Bitcoin’s drop this week paints a pretty discouraging picture for the near future, technical market analysts say.

Critically, bitcoin failed Monday to break above a key level close to $12,000, they said. The cryptocurrency has fallen more than 20 percent since amid a slew of negative headlines that have raised worries about regulatory crackdown on exchanges.

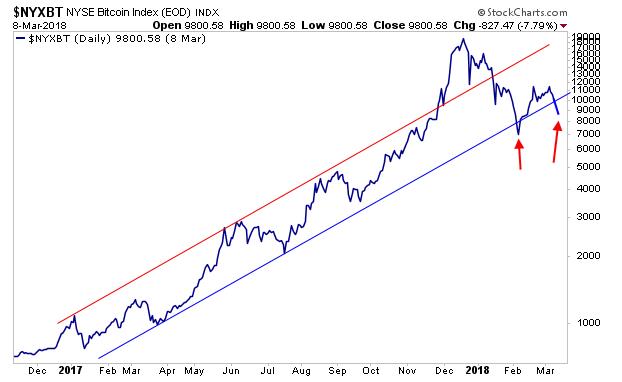

If bitcoin is to retest its highs soon, it must first top $11,500 and $14,300, said Frank Cappelleri, executive director, institutional equities at Nomura Instinet.

“Longer term, bitcoin is now back below a key uptrend line,” Cappelleri said. “The last time it tested this support line, demand flooded the cryptocurrency. If that doesn’t happen again soon, the February lows would in the cross-hairs.”

Bitcoin performance (Dec. ’16 – March ’18)

Source: StockCharts.com, Nomura Instinet

Bitcoin hit a low of $8,370.80 Friday, its lowest since Feb. 13, according to CoinDesk’s bitcoin price index. Its low for February is $5,947.40, hit the morning Securities and Exchange Commission Chairman Jay Clayton and Commodity Futures Trading Commission Chairman Chris Giancarlo testified before the Senate Banking, Housing and Urban Affairs Committee.

The cryptocurrency began to rally after the hearing turned out more supportive for the industry than some had expected.

But on Wednesday, the SEC issued a statement that expanded its scrutiny to digital currency exchanges and businesses for storing the assets. A Hong Kong-based exchange called Binance said the same day that some accounts may have been compromised due to phishing, while a report showed the trustee of the collapsed Mt. Gox exchange has sold roughly $400 million in bitcoin and bitcoin cash.

Bitcoin is “stuck right now in a range between $7,400 and $11,900,” said J.C. Parets, president and founder of All Star Charts.

“I don’t want to be buying dips. I want to be buying this on the way up,” Parets said. “In other words, for now if we’re not above $11,900, this is a ‘no touch.'”

Bitcoin’s high for the week is $11,660.24, according to CoinDesk. The last time bitcoin topped $11,900 and $12,000 was in late January, still well off its all-time high above $19,000 reached in mid-December.

However, Robert Sluymer, technical strategist at Fundstrat Global Advisors, said “there may be a silver lining developing.” He’s watching whether the area from around $8,076 to $8,773 becomes support for bitcoin.

For a volatile cryptocurrency that is fundamentally unlike traditional financial assets, the only certain analysis may be that the next move will be dramatic.

“Bitcoin finds itself near the apex of a narrowing pennant pattern,” Chris Kimble, founder and CEO of Kimble Charting Solutions, said in an email.

“These patterns don’t give odds per which direction the asset will take,” he said. “They do suggest a BIG move is ahead.”

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals