Global stock markets surge sharply today on optimism that coronavirus vaccine research took another big step. New Zealand Dollar leads commodity currencies generally higher. On the other hand, Yen, Dollar and Swiss Franc are under broad based pressure. Gold also retreats notably back below 1750 in the risk-on markets. WTI crude oil is extending recent strong rebound and regains 30 handle.

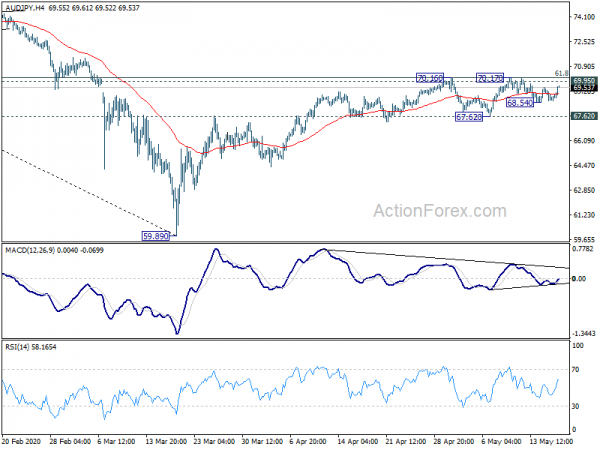

Technically, AUD/JPY’s strong rebound suggests that pull back from 70.17 has completed at 68.54. Focus is back on cluster resistance of 69.95 and 61.8% retracement of 76.54 to 59.89 at 70.17. Decisive break of this key resistance zone could open up stronger rise to 76.54. This will be a strong sign of sustainability of risk appetite.

In Europe, currently, FTSE is up 3.15%. DAX is up 4.15%. CAC is up 3.77%. German 10-year yield is up 0.009 at -0.520. Earlier in Asia, Nikkei rose 0.48%. Hong Kong HSI rose 0.58%. China Shanghai SSE rose 0.24%. Singapore Strait Times rose 0.62%. Japan 10-year JGB yield dropped -0.0078 to -0.011.

Moderna reports positive coronavirus vaccine trial results

Global investor sentiments are lifted as Moderna reported “positive” data on early-stage coronavirus vaccine trial. 45 study participants received two does of testing vaccine via intramuscular injection in the upper arm approximately 28 days apart. The does contains 25 microgram, 100 mcg or 250 mcg of vaccine, 15 in a group. At day 43, antibodies were produced in all 45 participants. Levels of binding antibodies in the 20mcg group were at levels seen in people who recovered from the coronavirus. Antibodies in the 100 mcg group had “significantly exceeded levels” in recovered patients. The vaccine also produced neutralizing antibodies against Covid-19 in at least 8 participants.

Bundesbank: Germany still far from normal despite easing coronavirus measures

Germany’s Bundesbank that the extent and speed of post coronavirus pandemic is uncertainty. “Despite the easing measures that have been introduced, social and economic life in Germany is still far from what was previously considered normal.” Economic indications like ifo business climate and Gfk consumer confidence painted a “correspondingly bleak picture”.

Also, there is a very high level of uncertainty about further economic development, dependent on the further course of the global infection process and the containment measures taken. . It also depends on how consumer and investment behavior changes against this background.

ECB Lane: Economy unlikely to return to pre-crisis level before 2021

ECB chief economic Philip Lane said in an interview by El Pais that “the speed at which the economy bounces back will then hinge on whether consumers are more reluctant to consume and businesses hold back on investment.” “From today’s perspective, it looks in any case unlikely that economic activity will return to its pre-crisis level before 2021, if not later.”.

Regarding the upcoming June ECB meeting, Lane said policymakers are “in the process of analyzing the situation”. “If we see that financial conditions are too tight, or the pressure on individual bond markets is not reflecting economic fundamentals, we can adjust the size or duration of our purchases, which we can anyway allocate flexibly over time and market segments, he added.

Japan GDP contracted -0.9% in Q1, Nishimura expects significant slump

Japan GDP contracted -0.9% qoq in Q1, better than expectation of -1.2% qoq. Following the -1.8% qoq contraction in Q4, the country was already in a technical recession for the first time in more than 4 years. In annualized rate, GDP contracted -3.4% in Q1, better than expectation of -4.6%.

Economy Yasutoshi Nishimura warned “both domestic and external demand show Japan’s economy is in a severe state.” The economy is expected to slump significantly.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2058; (P) 1.2148; (R1) 1.2194; More….

A temporary low is formed at 1.2065 with today’s recovery and intraday bias is turned neutral first. Some consolidations would be seen but recovery should be limited below 1.2467 resistance to bring another decline. Corrective rise from 1.1409 should have completed. On the downside, below 1.2065 will target a test on 1.1409 low. However, on the upside, break of 1.2467 will turn bias to the upside for 1.2647 resistance.

In the bigger picture, while the rebound from 1.1409 is strong, there is no indication of trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. Next medium term target will be 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273. In any case, outlook will remain bearish as long as 1.3514 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q1 P | -0.90% | -1.20% | -1.80% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 P | 0.90% | 1.00% | 1.20% | |

| 04:30 | JPY | Tertiary Industry Index M/M Mar | -4.20% | -0.40% | -0.50% | |

| 14:00 | USD | NAHB Housing Market Index May | 35 | 30 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals