Cleveland Federal Reserve President Loretta Mester raised her outlook for the economy and gross domestic product for 2018, adding that the central bank’s plan for gradual interest rate increases is appropriate.

“I’ve been upping my forecast. I’m now at 2.75 percent to 3 percent for the year, probably closer to 3 percent,” Mester told CNBC on Friday at the Fed’s annual summit in Jackson Hole, Wyoming. “I think that the fiscal policy — the stimulus and the tax cuts — has been a positive for the economy in terms of demand growth, and so that’s one of the factors.”

“But also there’s been more momentum in the economy than I might have anticipated,” she added. “Again, we’re at our targets, and yet we have accommodative monetary policy. Right now, this gradual upward path of policy rates seems appropriate to me.”

The Fed has been on a rate-hiking cycle since December 2015, raising rates seven times, after keeping the funds rate near zero for seven years. Mester is a voting member of the Federal Open Market Committee, the Fed’s policymaking arm.

Market watchers widely anticipate a Fed rate increase on Sept. 26 and possibly one more in December.

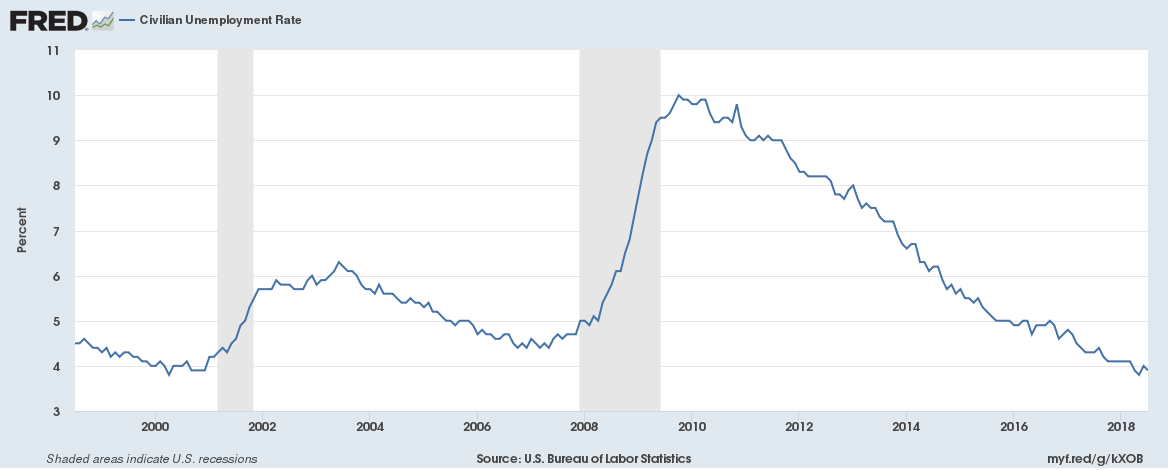

Source: U.S. Bureau of Labor Statistics, Civilian Unemployment Rate, retrieved from FRED.

“We’re basically at our 2 percent inflation target and I think we’ll be sustainably at that by the end of the year,” she told CNBC’s Steve Liesman in the interview, which aired on “Squawk Box.”

“We are monitoring financial conditions, we’re monitoring them very carefully. I think we’re doing a better job than we did in the past, but we certainly look for risk,” she said. “Leveraged lending is little up there, I think if you look at stock prices and other asset valuations, some of those are excessive. So we’ve got to take that into account.”

Fed Chair Jerome Powell is due to deliver a speech later in the day discussing the summit’s theme of changing market structures and the implications for monetary policy.

President Donald Trump, unhappy with the Fed’s decision to elevate borrowing costs, criticized Powell in an interview last month on CNBC, saying he was “not thrilled’ with rising interest rates. He repeated that criticism in an interview published Monday by Reuters.

Many economists have lauded the Fed’s plan, however, arguing that the central bank needs to stay on top of burgeoning inflation by keeping the money supply in check.

The normalization of interest rates, others argue, also provides central bankers with ammunition to combat future economic crises through lower rates.

“This is by any measure, this is a very solid U.S. economy, supported by fiscal policy and solid private spending,” Nathan Sheets, chief economist at PGIM Fixed Income, told CNBC on Monday.

“By any theory of central banking, they need to move the rate back to neutral,” he added. There are many more risks if they fail to do that. There’s a strong case for the Fed to act pre-emptively.”

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals