Goldman Sachs still isn’t convinced Tesla will be able to meet even its Model 3 production targets.

“We believe the sustainable production rate for the second quarter of 2018 is most likely below the 2,000 vehicle mark the company achieved in the final week of the [first] quarter,” Goldman analyst David Tamberrino wrote Tuesday. “We see the company likely sustaining Model 3 production around the 1,400 per week mark.”

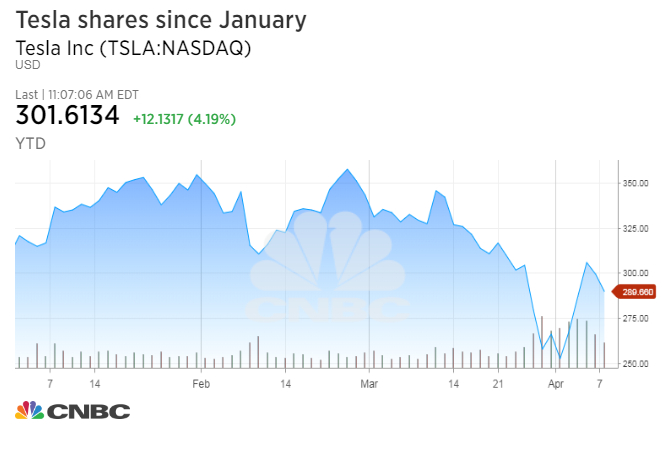

Tesla’s share price, which has declined 3 percent this year, is closely related to Model 3 production. So when the carmaker reiterated its production target of 5,000 Model 3 sedans per week by the end of June, shares popped.

But while the stock is up nearly 20 percent since the announcement last Tuesday, Goldman analysts remain unconvinced, fearful of persistent production bottlenecks.

Goldman Sachs predicts the electric car company will likely be forced to raise additional capital as soon as the third quarter despite recent assurances to the contrary.

Tesla did not immediately respond to CNBC’s request for comment. Shares closed up more than 5 percent Tuesday even after Goldman’s bearish note.

“Although the company stated that is does not require a capital raise this year, we note that this is predicated upon a sustained 5,000 per week production rate achieved exiting the second quarter of 2018,” Tamberrino explained. “Beyond a required capital raise to continue to fund the launch of the Model 3 program, the company would likely still need outside capital in the future for capacity and product expansion.”

The analyst reiterated his sell rating on the stock and cut his 12-month price target to $195 from $205, implying 32 percent downside over the next year.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals