EUR/USD Outlook: Strong German Data And Fed Inflated Euro But Gains Are Unlikely To Last Longer

The Euro extends recovery on Thursday, as better than expected German labor and inflation data added to positive near-term sentiment. The single currency was also supported by weaker dollar, driven by dovish Fed and month-end selling. Although the fundamentals are...

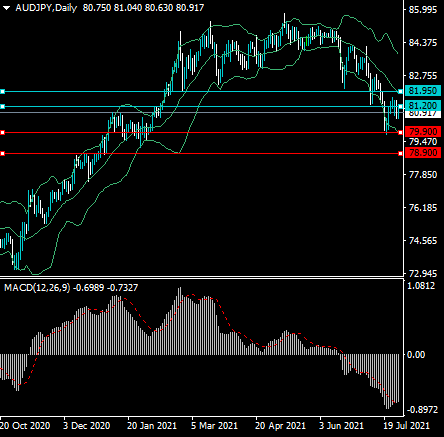

AUDJPY Still Bearish

Technical analysis The AUDJPY pair is bearish and is close to stage a major technical breakout under its lower daily Bollinger Band. The Bollinger Bands are also slopping downwards, which is bearish. The daily time frame shows that significant amounts...

EURGBP tests 0.85 lower border of trading range

EURGBP is in the vicinity of the base of the 3½-month sideways market after having surrendered its recent gains up to 0.8670. The 100- and the 200-day simple moving averages (SMAs) are weighing on the pair, keeping downside pressures alive,...

USD/JPY Pair Is Now Correcting Higher From The 109.58 Low

The US Dollar started a decline from well above the 110.20 level against the Japanese Yen. The USD/JPY pair broke the key 110.00 support zone to move into a bearish zone. The pair even broke the 109.80 support and settled...

USD/CAD Bullish Sentiment

On Tuesday, the US Dollar surged by 61 pips or 0.49% against the Canadian Dollar. The currency pair breached the 50– hour simple moving average at 1.2567 during Tuesday’s trading session. Buyers are likely to continue to drive the USD/CAD...

Chinese Crackdowns Hit Stock Indices, Send USD/CNH higher

The crackdown by the Chinese government on big tech companies, such as Alibaba and Tencent, has spilled over into other sectors, causing investors to flee stock markets. After the government began laying heavy fines and penalties on tech companies over...

WTI Futures Struggle to Surpass 200-Period SMA

WTI crude oil futures are moving sideways, finding strong resistance at the 200-period simple moving average (SMA) and support at the 20-period SMA. The RSI indicator is falling in the positive region, while the MACD is losing momentum in the...

NZDUSD Very Bullish

Technical analysis The NZDUSD pair has broken above the psychological 0.7000 level and the mid-line of the upper daily Bollinger Band, which is now located around the 0.6985 support area. Bulls could be preparing to take the NZDUSD pair towards...

Currency Pair of the Week: DXY

Big earnings, an FOMC meeting, important economic data, the track of the coronavirus, and the infrastructure bill could provide movements of the US Dollar index Although the US Dollar Index is (DXY) not a currency pair, the index has the...

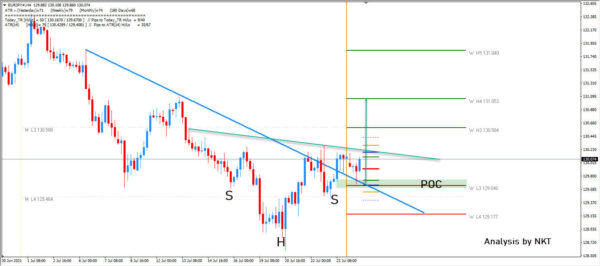

EUR/JPY Surges As Yen Weakens

EUR/JPY is trying to breakout above the W L3 which became a support. We could see further strength if the neckline breaks. The POC is a bouncing zone. 129.65-75 where buyers are. Look for a trend line break and continuation...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals