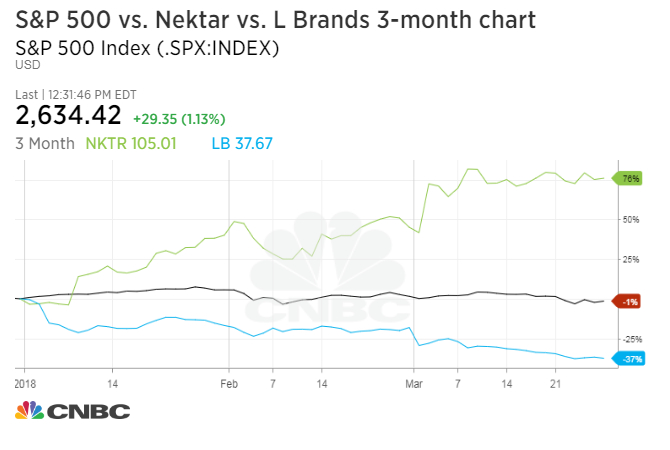

The first quarter of 2018 proved significantly more volatile for equity markets, with both the Dow Jones industrial average and the S&P 500 falling into correction territory at one point.

The major averages have recovered slightly and will end the quarter down about 1 to 2 percent.

The latest leg lower came as technology — one of the market’s largest and most successful sectors of the past year — began to show signs of fatigue. Still, the tech sector is set to finish the first few months of the year ahead of its peers, with Netflix emerging as the third-best performer in the S&P 500.

The stock added a hefty 49 percent over the first three months of the year.

Here is a list of the top 10 best performers in the S&P 500 during the first quarter.

Piper Jaffray analyst Mike Olson told CNBC that despite the recent downtick in Netflix’s stock price, his bullish thesis remains unchanged.

“Netflix has gotten caught up in the broader technology downdraft, but there’s nothing we’ve seen that causes us to have any concern on company fundamentals,” Olson said in an email. “In fact, our most recent analysis of Netflix-related search data in the first two months of the first quarter suggested that U.S. subscriber trends are solid, while there is potential for upside to international subscriber growth.”

The best stock performer in the 500-stock index, though, was biopharmaceutical company Nektar with a 78 percent gain over the past three months. The San Francisco-based company popped more than 10 percent earlier in the quarter after Bloomberg News reported that the biotech company was exploring options including a potential sale.

“Through collaborations and licensing partnerships, numerous biotechnology and pharmaceuticals companies have gained access to Nektar’s technology, which has resulted in many commercially successful drugs,” Cowen analyst Chris Shibutani wrote earlier in March. “We believe Nektar’s pipeline positions the company amongst potential leaders in the development of novel immuno-oncology combinations.”

On the flip side, energy stocks comprised a plurality in the list of 10 worst-performing stocks in the S&P 500, with Newfield, Devon and Cimarex all down roughly 24 percent. Despite the underperformance among big energy names, some analyst saw the pullback as a buying opportunity.

L Brands was the worst performer in the first quarter, down more than 30 percent over three months.

Here is a list of the top 10 worst performers in the S&P 500 during the quarter.

“We believe Newfield is positioned to outperform from here. In our view, the market unfairly punished the stock for its 2018 guide and outlook based on non-related, industry developments,” Stifel analyst Derrick Whitfield on Wednesday. “Newfield has the highest 2018 to 2020 free cash flow yield among the small and mid-caps and offers exposure to some of the most impactful 2018 developments across our coverage universe.”

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals