Euro Prone to Downside as PMIs Awaited, Traders Shrug US Debate

It appears that the stock markets couldn’t care less about the last debate before US Presidential election. Major Asian indices are trading in right range with mild gains. Nevertheless, Yen is trying to lead Dollar for a comeback while European...

Dollar Recovers Mildly after Job Data, Markets Tread Water

Dollar recovers in early US session, with help from better than expected job data. Yet, it remains the weakest one for the week at this point. Buying momentum for the greenback doesn’t warrant a reversal yet. The forex markets are...

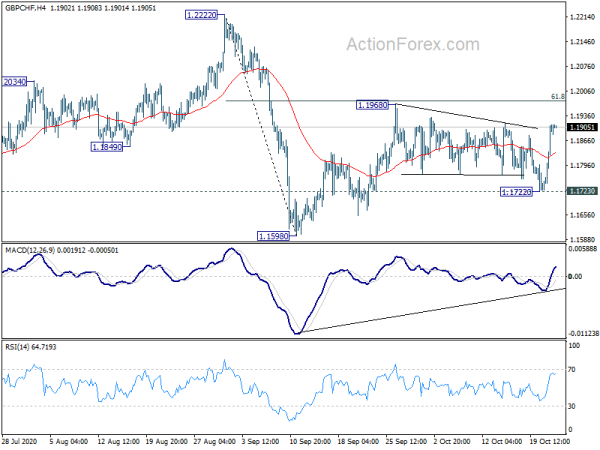

Sterling to Take the Limelight as Dollar Takes a Breather

Dollar recovers mildly in Asian session today but remains generally weak, as the worst performing one for the week so far. Sellers appear to be taking a breather for now, and wait for fresh development regarding fiscal stimulus, as well...

Dollar and US Treasuries Dive Together, Funds Moving Out?

Dollar tumbles sharply today together with US treasuries. 10-year yield breaks above 0.8% handle but that’s giving no support to the greenback. Instead, in a rather unusual development, Yen surges sharply at the same time. Stock futures are just steady....

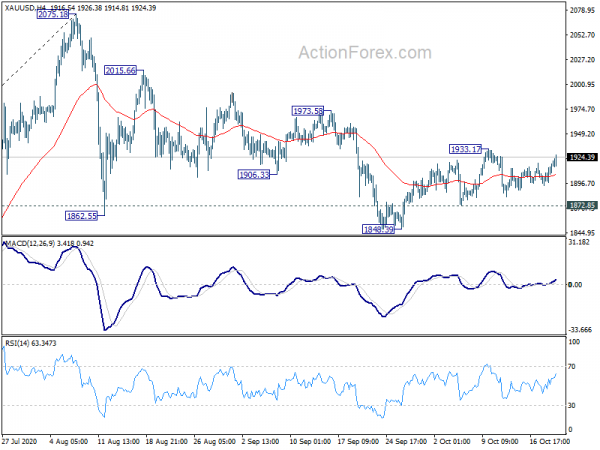

Dollar Pressured on US Stimulus Hope Again, Euro Stays Strong

Dollar is under some selling pressure since overnight as US politicians were still optimistic in closing a fresh stimulus deal by election. This appears to be the most volatility triggering theme for the near term for now. Commodity currencies are...

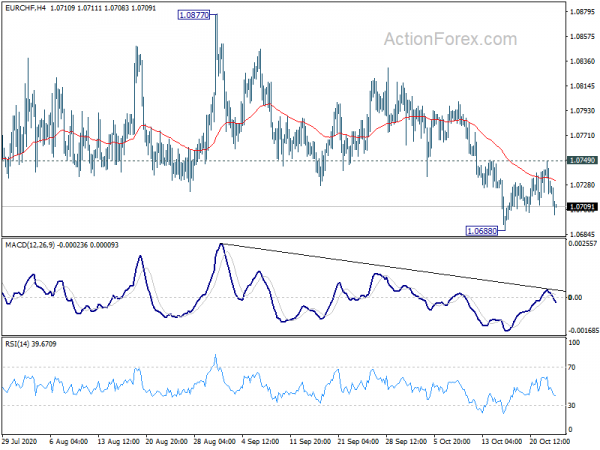

Euro and Swiss Franc Rally as Markets Expect More Negative Rates Elsewhere

Markets continue to be dominated by strength of Euro and Swiss Franc today. That comes in spite of surging coronavirus infections in Europe. Meanwhile, the deadlock of Brexit negotiations remain. Traders are apparently adding to bet that more global central...

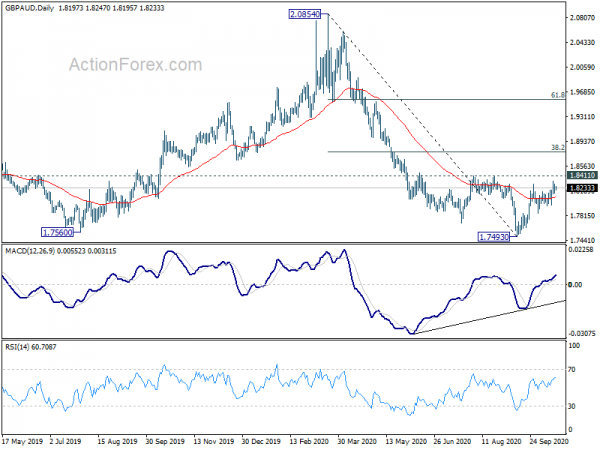

Aussie Bears in Control on RBA, Euro Strength Continues

Australia’s Dollar’s decline is resuming today as RBA minutes, as well ass comments from a top official solidify the case for imminent easing in November. Weaker risk sentiments also weigh on commodity currencies in general, after US stocks reversed initial...

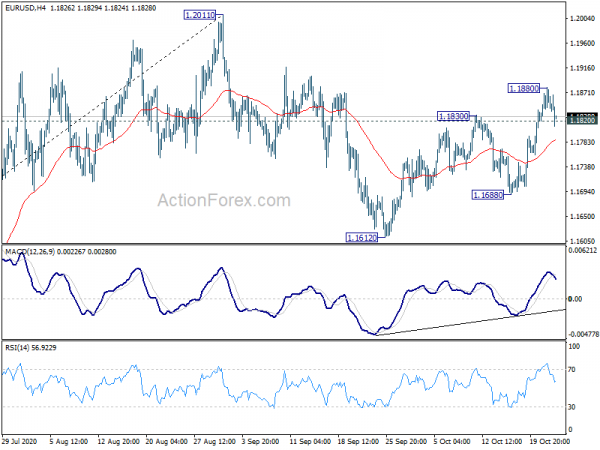

Dollar Weakens on Renewed Stimulus Hope, Euro Surges

Dollar and Yen are back under notable selling pressure today. US investors are apparently ignoring continuing surge in global coronavirus infections, which broke 40m mark. Instead, there is renewed hope of fresh fiscal stimulus, as House Speaker Nancy Pelosi said...

Sentiments Lifted Slightly by Upbeat Chinese Data, But Movements Limited

Commodity currencies follow Asian markets slightly higher today, with support from solid economic data from China. On the other hand, Euro and Swiss Franc are softer on concerns over record coronavirus infections and return to lockdown. Additionally, Euro could face...

Chaotic Markets With Many Themes Going On

It’s a rather chaotic week with many themes developing. The first October surprise of US President Donald Trump’s coronavirus infects seemed to have fade as he’s back in election campaign. Just as challenger Joe Biden appeared to be widening lead,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals