Dollar rides on renewed rally in US treasury yields and trades broadly higher today. The greenback’s strength is quite overwhelming for now. On the other hand, Yen and Swiss Franc are trading as the weakest ones, followed by commodity currencies. The stock markets are having little reactions so far, with European indices mildly in black while US futures are just slightly now. We’re not expecting drastic reactions in stocks unless 10-year yield could surge past 2% handle, which is still quite far away. But who knows?

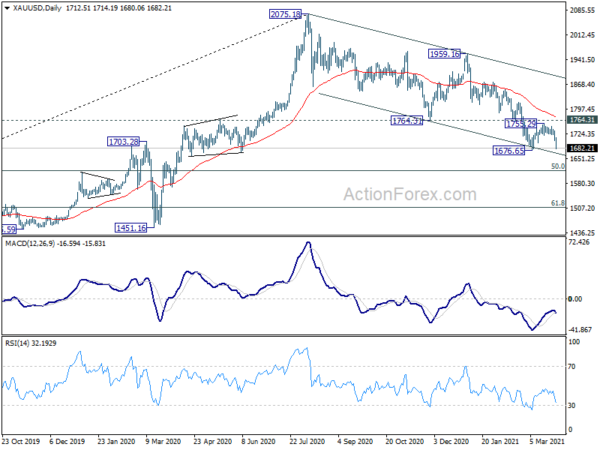

Technically, Gold is now in focus as it’s getting close to 1676.65 support. Break there will resume whole corrective fall from 2075.18 towards 50% retracement of 1160.17 to 2075.18 at 1617.67. We’d tentatively look for bottoming signal there. But further rise in yield, Dollar, and Gold could reinforce the moves of each other.

In Europe, currently, FTSE is up 0.10%. DAX is up 0.70%. CAC is up 0.51%. Germany 10-year yield is up 0.0522 at -0.263. Earlier in Asia, Nikkei rose 0.16%. Hong Kong HSI rose 0.84%. China Shanghai SSE rose 0.62%. Singapore Strait Times rose 0.48%. Japan 10-year JGB yield rose 0.0229 to 0.093.

Eurozone economic sentiment jumped to 101, back above long-term average

Eurozone Economic Sentiment Indicator (ESI) jumped to 101 in March, up from 93.4, above expectation of 96. It’s now slightly above its long-term average since the pandemic began. Employment Expectations Indicator jumped 6.8 pts to 97.7. Looking at some more details, industrial confidence rose form -3.1 to 2.0, turned positive. Services confidence rose form -17.0 to -9.3. Consumer confidence rose from -14.8 to -10.8. Retail trade confidence rose from -1.1 to -12.2. Construction confidence rose from -7.5 to -2.7.

EU ESI rose 6.9 pts to 100.0, back at long-term average. Amongst the largest EU economies, Germany stood out with the largest monthly improvement of its ESI on record (+7.9) and is currently the only of the ‘big-6’ countries where sentiment returned to above its long-term average. The monthly increases in sentiment in the other big countries were nevertheless very significant, too: Spain (+6.2), France (+5.4), Italy (+4.9), the Netherlands (+4.4), Poland (+3.3).

Swiss KOF rose to 117.8, highest since 2020, rapid recovery ahead

Swiss KOF Economic Barometer rose to 117.8 in March, up from 102.7, well above expectation of 104.3. The index is now “as high as it was last in summer 2010”, signal a “rapid economic recovery for the coming months”.

KOF said the improvement is “largely due to the indicators from the Swiss manufacturing industry”. The other groups of indicators, both for domestic and foreign demand, all signal a positive development, albeit significantly weaker.

BoJ Kuroda: Absolutely not that case of exiting ultra-loose policy

BoJ Governor Haruhiko Kuroda reiterated in an interview with the Japan Daily, the central bank had “absolutely no play” to stop ETF purchases, or unload its holdings. “We will continue to buy ETFs flexibly and in a nimble fashion, so it’s absolutely not the case that we are exiting ultra-loose monetary policy”, he added.

Separately from Japan, retail sales dropped -1.6% yoy in February, better than expectation of -2.8% yoy. That’s still the third straight month of annual decline. Unemployment rate was unchanged at 2.9%, better than expectation of a rise to 3.0%.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.53; (P) 109.69; (R1) 110.00; More…

USD/JPY’s rally continues today and reaches as high as 110.38 so far. Intraday bias remains on the upside. Sustained break of long term channel resistance will carry larger bullish implication and target 111.71 resistance next. On the downside, below 109.70 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 108.40 support holds, in case of retreat.

In the bigger picture, focus is now back on long term channel resistance (now at 110.00). Sustained break there will indicate that the down trend from 118.65 (Dec 2016) has completed. Further break of 112.22 resistance will confirm this bullish case and target 118.65 next. However, rejection by the channel resistance will keep medium term outlook bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Feb | -18.20% | 2.10% | 1.50% | |

| 23:30 | JPY | Unemployment Rate Feb | 2.90% | 3.00% | 2.90% | |

| 23:50 | JPY | Retail Trade Y/Y Feb | -1.50% | -2.80% | -2.40% | |

| 06:00 | EUR | Germany Import Price Index Y/Y Feb | 1.40% | 1.00% | -1.20% | |

| 07:00 | CHF | KOF Leading Indicator Mar | 117.8 | 104.3 | 102.7 | |

| 09:00 | EUR | Eurozone Economic Sentiment Mar | 101 | 96 | 93.4 | |

| 09:00 | EUR | Eurozone Services Sentiment Mar | -9.3 | -14.5 | -17.1 | -17 |

| 09:00 | EUR | Eurozone Industrial Confidence Mar | 2 | 0 | -3.3 | -3.1 |

| 09:00 | EUR | Eurozone Consumer Confidence Mar F | -10.8 | -10.8 | -10.8 | |

| 09:00 | EUR | Eurozone Business Climate Mar | 0.3 | -0.14 | -0.13 | |

| 12:00 | EUR | Germany CPI M/M Mar P | 0.50% | 0.50% | 0.70% | |

| 12:00 | EUR | Germany CPI Y/Y Mar P | 1.70% | 1.70% | 1.30% | |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Jan | 10.70% | 10.10% | ||

| 13:00 | USD | Housing Price Index M/M Jan | 1.30% | 1.10% | ||

| 14:00 | USD | Consumer Confidence Mar | 96 | 91.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals