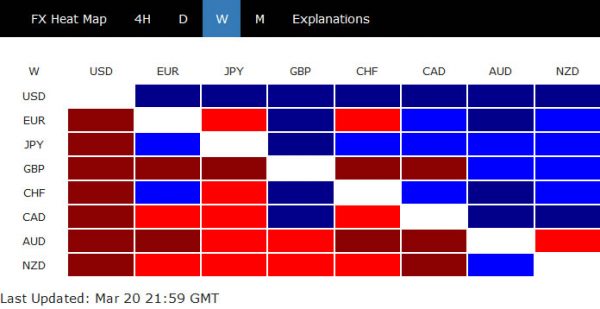

Sentiments Take a U-Turn as Fed Goes QE Unlimited

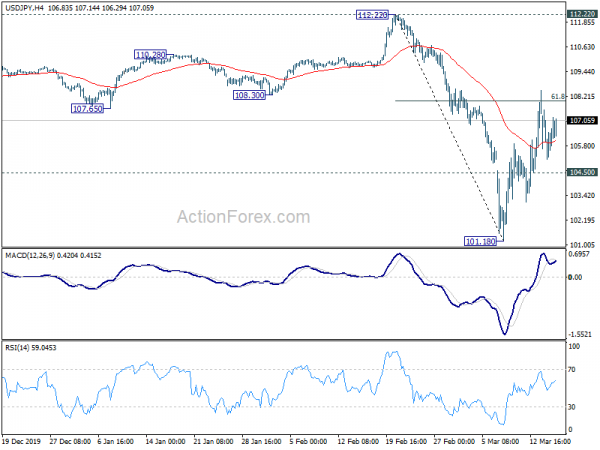

Market sentiments take a u-turn today after Fed surprised the markets with another emergency announce. Now, the targets for asset purchases are removed and Fed is going into QE unlimited. US futures turned from limit down to positive while major...

Risk Aversion Continues, RBNZ Cut, NZ & AU Lockdown, US to See Surge in Unemployment

Markets are back in risk averse mode as another week starts, after Spain and Italy suffered the worst days of coronavirus pandemic over the weekend. US Senate failed to advance another aid package on differences between Republican and Democrats. But...

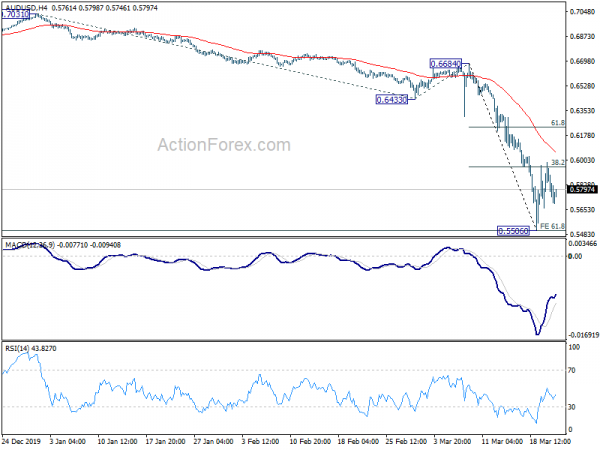

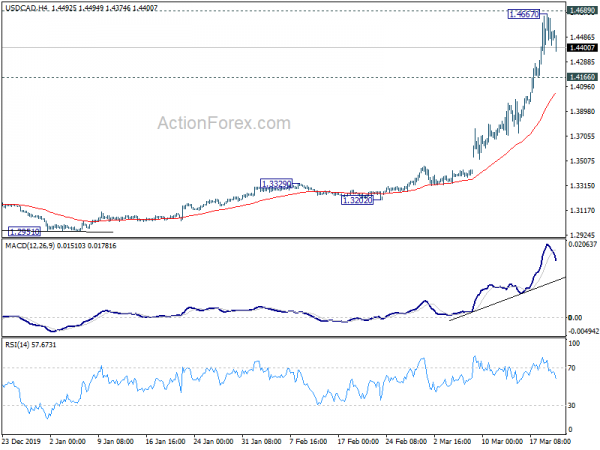

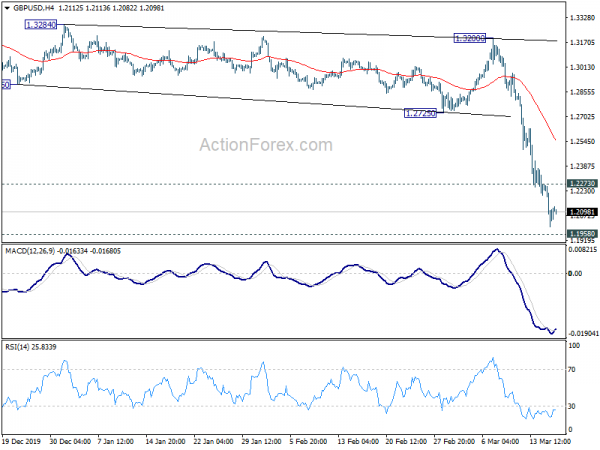

Dollar in Strong Rally as Coronavirus Pandemic Worsened, Key Resistance Levels Broken

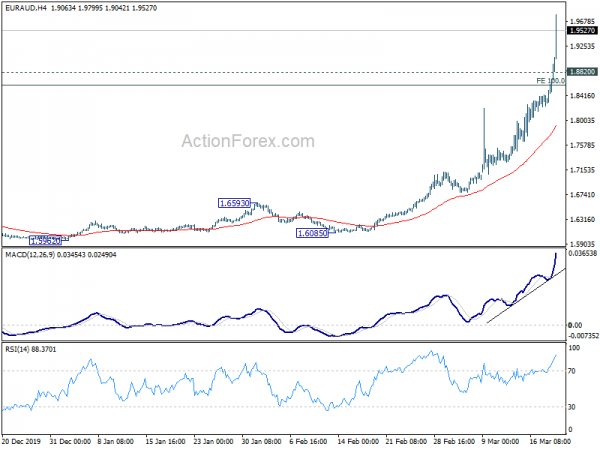

The anticipated market stabilization didn’t happen last week. Instead, despite massive monetary and fiscal stimulus, stocks around the world still ended sharply lower. Nevertheless, as stocks are showing sign of loss of downside momentum. Treasury yield has somewhat stabilized in...

Markets Staying in Consolidation as Dollar and Yen Turn Mildly Softer

The financial markets are generally staying in consolidative mode today. Global stocks managed to reverse some of this week’s loss. in the currency markets, Dollar pares back some of recent gains while commodity currencies recover. Though, these moves are generally...

Markets Digesting Wild Moves, Stabilizing ahead of Weekend

Asian markets are rather quiet finally as the weekend is coming. Currencies are digesting this week’s sharp moves for now, with mild recovery seen in commodity currencies and Sterling. Dollar and Yen turn slightly softer. But for the week, the...

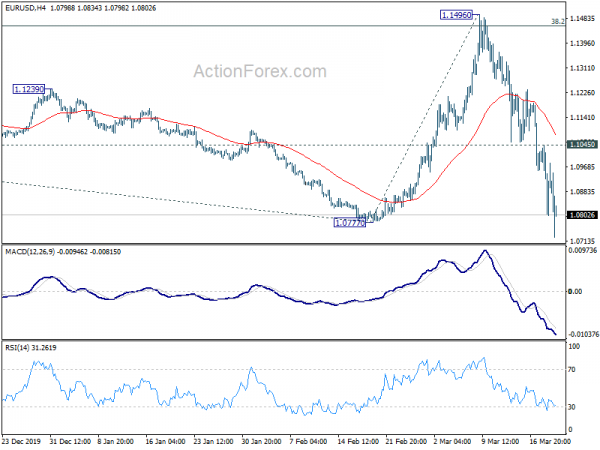

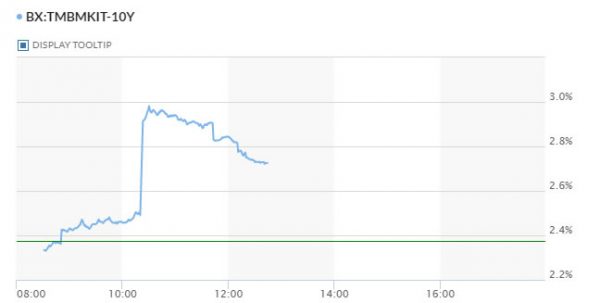

ECB’s Stimulus Lifted Peripheral Bonds, But Not Stocks Nor Euro

ECB’s massive coronavirus pandemic program do have notably impact on peripheral bond markets. In particulars, Italian and Spanish bond yields dropped sharply today, with Italy 10-year yield back below 1.9% currently, Spanish 10-year yield below 0.9%. The boost to other...

No Support from ECB’s Pandemic Emergency Purchase, Nor RBA’s Rate Cut and Bond Buying

Once again, it seems that emergency fiscal and monetary measures by global governments and central banks couldn’t be cared less by investors. US Congress’ second stimulus package, ECB’s massive EUR 750B pandemic emergency purchase program, RBA’s rate cut and government...

Stimulus Effects Fade, Oil Tanks, Italian Yield Spikes Up

Neither fiscal nor monetary stimulus is able to provide sustainable support to market so far. Stock markets are back under pressure today despite the massive USD 1T stimulus proposal by the US. Additionally, sentiments are pressured by the sudden spike...

US Fiscal Response to Coronavirus Just Gave Brief Lift to Sentiments

Investor sentiments were given only and mild and brief boost by the massive fiscal stimulus of the US. Asian markets quickly reversed initial gains and pessimism over coronavirus pandemic wild likely continue in European markets too. As for currencies, Canadian...

Dollar Surges as Focus Turns from Stock to Currency Markets

Focus somewhat turns from stock markets to currencies today. Major global indices are staying in rather tight range today, based on recent volatility. Fiscal and monetary measures from major central banks and governments are providing little support to sentiments, as...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals