30% | 1.30% | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Nov | 0.60% | -0.60% | ||

| 13:30 | CAD | International Merchandise Trade (CAD) Nov | -0.8B | -1.1B | ||

| 13:30 | USD | Trade Balance (USD) Nov | -44.5B | -47.2B | ||

| 15:00 | USD | ISM Non-Manufacturing PMI Dec | 54.5 | 53.9 | ||

| 15:00 | USD | Factory Orders M/M Nov | 0.20% | 0.30% | ||

| 15:00 | CAD | Ivey PMI Dec | 60.2 | 60 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals