Dollar Turns Mixed as Risk Aversion Recedes Mildly, Overall Markets Mixed

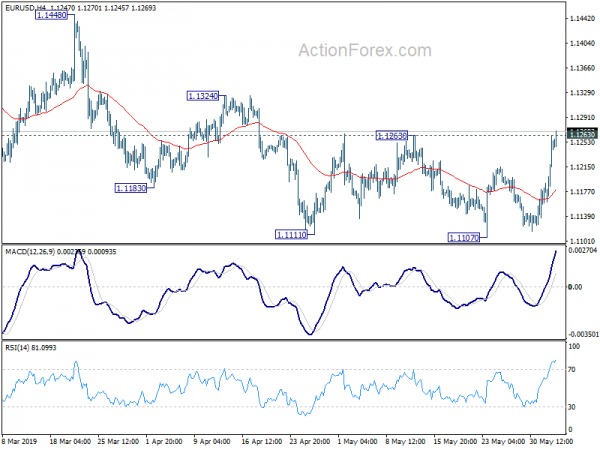

While Dollar has been pressured for most of the day, receding risk aversion seems to be giving in a hand in early US session. The greenback is riding on recovery in both US yield and stocks and trades mildly higher....

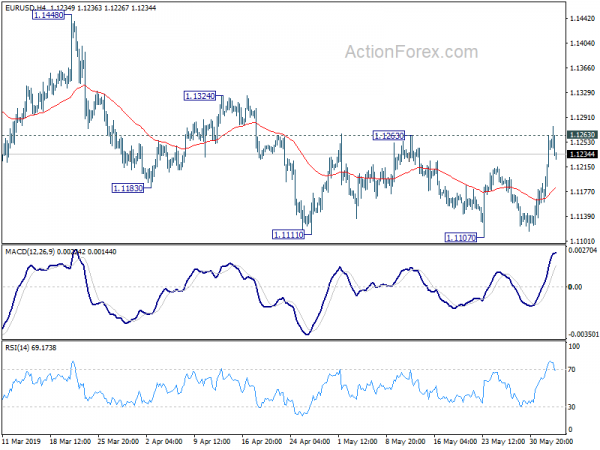

Dollar Decline Accelerates on Falling Yield and Stocks, Trade Wars and Fed Cut Talks

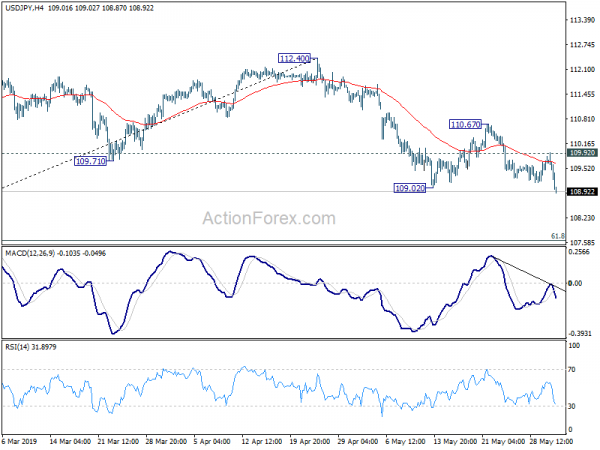

Dollar suffered another round of selloff this week and remains broadly weak today. Free fall in treasury yields continued overnight with 10-year yield closing at 2.081, down -0.061. 2% handle is now looking vulnerable with current downside acceleration. Tech stocks...

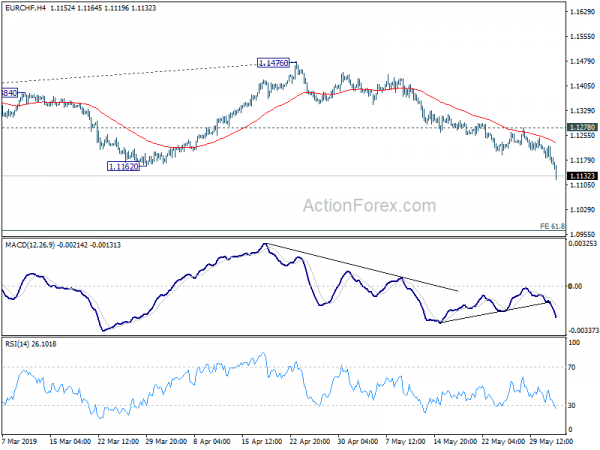

Dollar Softens ahead of Important Economic Data, EUR/CHF Hits 2-Yr Low

Dollar weakens broadly today as markets are turning their focuses to manufacturing from the US. Final reading of Markit PMI shouldn’t deviate much from the first print 50.6. Meanwhile, ISM manufacturing could probably how confidence turned after last round of...

Dollar Mixed as China’s White Paper Signals No Quick End to Trade War

Dollar opened the week mildly lower but appears to have found some footing in early European session. Trump is fighting trade wars on two fronts, at least. On the one hand, China has cleared stated its position for not backing...

Sentiment Sank on Trump’s Political Weaponization of Tariffs

Free fall in major government yields extended, and accelerated last week. Meanwhile, it seemed that stocks investors finally woke up with sharply deteriorating sentiments. Major indices staged steep decline as risk aversion heightened. The first factor being the “ever-present” US-China...

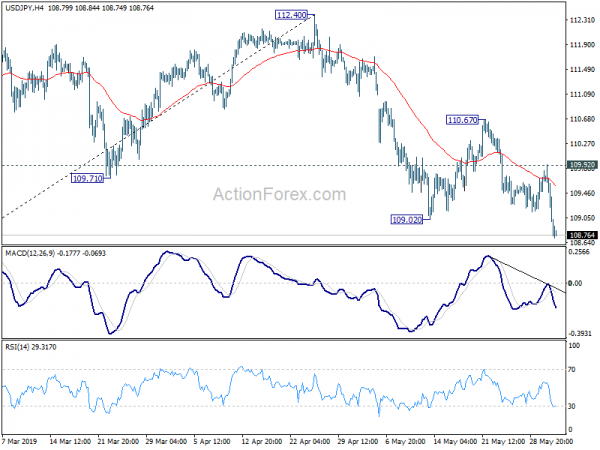

DOW Opens Down 1% as Bears Cheer Trump’s Mexican Tariffs, Yen Maintains Strong Momentum

Global financial markets are rocked by Trump’s decision to use tariffs as a way to force Mexico to solve border security crisis of the US. 5% tariffs will be imposed in all Mexico imports to US starting June 10, then...

Yen Jumps as Trump Uses His Only Trick of Tariffs on Mexico

Risk aversion intensifies again today as Trump uses his one old tricky in tariffs again, but turned to Mexico. 5% tariffs will be imposed on all Mexican imports on June 10, and “gradually” move up to 25% in less than...

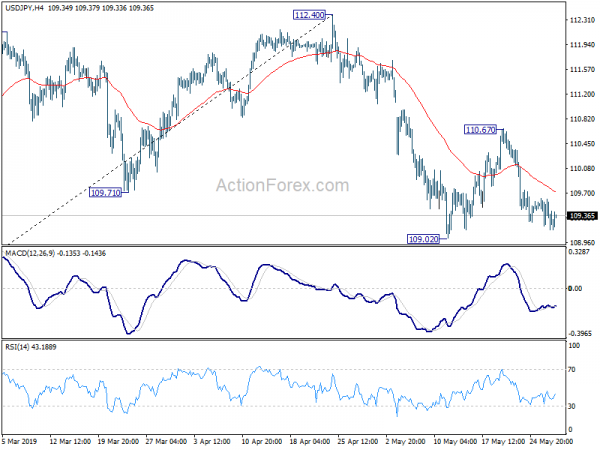

USD/JPY Extends Recovery on Solid US Data, Trade Spats Shrugged

Dollar trades generally higher today as risk markets stabilized, partly helped by recovery in treasury yields too. Economic data from US generally matched expectations. Markets also shrugged off repeated comments from US and China regarding trade war. Though, at the...

Sentiments Stabilized Despite More Hard-Line Trade Rhetorics, Stock Markets Not Ready for Crash Yet

Risk sentiments stabilized somewhat in Asian session today. While major Asian indices are down, losses are so far limited. Late buying in the US overnight argues that the markets are not in a crash yet despite all the talks on...

Risk Aversion Stays With Persisting Trade Worries, Franc and Yen Strong Again

Risk aversion stays in the global financial markets today but it’s not in the most intense state yet. A trigger for selloff in stocks and decline in yield is China’s threat to squeeze supply of rare earths to the US...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals