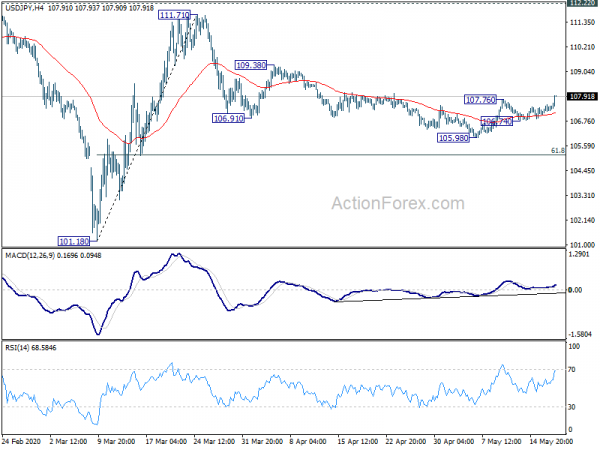

Markets in Risk Aversion Over Hong Kong’s Future, Yen and Dollar Rebound

Yen and Dollar surge in Asian session today as markets are clouded by new uncertainty over Hong Kong’s future. The situation carries significance firstly on the direction of US-China trade tension. Secondly, Hong Kong’s international financial hub status could be...

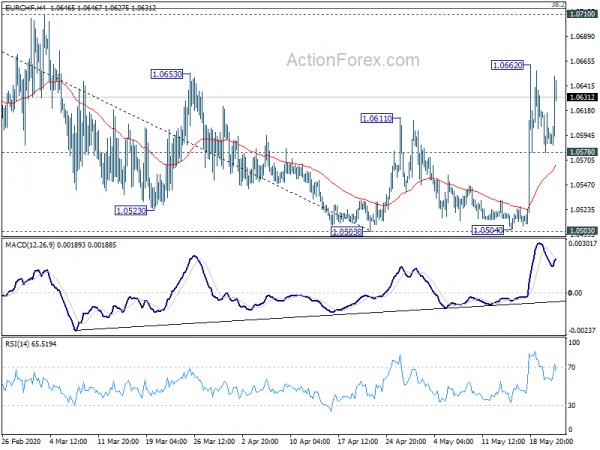

Dollar Recovery Attempt Falters Quickly, Swiss Franc Dives Again

The financial markets are, generally speaking, a bit mixed today. European stocks are slightly in red while US futures are down. But losses are very limited. Bulls are still in overwhelming control. In the currency markets, Swiss Franc drops sharply...

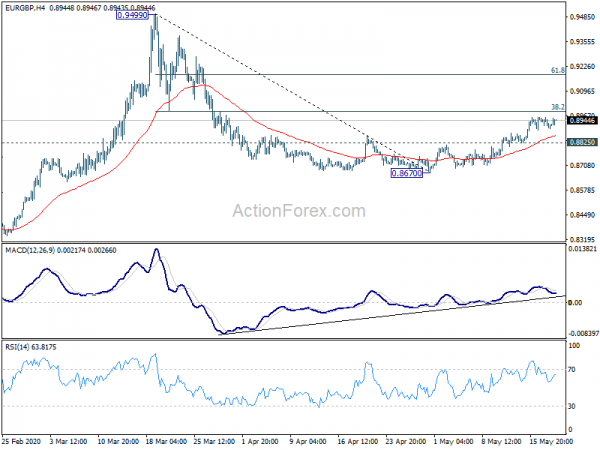

Sterling Soft as Risk Rally Pauses, Focus Turns to PMIs

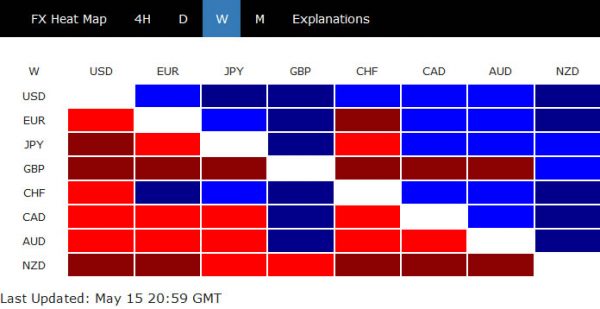

Dollar recovers mildly in Asian session, together with Yen, as stock rally takes a breather again. But both remains the worst performing over the week. Similarly, Australian and New Zealand Dollars also retreats mildly but remain the strongest one for...

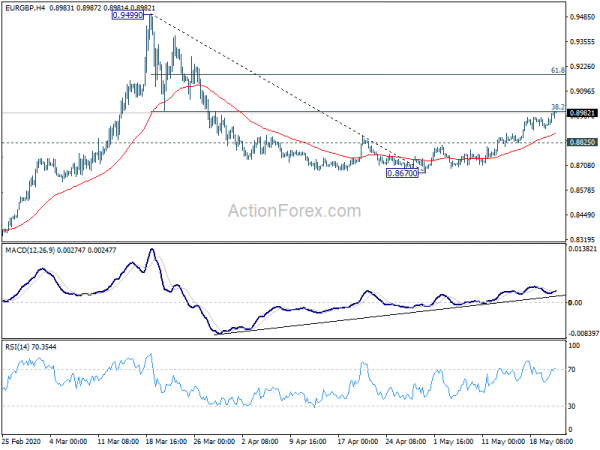

Sterling Softens after UK Sold Bonds With Negative Yield

Sterling weakens mildly today after UK sold government bond with a negative yield for the first time ever. According to the Debt Management office, It auctioned GBP 3.75B of 3-year bonds at an average rate of -0.003%. Demand was weak...

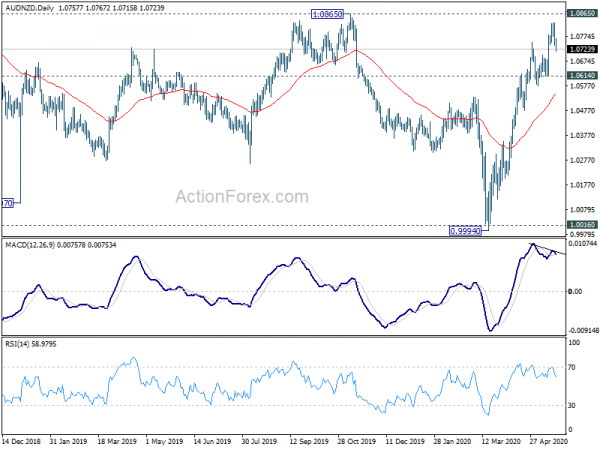

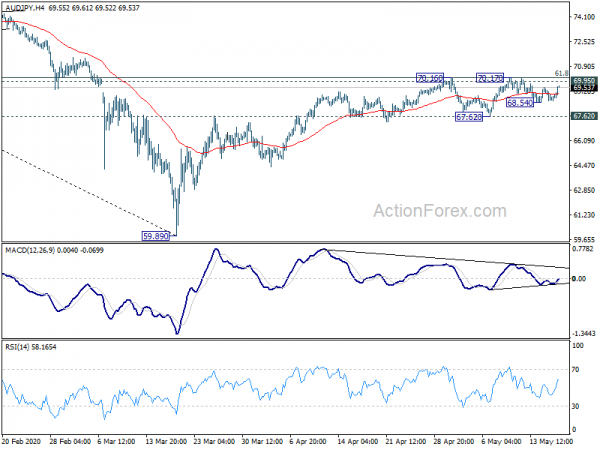

Dollar and Yen Soft, Awaiting Next Move in Risk Markets

While risk market retreats mildly, the developments in currency markets are unchanged. New Zealand and Australian Dollar remain the strongest one for now. In particular, Kiwi is lifted a bit further by RBNZ governor’s comment that it doesn’t want to...

Euro Surges of Recovery Fund Hope, Yen Tumbles

Yen, Dollar and Swiss Franc remain generally weak today eventual risk rally starts to take a breather in European session. On the other hand, currency market have some what shifted from commodity currencies to Euro and Sterling. Euro is lifted...

Sterling Soars on New UK Tariff Regime, Broad Based Risk Appetite Continues

Sterling surges notably today after UK announced new tariff regime after Brexit, allowing 60% of trade to be tariff free. In the background, markets are supported by solid risk appetite, on coronavirus vaccine optimism. New Zealand and Australian Dollar are...

Investor Cheers Coronavirus Vaccine news, Risk On

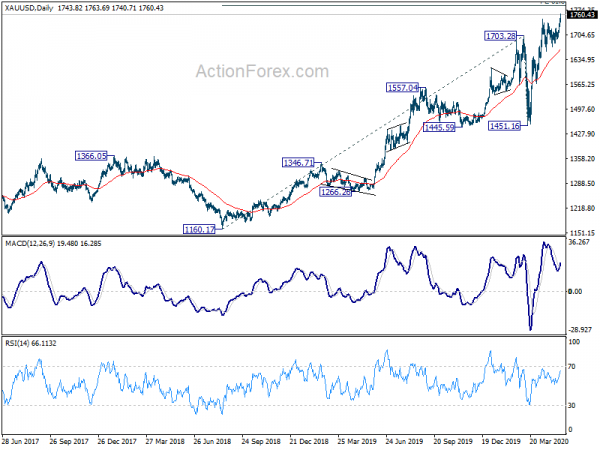

Global stock markets surge sharply today on optimism that coronavirus vaccine research took another big step. New Zealand Dollar leads commodity currencies generally higher. On the other hand, Yen, Dollar and Swiss Franc are under broad based pressure. Gold also...

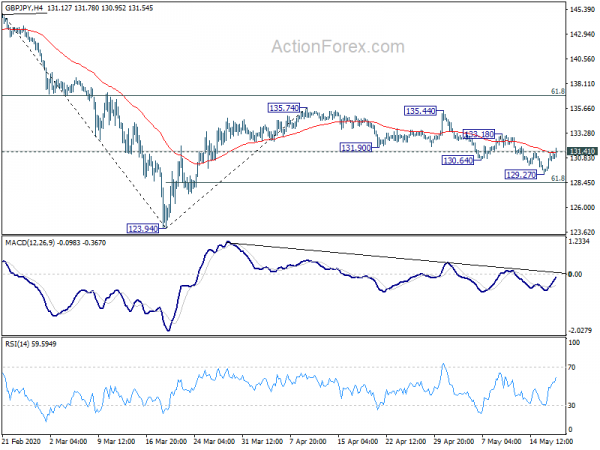

Sterling Weak of Negative Rate Talks, Gold Extending Up Trend

Sterling stays generally weak as another week starts. The Pound was weighed down by comments from BoE chief economists Andy Haldane, who said that negative rate was “something we’ll need to look at – are looking at – with somewhat...

Negative Interest Rate Expectations Drove Markets, Risk Reversal TBC Soon

The topic of negative central bank interest rates was a key driver in the forex markets last week. Dollar ended as the strongest one against a chorus of Fed officials expressed their objection. New Zealand Dollar, on the other hand,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals