More Risk Aversion Likely after First October Surprise

Investors could have been anticipating an October surprise. But none could have expected it to come that early, with US President Donald Trump’s coronavirus infections. The world has been in historically high level of uncertainty ever since the virus outbreak...

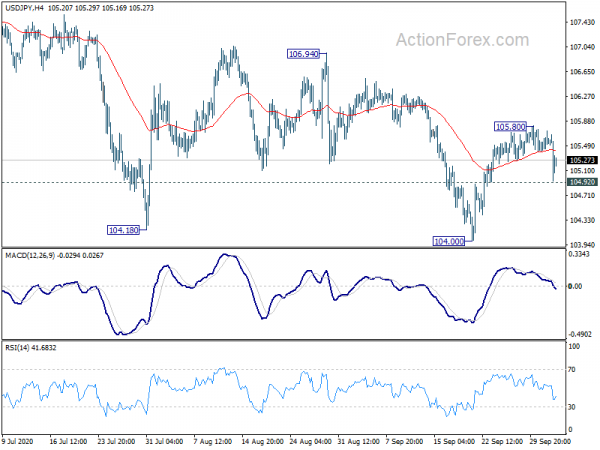

Mixed NFP Data Overshadowed by Trump’s Coronavirus Infection, Yen Staying Strong

Global markets are clearly staying in risk-off mode before weekly close. Mixed US job data was largely ignored. Eyes are staying on the development regarding US President Donald Trump’s coronavirus infections, and the impact on the Presidential election which is...

Risk-Off on First October Surprise, Trump Tested Positive for COVID

Markets suddenly turned into a risk-off mode on the first October surprise. US President Donald Trump and wife Melania had tested positive for coronavirus. Both were going to quarantine with Trump’s scheduled cleared of all travels. Yen surges broadly as...

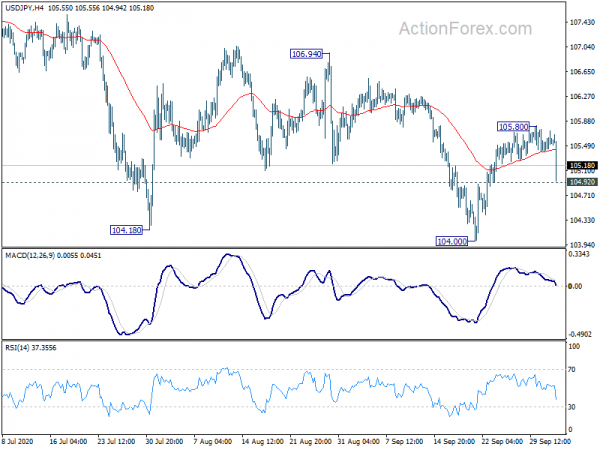

Dollar Decline Paused after Better than Expected Data

Dollar attempted to edge lower earlier today but the bears are still not too committed. Selling has indeed turned to Yen in early US session, after some better than expected US data. The stocks markets are also lacking a clear...

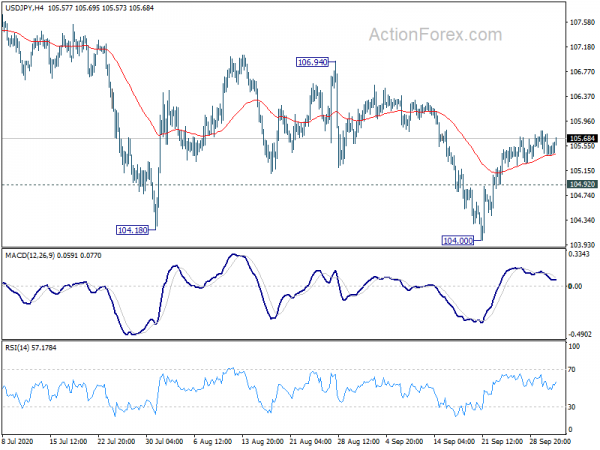

Dollar and Yen Pressured after Unconvincing Stock Rally

Dollar and Yen are generally weak in Asian, after being pressure overnight with a return to risk-on markets. US stocks were lifted on as Treasury Secretary Steven Mnuchin “made a lot of progress in a lot of areas” with House...

Markets in Range, Trapped by Low Month-End Volatility

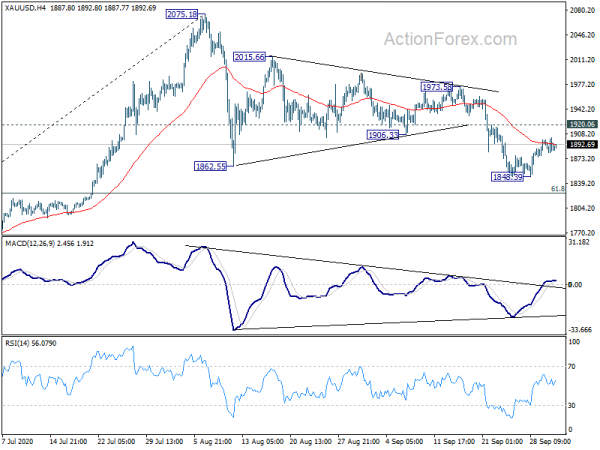

The forex markets are generally staying in tight range today, without much reaction to better than expected job data from US and GDP from Canada. Nor was there much movements after comments from ECB President and BoE Chief Economist. Subdued...

Sleepy Markets Yawn US Debate, Focus Back to Economic Data

Dollar and Yen recover some ground in Asian session but it’s unsure if this week’s pull back is completed yet. There were little reactions to the President debate of Donald Trump and Joe Biden. Asian markets are mixed despite some...

Dollar Drops Further ahead of Trump-Biden Debate

Dollar drops broadly today, partly due to month-end flows, and partly as position adjustment ahead of the first one-on-one Presidential debate between Donald Trump and Joe Biden. Nevertheless, Yen and Canadian Dollar are slightly weaker. On the other hand, Aussie...

Dollar Soft as Focus Turns to Fed Speakers, But Yen Even Weaker

Asian markets trade with a mixed tone today despite strong rebound in the US overnight. Positive sentiments couldn’t carry through to the session again. Nevertheless, Yen is trading slightly weaker in general, followed by Canadian and Dollar. Aussie and Kiwi...

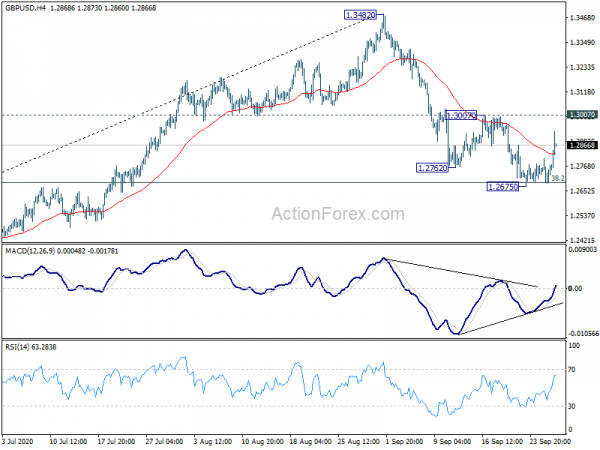

Sterling Jumps on BoE Comments, Dollar Softens as Stocks Rebound

Sterling rises broadly today after BoE Deputy Governor indicated that negative interest rate is not imminent. Rebound in the Pound somewhat lifts other European majors too. Australian Dollar is following as the second strongest for now, with help from rebound...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals