Warren Buffett believes investors should avoid using borrowed money to outperform.

The Oracle of Omaha explained the perils of using debt and leverage in his 2017 annual letter to Berkshire Hathaway shareholders released on Saturday.

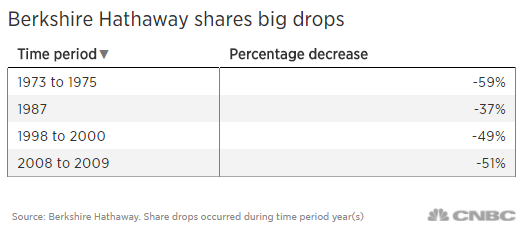

“Berkshire, itself, provides some vivid examples of how price randomness in the short term can obscure long-term growth in value. For the last 53 years, the company has built value by reinvesting its earnings and letting compound interest work its magic. Year by year, we have moved forward. Yet Berkshire shares have suffered four truly major dips,” he wrote.

The investor shared the data which revealed Berkshire Hathaway’s stock declined by a range of 37 percent to 59 percent multiple times over the last five decades.

“This table offers the strongest argument I can muster against ever using borrowed money to own stocks. There is simply no telling how far stocks can fall in a short period,” he wrote. “Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

Buffett predicted the company’s stock will fall again by similar large declines in the next 53 years.

“No one can tell you when these will happen. The light can at any time go from green to red without pausing at yellow,” he wrote. “When major declines occur, however, they offer extraordinary opportunities to those who are not handicapped by debt.”

The investor shared an excerpt from British Nobel laureate Rudyard Kipling’s 1895 poem “If—” to illuminate the investing lesson:

“If you can keep your head when all about you are losing theirs . . .

If you can wait and not be tired by waiting . . .

If you can think – and not make thoughts your aim . . .

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.”

Buffett blasted the belief that bonds were a lower risk investment over the long-term. He recommended investors stay in equities due to negative impact from inflation on the purchasing power of fixed income holdings.

“I want to quickly acknowledge that in any upcoming day, week or even year, stocks will be riskier – far riskier – than short-term U.S. bonds. As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates,” he wrote. “It is a terrible mistake for investors with long-term horizons – among them, pension funds, college endowments and savings-minded individuals – to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks. Often, high-grade bonds in an investment portfolio increase its risk.”

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals