Risk aversion remain a major theme today on concern over coronavirus second wave. DOW futures point to sharply lower open and the index could lose 25k handle. NASDAQ might also have another take on 9500 too. In the currency markets. Swiss Franc, Yen and Dollar are taking turns to the strongest for today. But all three are limited below Friday’s high against other major currencies. Australian Dollar is leading commodity currencies lower.

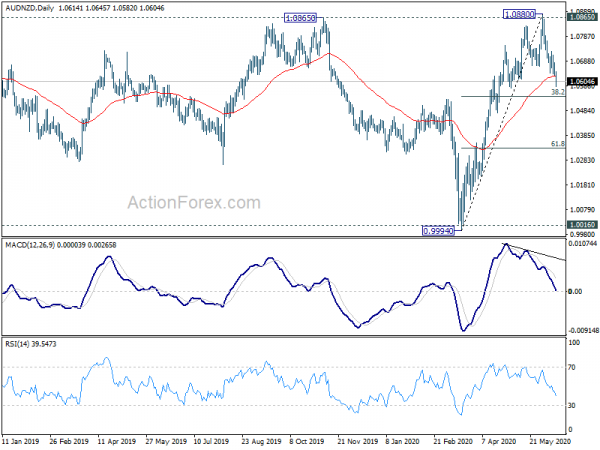

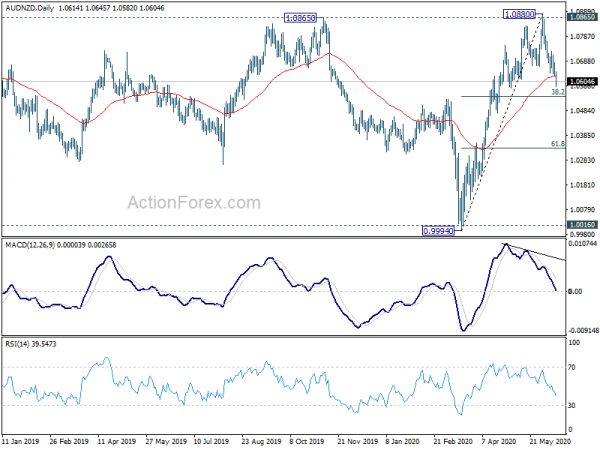

Technically, one development to note is the selloff in AUD/NZD. the break of 55 day EMA suggests rejection by 1.0865 near term resistance. Fall from there could have a take on 38.2% retracement of 0.9994 to 1.0880 at 1.0542. Reaction from there would determine which one of Aussie or Kiwi would underperform in the next move.

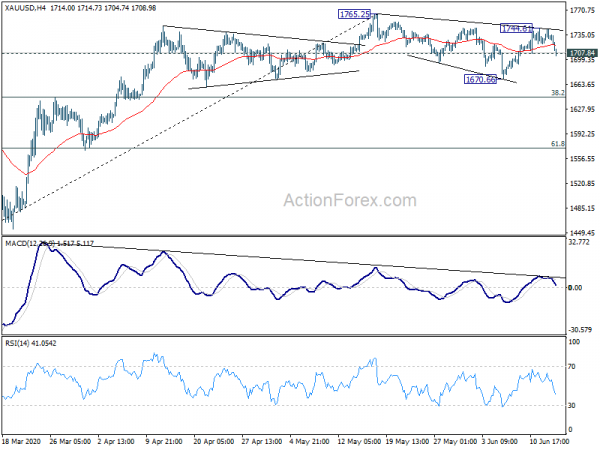

Gold’s sharp decline today and break of 1707.84 minor support dampens our original bullish view. Corrective pattern is extending with another fall, with prospect of a break of 1670.66 low to 38.2% retracement of 1451.16 to 1766.25 at 1645.26.

In Europe, currently, FTSE is down -1.09%. DAX is down -0.96%. CAC is down -0.70%. German 10-year yield is down -0.0174 at -0.456. Earlier in Asia, Nikkei dropped -3.47%. Hong Kong HSI dropped -2.16%. China Shanghai SSE dropped -1.02%. Singapore Strait Times dropped -2.64%. Japan 10-year JGB yield dropped -0.0121 to 0.005.

US Empire state manufacturing rose to -0.2, six-month expectations jumped to decade high

US Empire State Manufacturing Business Conditions rose notably to -0.2 in May, up from -48.5. Looking at some details, new orders jumped form -42.4 to -0.6. Shipments jumped from -39.0 to 3.3. Delivery time rose from -4.1 to 1.3. Price paid rose from 4.1 to 16.9. Price received rose from -7.4 to -0.6. Number of employments rose form -6.1 to -3.5, but stayed negative. Average employee workweek rose form -21.6 to -12.0, also negative.

Six month ahead expectations improved drastically from 29.1 to 56.5, hitting the highest level in more than a decade. Six-month employment also rose from 10.4 to 19.0, hitting highest level in many months.

Canada manufacturing sales dropped record -28.5% in April

Canada manufacturing sales dropped a record -28.5% mom to CAD 36.4B in April, much worse than expectation of -20.2% mom. StatCan said, “April marked the first full month of physical distancing measures in the wake of COVID-19 and manufacturing plants operated at limited capacity or ceased operations completely.”

Sales were down in all 21 industries, led by sharp declines in the transportation equipment and petroleum and coal product industries. In volume terms, manufacturing sales fell by a record 26.0%, indicating that a much lower volume of products was sold in April.

Germany economy ministry: H2 recovery will be sluggish and take longer

Germany’s Economy Ministry said in the monthly report that the economy is in a “deep recession” due to coronavirus pandemic. The “low point” was already reached with the tough shutdown measures in April. Overall economic performance will “decline much more strongly on average” in Q2, comparing to Q1. Recovery in H2 and afterwards will be “sluggish and take longer”.

Eurozone trade surplus shrank to EUR 1.2B in Apr (s.a.), intra-EA trade dropped -21.7% mom

In April, in non-seasonally adjusted term, Eurozone exports to the world contracted -29.3% yoy to EUR 136.6B. Imports from the rest of the world contracted -24.6% yoy to EUR 133.7B. Trade surplus dropped to EUR 2.9B. Intraday Eurozone trade also dropped -32.3% yoy to EUR 112.4B.

In seasonally adjusted term, extra Eurozone exports dropped from EUR 182.0B in March to 137.3B in April, down -24.5% mom. Extra-eurozone imports dropped from EUR 156.5B in March to EUR 136.1B in April, down -13.0% mom. Extra Eurozone trade surplus narrowed from EUR 25.5B to EUR 1.2B. Intra-Eurozone trade dropped from EUR 143.9B to EUR 112.7B, down -21.7% mom.

From Swisss, PPI came in at -0.4% mom, -4.5% yoy in May, versus expectation of -0.9% mom, -4.6% yoy.

China industrial production continues to rebound while retail sales shrink

Released from China, industrial production grew 4.4% yoy in May, accelerated from April’s 3.9% yoy, but missed expectation of 5.0% yoy. Retail sales’s contraction slowed to -2.8% yoy, up from April’s -5.7% yoy, and missed expectation of -2.0% yoy. Fixed asset investment dropped -6.3% ytd yoy, missed expectation of -5.9% ytd yoy too.

Outlook of China’s economy is clouded by the resurgence of coronavirus risk in its capital city. Beijing reported a cluster of new coronavirus cases linked to its biggest wholesale food markets overnight weekend, which is now shutdown. Authorities in Beijing locked down 11 residential communities near the Xinfadi market. Additionally, the China Southern Airlines was required to suspend flights between Dhaka, Bangladesh, and the southern city of Guangzhou for four weeks.

From Japan, tertiary industry index dropped -6.0% mom in April, versus expectation of -7.5% mom.

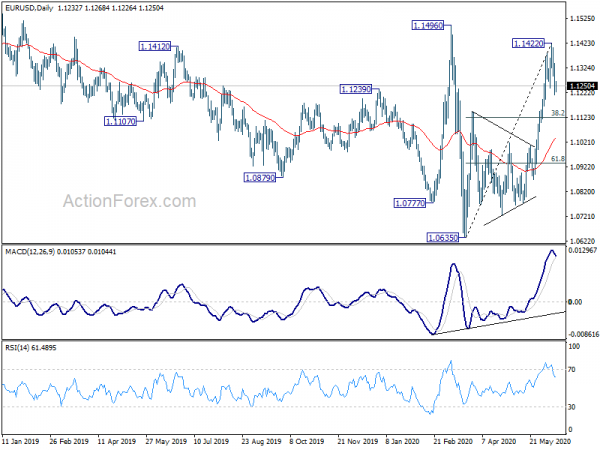

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1203; (P) 1.1271; (R1) 1.1330; More….

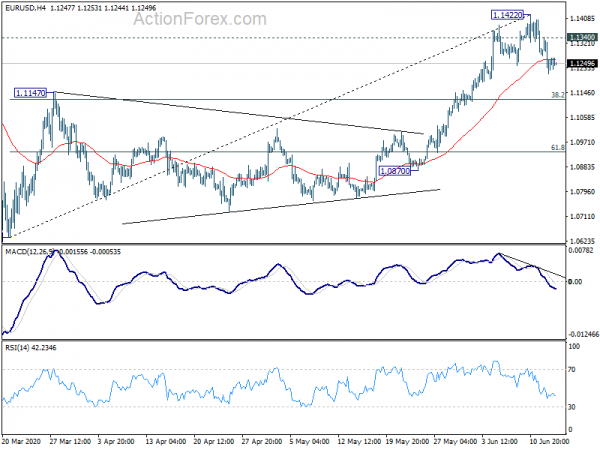

EUR/USD’s decline form 1.1422 short term top is still in progress. Intraday bias remains on the downside for 38.2% retracement of 1.0635 to 1.1422 at 1.1121. Sustained break there will argue that whole rebound from 1.0635 has completed and bring deeper fall to 61.8% retracement at 1.0936. On the upside, though, break of 1.1230 minor resistance will turn bias back to the upside for 1.1422 instead.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | Retail Sales Y/Y May | -2.80% | -2.00% | -7.50% | |

| 02:00 | CNY | Industrial Production Y/Y May | 4.40% | 5.00% | 3.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y May | -6.30% | -5.90% | -10.30% | |

| 04:30 | JPY | Tertiary Industry Index M/M Apr | -6.00% | -7.50% | -4.20% | -3.80% |

| 06:30 | CHF | Producer and Import Prices M/M May | -0.50% | -0.90% | -1.30% | |

| 06:30 | CHF | Producer and Import Prices Y/Y May | -4.50% | -4.60% | -4.00% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Apr | 1.2B | 20.3B | 23.5B | 25.5B |

| 12:30 | USD | Empire State Manufacturing Index Jun | -0.2 | -30 | -48.5 | |

| 12:30 | CAD | Manufacturing Sales M/M Apr | -28.50% | -20.20% | -9.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals