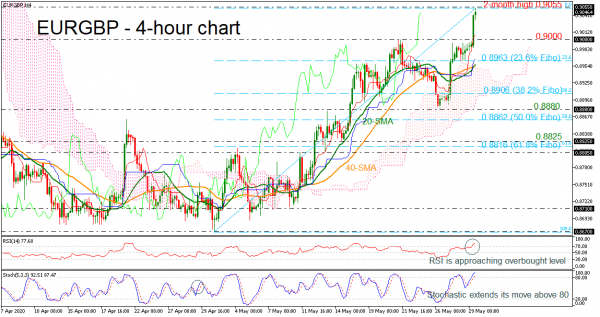

EURGBP surged towards a fresh two-month high of 0.9055 earlier today after picking up momentum above the 0.9000 resistance. Meanwhile, in technical indicators, the RSI is hovering in overbought zone, while the blue %K line of the stochastic oscillator is turning slightly down suggesting a potential downside retracement in the near term.

In case of stronger upside pressures the pair could hit the 0.9280 resistance, identified by the peak on March 25. Above that, the 0.9385 barrier from March 23 could attract attention as well.

Alternatively, the market could pause its upside structure and move downwards to retest the 0.9000 round number before meeting the 23.6% Fibonacci mark of the up leg from 0.8670 to 0.9047 at 0.8963, which stands near the bullish crossover within the 20- and 40-period simple moving averages (SMAs). Also, the upper surface of the Ichimoku cloud is located near the aforementioned barrier and more losses could slip the price to the 38.2% Fibo of 0.8906.

Summarizing, EURGBP is having an impressive bullish rally the past few hours, further brightening the positive outlook in the short-term timeframe.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals