Yen Continues to Shine as Sentiments Weighed Down by Italy and Trade Tension

Italy political turmoil and trade tensions are weighing on market sentiments on two fronts. Italy will now likely go into a snap election soon. And the eurosceptic parties will frame that as referendum on Euro membership. US President Donald Trump...

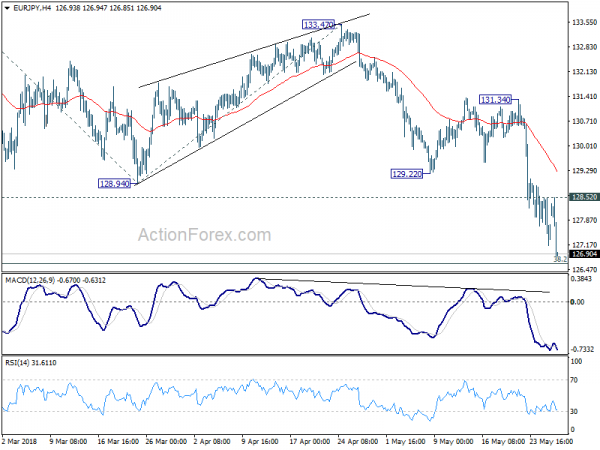

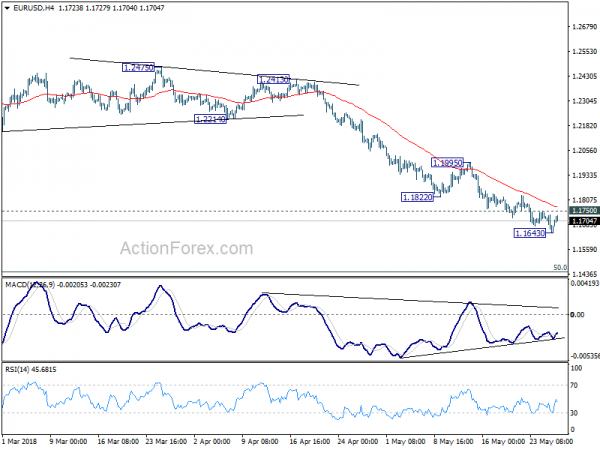

Euro Pared Loss after Steep Selloff as 5 Star Di Maio Calmed Markets

While Euro remains the worst performer for today, selling slowed and it recovered much ground as in early US session. Investors seemed to be calmed by Five Star leader Di Maio’s facebook comment that he never see leaving the Euro....

Yen Extends Rally as 10 Year Yield Breaches 2.9%

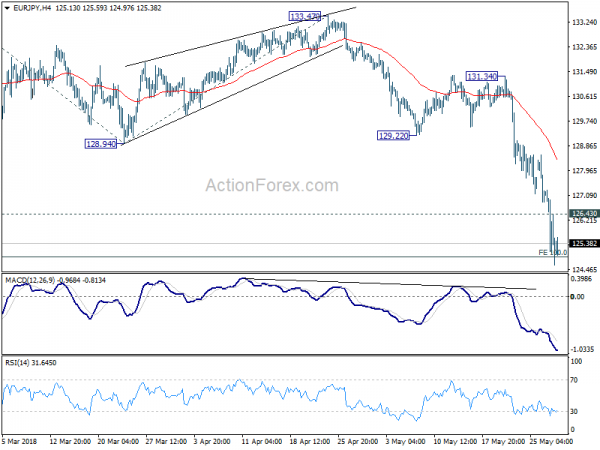

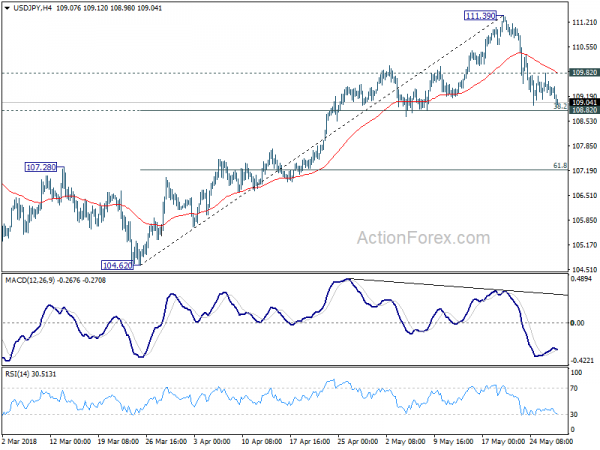

Yen is staying strong today and it’s extending recent rally. Falling major European and US treasury yields and risk aversion are the main factors. German 10 yield bun yield closed at 0.353% yesterday’s concern. That’s nearly half of this month’s...

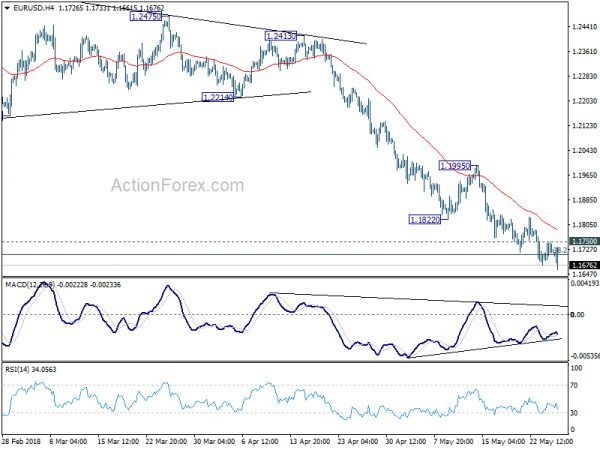

Euro Decline Resumes as Italy is Facing New Election Risks

Euro is back under broad based selling pressure after an ex-IMF official accepted the mandate to form an interim government. While traders were relieved that the anti-establishment eurosceptic coalition government couldn’t be formed, they’re now facing uncertainty of a new...

Euro Rebounds as Markets Cheer Italy Political Turmoil, Yen and Franc Retreat

Euro rebounds strongly and broadly today as the markets cheer political turmoils in Italy. On the other hand, Swiss Franc and Japanese Yen are trading as the weakest as sentiments improved. There appears to be some breakthrough again between US...

Yen Surged Again as Italy, Protectionism, Geopolitics and Central Bank Expectations Weighed on Yields

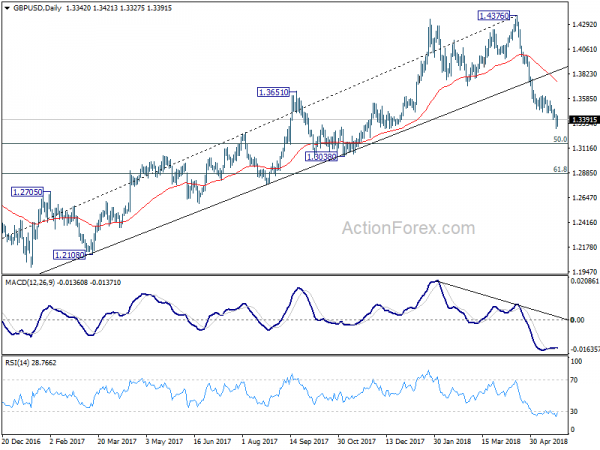

Yen ended as the strongest one last week followed by Swiss Franc. Meanwhile Sterling was the weakest one, followed by Euro, Canadian and then US Dollar. A number of factors were behind such development and they’re all inter-related. The most...

Italy Concerns Hammer German Yield and Euro, Canadian Dollar Falls With Oil Price

Canadian Dollar, Euro, to a lesser extend Sterling, are the clear losers today. The Loonie is dragged down by oil price as WTI drops through 70 handle. It reaches as low as 68.96 so far on news that OPEC and...

Markets Calm as North Korea Responded Diplomatically to Trump’s Unilateral Cancellation of Summit

Markets are rather steady in Asian session today. Major forex pairs and crosses are staying in yesterday’s range. Dollar is a bit firmer entering into European session. But there is no follow through buying yet. US President Donald Trump’s cancellation...

Trade Wars and Auto Tariffs Dominate the Markets, 10 Year Yield Losing 3% Handle

Sterling recovers mildly today as there was finally a piece of better than expected key data from the UK. Nonetheless, Swiss Franc outshines Sterling as the strongest one for today. And the Pound is still the weakest one for the...

Yen Stays Strong on Risk Aversion and Trump Pushes for Auto Import Tariffs

Yen strengthens broadly today and remains the strongest one for the week. New wave of risk aversion trades was triggered by news that US President Donald Trump is using national security as excuse again to study imposition of tariffs on...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals