Yen and Franc Surge as German Yield in Free Fall on Italy Budget

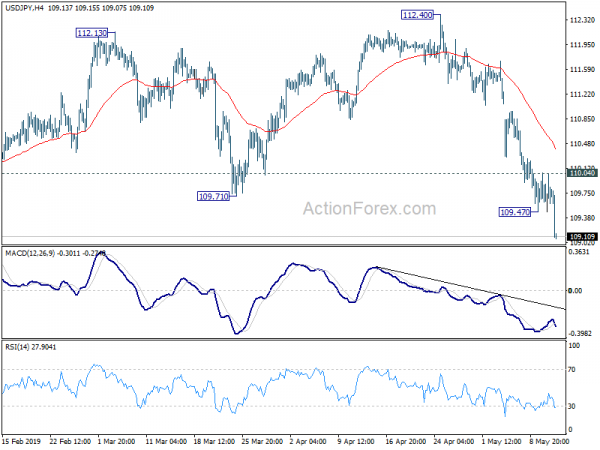

Worries over Italy’s budget takes center stage today. Italy 10-year yield hit as high as 2.812. On the other hand, German 10-year yield dived to as low as -0.131. US 10-year yield is also dragged down to as low as...

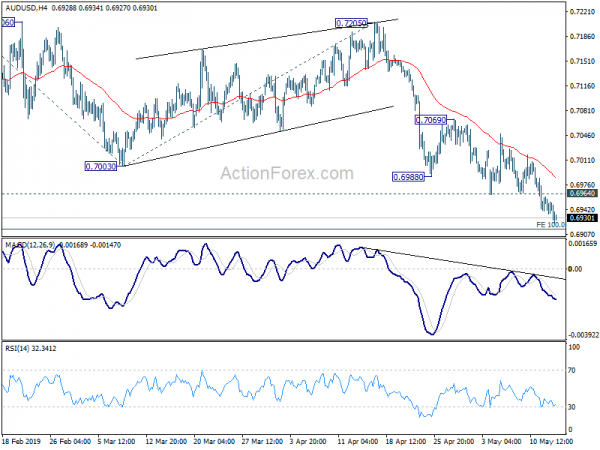

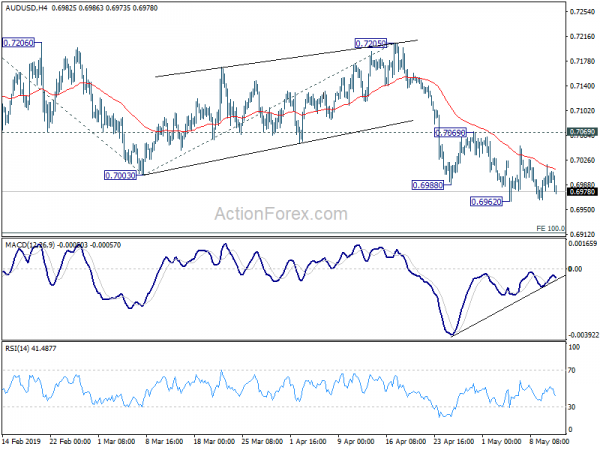

Australian Dollar Tumbles on Wage Growth Miss, China Data Point to More Slowdown

After some initial hesitation, Asian markets picked up some momentum and strengthen broadly, recovering some of this week’s losses. Though, strength is so far limited with lots of uncertainty ahead. It’s a fact that US-China trade war is dragging on...

Market Sentiments Stabilized, UK Job Data and German Confidence Ignored

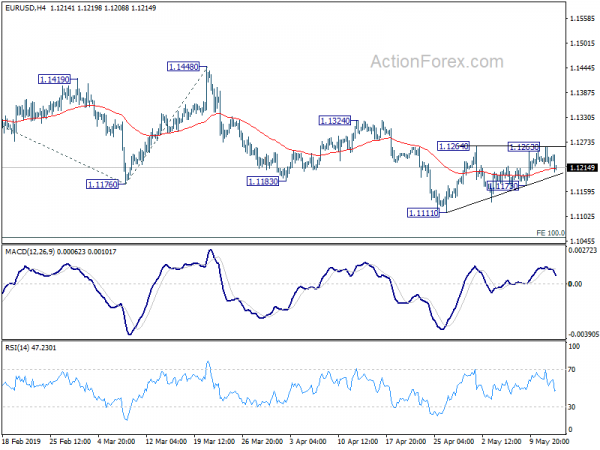

Markets sentiments generally stabilized today as it seems that US and China are still will to continue trade negotiations. Nevertheless, otherwise some pleasing words, there is nothing concrete, not even a scheduled meeting. Further decline in German 10-year yield, deeper...

Yen and Franc Retreat as Sentiments Stablized Somewhat, But More Tariffs Still on the Way

Market sentiments somewhat stabilized in Asian session today. Major indices opened lower, following the selloff in US. But losses are so far rather limited. Indeed, in the currency markets, Yen and Swiss Franc are paring some of yesterday’s strong gains...

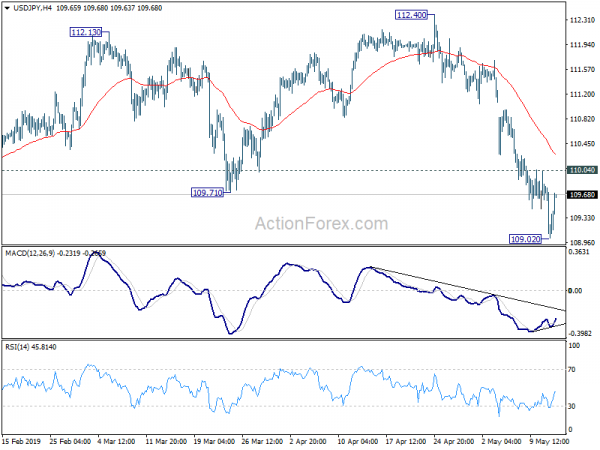

China Announced Retaliations as Nobody Read Trump’s Threat Tweets

Rallies in Yen and Swiss Franc accelerate while selloffs in commodity currencies intensify on US-China trade war today. Trump “stepped up” his pressure on China and warned the latter not to retaliate. But it’s actually unsure who he was talking...

Risk Aversion Staying after US and China Admitted the Gulf of Differences in Trade

Markets are back in risk averse mode in Asian session, with heavy selloff see in Chinese stocks and Yuan. Some noted that the gulf between US and China in trade talks have widened since last week’s development. But the “gulf”...

US-China Trade War Escalated, No End in Sight as Principle Differences Remain

US-China trade war was the center of global focus last week. Markets were expecting a deal with Chinese Vice Premier Liu He visited Washington Instead Trump announced to escalate to full-blown level after China reneged on its commitments during the...

Canadian Dollar Surges on Strong Job Data, Markets Shrug New Tariffs

A new round of US tariffs on Chinese imports took effect today and market reactions are rather muted. Trump stepped up his hard-line rhetorics and tweeted he’s in no rush to make a trade deal. Yet investors shrug off such...

Markets Steady as New Tariffs on China Take Effect, No Apparent Progress in US-China Negotiations

The financial markets are relatively steady today as new round of US-China trade war formally starts. Asian index are just mixed, with gains even seen in Hong Kong and Chinese stocks. In the currency markets, Dollar is currently trading as...

New “Season” of US-China Trade War to Start Soon, Sentiments Weak

Risk aversion Dominates the market today as the world awaits a new “season” in US-China trade war drama. At this point, with Trump’s hard line rhetoric, it’s very doubt if Chinese Vice Premier Liu He could turn around the situation...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals