Nine years into the second-longest bull market run in history, the level of total net worth compared with income has reached a record, according to Joe LaVorgna, chief economist for the Americas at Natixis, citing Federal Reserve data.

Since the Great Recession ended in June 2009, the disparity between net worth and income has soared, attributable in large part to the growth in financial assets, which have increased by $33.9 trillion, compared with $10.4 trillion in nonfinancial assets.

Essentially, that means that American wallets have grown fatter from the accumulation of financial assets like stocks and mutual fund holdings than they have from gains in their homes and other physical assets like autos.

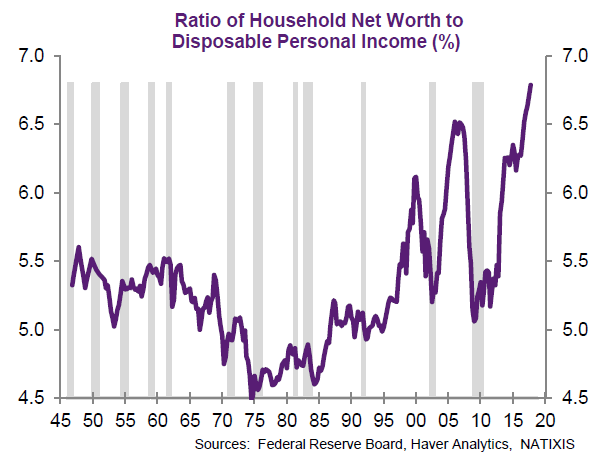

In all, total net worth of $98.75 trillion is now 6.79 times the $14.55 trillion in disposable income for households as of the fourth quarter, according to Fed financial accounts figures. That’s up from 6.71 times in the third quarter.

The previous tops came in the first quarter of 2006, with 6.51, and the first quarter of 2000, at 6.12. Those two levels cast ominous signals over the U.S. economy.

“A recession started four quarters from the peak of the former and eight quarters from the zenith in the latter,” LaVorgna said Tuesday in a note to clients.

As a practical matter, the level should serve as a yellow flag for Fed officials, who are on a course of hiking rates gradually but steadily.

“Given the importance of asset prices in the economy and the formulation of monetary policy, Fed folks need to be careful in not sending too hawkish a message when they raise official interest rates,” LaVorgna said.

The Fed is an important part of the equation in that it helped boost financial assets through historically low interest rates and an aggressive policy of monthly bond buying called quantitative easing.

Since October 2014, the central bank has both halted QE and raised its benchmark interest rate five times. Markets are widely expecting another hike at this week’s two-day meeting that concludes Wednesday, along with at least two more increases later this year.

This is the first meeting for new Chairman Jerome Powell, who must navigate the Fed through rate increases aimed at controlling but not stopping growth. After years of mostly steady gains since the bull market run began in 2009, volatility has crept in 2018 and raised the specter that forward gains will be tougher to achieve.

“Powell needs to be mindful of the current backdrop and not signal aggressive rate hikes to come,” LaVorgna said. “Otherwise, stock prices and the economy are in trouble.”

WATCH: Tech stocks also are flashing a bubble sign.

Disclaimer

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals