It was a roller coaster ride in US stocks overnight. The markets cheered Trump’s backing down on the hard-line position on curbing Chinese investments in US companies. But White House economic advisor Larry Kudlow spoiled the party said the plan is neither harder nor softer. NASDAQ led the losses again, dropping -116.55 pts or -1.54 % to close at 7445.08. DOW lost -165.52 pts or -0.69% to 24117.59 while S&P 500 decline -23.43 pts or -0.86% to 2699.63. Notable strength was also seen in treasuries as 10 year yield dropped -0.053 to 2.827, breaking last week’s low. WTI crude oil surged through 72.83 key resistance. Gold stays pressured after diving to 1251.

In the currency markets, Dollar swam against the tide of falling yield and stocks. While the greenback retreats mildly in Asian session, it’s staying as the strongest one for the week. Yen follows as the second strongest for the week on risk aversion. Canadian Dollar is trading as the third strongest for the week, helped by oil strength but capped by trade and BoC uncertainties. On the other hand, New Zealand Dollar remains the weakest one after some dovish tweaks in RBNZ statement. Sterling and Aussie are the next weakest ones.

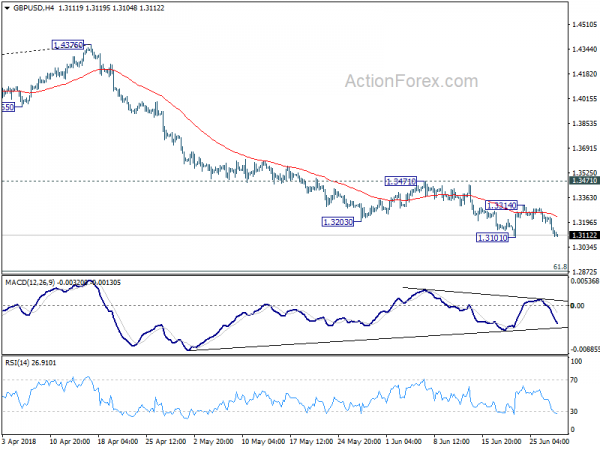

Technically, for now, EUR/USD is still holding above 1.1507 support and this will be the level to watch today. GBP/USD is catching up on Sterling weakness and could break equivalent support at 1.3101 earlier than EUR/USD. GBP/JPY’s break of 144.37 support should now bring deeper decline to 143.18. AUD/USD breached 0.7328 key cluster support level as recent fall resumed. But there is no follow through buying yet. This will also be a level to watch today too. USD/CAD’s rally looks ready to resume but 1.3381 must be overcome decisively first.

DOW reversed initial rebound as Kudlow spoiled the party

The initial rebound in stocks was fueled by lessened worries on US-China trade relationship. Trump announced to use a a strengthened national security review panel — the Committee on Foreign Investment in the United States (CFIUS) to guard against threats from Chinese investments in US technology companies. That’s a blanket measure that doesn’t single out China as the target, as confirmed by Trump’s own words, and comments by Treasury Secretary Steven Mnuchin.

The markets generally see that as Trump backing down to a softened approach on China. But such notion was rejected by Kudlow. In an interview, Kudlow said “the idea of softer or harder is really beside the point”. And, “That’s really not the intent. We’re not driving there.” Kudlow added that “it’s not meant to be harder or softer,” and “it’s going to be very comprehensive and very effective at protecting our technological family jewels in the United States.”

Two auto groups blast Trump’s auto tariffs

The Association of Global Automakers issued a statement titled “International Automakers Are Not A National Security Threat” today in objection to Trump’s intention to impose tariffs on import cars. The group warned that “these tariffs will harm today’s U.S. auto industry, which is comprised of fourteen auto manufacturers, all of which are global and 10 of which are international automakers.” And, “each of these companies employ American workers to produce cars in the United States, and tariffs will substantially increase prices for consumers.”

Further it criticized that “there is no national security justification for taxing imports of vehicles and parts or discriminating between global companies headquartered here or in allied countries.” The group noted that “every U.S. production facility in the industry could be made available in a national emergency, and the 130,000 Americans who work directly for international automakers are no less patriotic or willing to serve their country in a time of crisis than any other American.”

Finally, it warned that “if this investigation leads to tariffs, retaliation against U.S. exports is inevitable.” And, “substantial tariffs against major US auto exports have in fact already been announced, placing American auto workers on the front lines of this trade conflict.”

Another group Alliance of Automobile Manufacturers also object to the tariff. It said in a statement that “tariffs are not the right approach” to achieve a level playing field. And, it urge reduction in trade barriers across the board and achieve “fairness” through “facilitating rather than inhibiting trade.” And, economic security of the auto industry and country would be strengthened through modernizing NAFTA and concluding a U.S.-EU Trade Pact.

The statement also listed the bad effects of auto tariffs. There will be USD 45B in additional tax for consumers. a 25% tariffs would result in 1.5% decline in production and cause USD 195k works to lose jobs over 1-3 years or possibly longer. Job losses could surge further to 624k on retaliation by other countries. Auto sales will fall 1-2m units. It will cancel out tax reform benefits, reduce auto exports and harm other vital sectors of the economy. Besides, it will cede US leadership on future vehicle technologies.

Boston Fed Rosengren: Don’t let the economy run above capacity

Boston Fed President Eric Rosengren delivered a speech titled Ethics and Economics Making Cyclical Downturns Less Severe yesterday. There he argued that Fed shouldn’t let the economy “run above capacity” and “fall far below the sustainable unemployment rate”. He noted it’s the path that will “increase the probability of a longer recession-free period”.

It should be noted that unemployment rate, currently at 3.8% in May, is already quite far below Fed’s longer run rate at 4.5%. But where the real natural rate is, it’s still up for debate.

Also, Rosengren repeated his push for inflation range target. He said “one might allow the inflation target to rise within the range during periods of low real rates, thus providing more room for the funds rate to fall during an economic downturn.”

BoC Poloz sent mixed messages on July hike

BoC Governor Stephen Poloz’s speech yesterday caught much attention given that the central bank is due to meet again on July 11, just two weeks away. Expectations on a July hike was built up after the statement in May. But such expectations were put in doubt after a string of weaker than expected data. Escalation on trade tension with US also cloud the economic outlook. Overall, Poloz gave little hint on the chance of a July move with mixed messages with the post speech press conference.

On the hawkish side, Poloz said the shift in the language in May’s statement showed “increased confidence that the economy was performing as we expected, and that higher interest rates will indeed be warranted.” He also down played recent disappointing data. He said, “having the occasional data point that didn’t fit market expectations is not the sort of thing that throws that entire narrative off course. We are data dependent, not headline dependent.”

However, Poloz also emphasized that policy makers “cannot mechanically follow the rate path provided by our models because there is simply too much uncertainty in the world.” He pointed out that ” the degree to which uncertainty about trade policy is holding back business investment” is one of the certainties. And, the impact of new lending guidelines on housing markets is another one.

Poloz added that “as we approach our next interest rate decision, we are working to incorporate in our projections the effects of the recently announced US steel and aluminum tariffs, along with retaliatory measures, both in Canada and globally.” Also, BoC will analyze how the new lending guidelines are affecting the housing markets. These issues will ” figure prominently in our upcoming deliberations.” This is seen as the dovish side of the messages.

The upcoming data, April GDP and Business Outlook Survey will be highly critical on July BoC rate decision. In our view, should they disappoint, a July hike would be ruled out. Otherwise, it could be a 50/50 for BoC policy makers.

RBNZ to stay on hold longer as dovish statement indicates

New Zealand Dollar stays pressured after RBNZ left OCR unchanged at 1.75% as widely expected. The central bank reiterated in the statement that the best contribution it could make is “to ensure the OCR is at an expansionary level for a considerable period.” Also, the next move could come in “either direction – up or down”.

Nonetheless, there are some dovish tweaks in the statement too. Firstly, the global economic outlook has been “tempered slightly by trade tensions in some major economies” and “ongoing volatility in some emerging market economies continues.” Secondly, “recent weaker GDP outturn implies marginally more spare capacity in the economy than we anticipated.” And thirdly, “the Government’s projected spending impulse is also slightly lower and later than anticipated.”

The dovish tweaks argue that RBNZ would stay on hold for longer even though they don’t warrant a cut yet.

On the data front

Elsewhere, Japan retail sales rose less than expected by 0.6% yoy in May. Germany will release Gfk consumer sentiment and CPI in European session. Eurozone will release confidence indicators. Later in the day, US will release Q1 GDP final and jobless claims.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3066; (P) 1.3154; (R1) 1.3203; More…

GBP/USD drops to as low as 1.3104 so far and focus is now on 1.3101 support. Break will resume fall from 1.4376 and target 61.8% retracement of 1.1946 to 1.4376 at 1.2875 next. In case of another recovery, we’d continue to expect upside to be limited by 1.3471 resistance to bring decline resumption.

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken firmly, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4177). 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 is the next target. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. For now, outlook will stay bearish as long as 1.3471 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:50 | JPY | Retail Trade Y/Y May | 0.60% | 1.20% | 1.60% | 1.50% |

| 06:00 | EUR | German GfK Consumer Confidence Jul | 10.6 | 10.7 | ||

| 08:00 | EUR | ECB Monthly Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Business Climate Indicator Jun | 1.2 | 1.45 | ||

| 09:00 | EUR | Eurozone Economic Confidence Jun | 112.1 | 112.5 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Jun | 6.5 | 6.8 | ||

| 09:00 | EUR | Eurozone Services Confidence Jun | 15.9 | 14.3 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -0.1 | -0.5 | ||

| 12:00 | EUR | German CPI M/M Jun P | 0.50% | |||

| 12:00 | EUR | German CPI Y/Y Jun P | 2.20% | |||

| 12:30 | USD | GDP Annualized Q/Q Q1 T | 2.20% | 2.20% | ||

| 12:30 | USD | GDP Price Index Q1 T | 1.90% | 1.90% | ||

| 12:30 | USD | Initial Jobless Claims (JUN 23) | 220K | 218K | ||

| 14:30 | USD | Natural Gas Storage | 91B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals