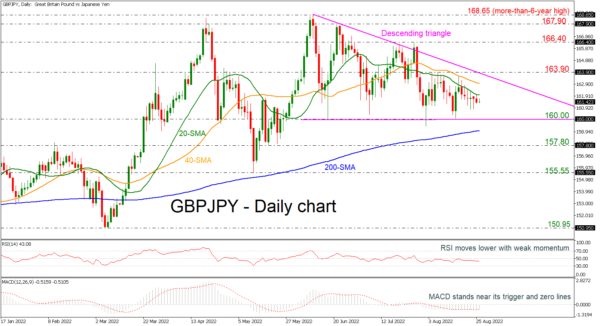

GBPJPY is heading south, and it has been holding within a descending triangle pattern since June 9. Currently, the price is moving beneath the short-term simple moving averages (SMAs) and is approaching the 160.00 psychological mark, which is the lower boundary of the triangle. The RSI indicator is standing below the neutral threshold of 50, moving with weak momentum while the MACD is hovering slightly up its trigger line in the negative region.

Violating the flat line of the pattern at 160.00, could see losses extending towards the 200-day SMA currently at 159.05. Even lower, the bears could stall around 157.80 and the 155.55 support.

If the market corrects higher, the bullish action may pause initially near the 20- and 40-day SMAs at 162.05 and 162.95 respectively before attention shifts to the downtrend line and the 163.90 resistance. A rally on top of the latter would probably stage fresh buying pressure, with the price meeting next to 166.40 barrier.

In the medium-term picture, GBPJPY would endorse the negative scenario if there is a penetration of the descending triangle to the downside.

Signal2forex.com - robot Best Forex jeung sinyal

Signal2forex.com - robot Best Forex jeung sinyal