Asian Markets Lower as US Gives Up Easter Coronavirus Target, Yen Firmer

Asian markets open the week generally lower as there is no sign of even a slowdown in coronavirus pandemic. The US has also given up hope for returning to normal by Easter. Yen strengthens generally, followed by Dollar. Meanwhile, Sterling...

As Recovery in Stocks Lose Momentum, Could Dollar Strike Back?

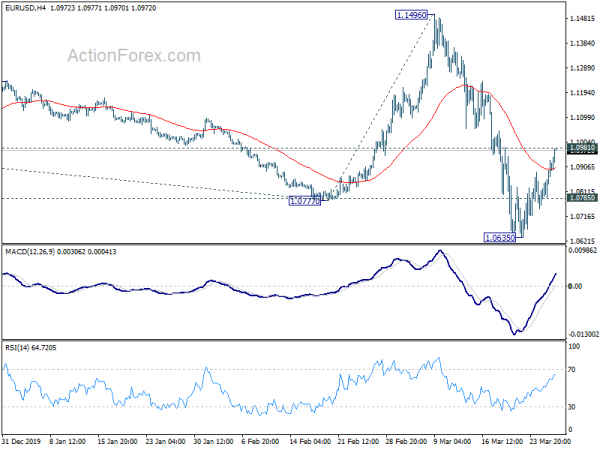

While the coronavirus pandemic continued to worsen globally, investor sentiment somewhat stabilized after governments and central banks rushed to push out tighter lockdown measures, fiscal stimulus and monetary easing. Dollar suffered massive selling on easing risk aversion, improving funding conditions,...

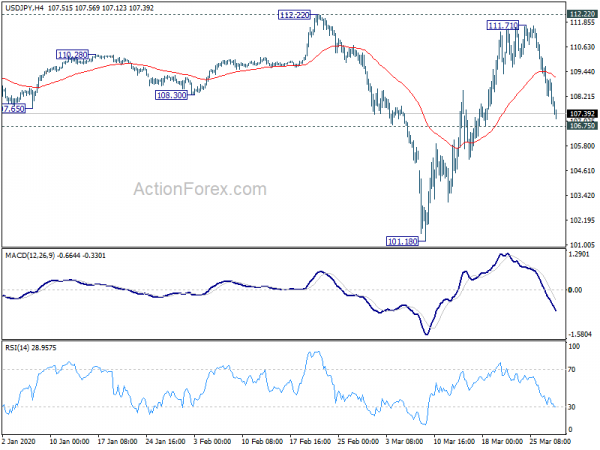

Markets in Profit Taking Retreat, Yen and Dollar Recovering Grounds

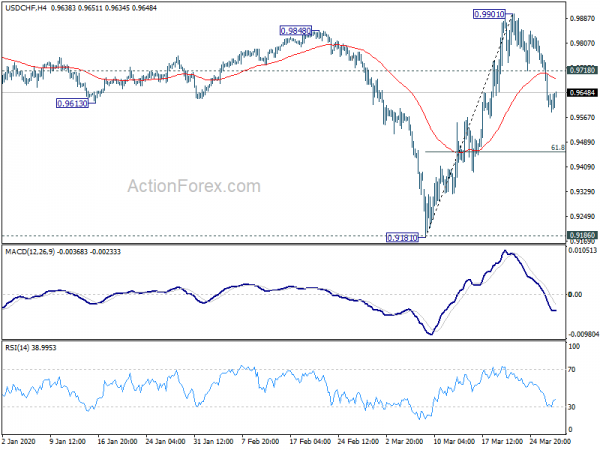

European stocks and US futures turn softer today, apparently on pre-weekend profit taking again. FTSE is additionally pressured, possibly as Prime Minister Boris Johnson was tested positive for coronavirus. In the currency markets, Yen regains some ground together with Swiss...

US Coronavirus Infections and Stocks Surge, Dollar Weakens

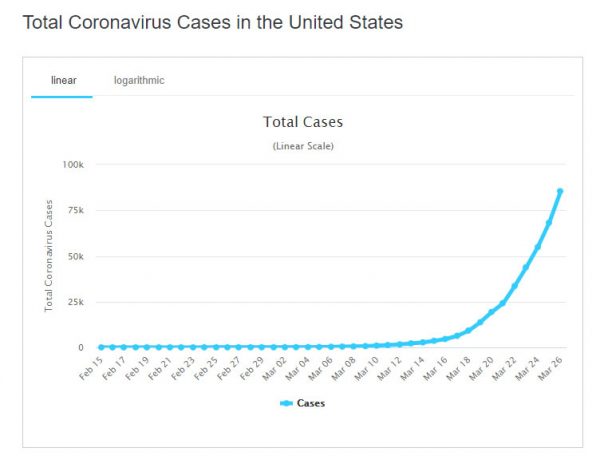

Dollar is set to end the week as the week as the worst performing as corrections in the financial markets extend. Asian indices are generally higher following another day of strong close in the US overnight. Yen follows Dollar as...

Dollar Stays Soft after Shocking Jobless Claims, BoE Stands Pat

Dollar softens mildly again today as consolidation extends. The shock delivered by initial jobless claims is actually rather well expected. The greenback dips slightly after Fed chair Jerome Powell’s comments, but that’s it. BoE keep monetary policies unchanged at the...

Risk Rebound Fades as Focus Turns to Jobless Claims and BoE

Asian markets turn softer today as boost from US stimulus package fades very quickly. Focus will instead turn to BoE rate decision and US jobless claims. In particular, the latter would reveal how serious the initial impact of coronavirus outbreak...

Markets Turned Mixed after Stimulus Rally, Dollar Staying in Consolidations

The stimulus deal in US Congress gave markets just a very brief lift. European indices turned mixed after initial rally while US futures are essentially flat. Trading in the currency markets is subdued too with Australian Dollar leading commodity currencies...

Sentiments Boosted By US Stimulus Deal, Dollar, Yen and Swiss Soften

Asian markets generally strengthen today and are given another lift after US politicians finally agreed to a USD 2T coronavirus stimulus deal. Australian Dollar leads other commodity currencies higher. On the other hand, Yen weakens broadly, followed by Yen and...

Markets Shrug Disastrous PMIs, Continue to Digest Recent Moves

PMI data released together generally showed a disastrous picture in the service sectors around the world, due to coronavirus pandemic and the measures to contain it. Nevertheless, these data are generally shrugged off as they’re generally expected. Reactions would likely...

Dollar Softens on Fed QE Infinity, Global PMIs in Focus

While Fed’s QE infinity gave no apparent boost to US stocks, Asian markets are responding rather positively. Strong gains are seen in major indices. Dollar has turned broadly weak, followed by Swiss Franc, Yen and Euro. Australian Dollar is leading...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals