Cryptocurrency ripple climbed Monday amid renewed speculation that popular exchange Coinbase would add the cryptocurrency to its platform.

The company has not made any announcement and did not immediately respond to a CNBC request for comment. It said in a Jan. 4 blog post that as of publication, any statement that Coinbase or its GDAX exchange is adding a new asset “is untrue and not authorized by the company.”

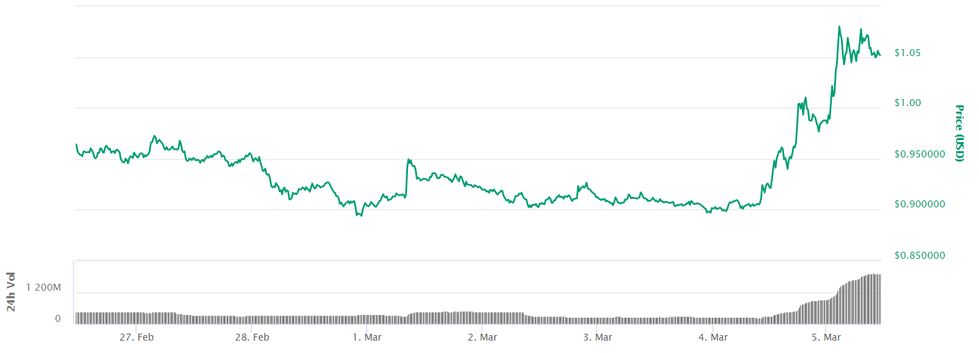

Ripple, the third-largest digital currency by market cap, traded near $1.05 as of 11:50 a.m. ET Monday, up about 14 percent over the last 24 hours, and roughly 4 percent on the day, according to CoinMarketCap.

Coinbase is the leading U.S. marketplace for buying and selling major digital currencies and is popular with both retail and professional traders. The platform only supports bitcoin, bitcoin cash, ethereum and litecoin right now. As a result, the addition of a new coin to Coinbase would likely bring in many more buyers.

Ripple 7-day performance

Source: CoinMarketCap

“I’ve seen rumors spreading around Coinbase additions and Japanese banking partnerships and [Ripple CEO] Brad Garlinghouse’s upcoming appearance on Fast Money,” said Alex Sunnarborg, founding partner at cryptofund Tetras Capital.

“Larger buys in advance of expected news in these markets are then compounded by retail investors buying out of FOMO and trying to chase gains,” Sunnarborg said, referring to the acronym for “fear of missing out” on price gains.

Ripple CEO Brad Garlinghouse is set to appear on CNBC’s “Fast Money” on Tuesday, alongside Coinbase President and Chief Operating Officer Asiff Hirji. The joint appearance had some Twitter users speculating that a trading announcement was on deck.

Ripple, or XRP, is still trading more than 70 percent off its record high of $3.84 hit in early January. The cryptocurrency had surged in December amid speculation it would be added to Coinbase.

Strong demand from South Korean investors also helped XRP rise Monday.

The cryptocurrency traded at a 1-cent premium on a major South Korean exchange called Bithumb, according to CoinMarketCap. Trading in South Korean won made up just over 33 percent of XRP’s daily trading volume, according to CryptoCompare.

Ripple is officially the name of a San Francisco-based company developing a network for fast, global financial payments. XRP is the name of the digital token that financial institutions on the network can use to transact quickly.

In the last half year, Ripple has announced a handful of financial firms are at least testing the use of XRP for cross-border payments.

Just Thursday, global payments company Fleetcor and its subsidiary Cambridge Global Payments will test the use of XRP. The announcement follows news in January that MoneyGram will test XRP, as will MercuryFX and IDT.

Ripple owns about 60 billion of the 100 billion XRP ever made, bringing its market cap based on holdings alone close to $62 billion.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals