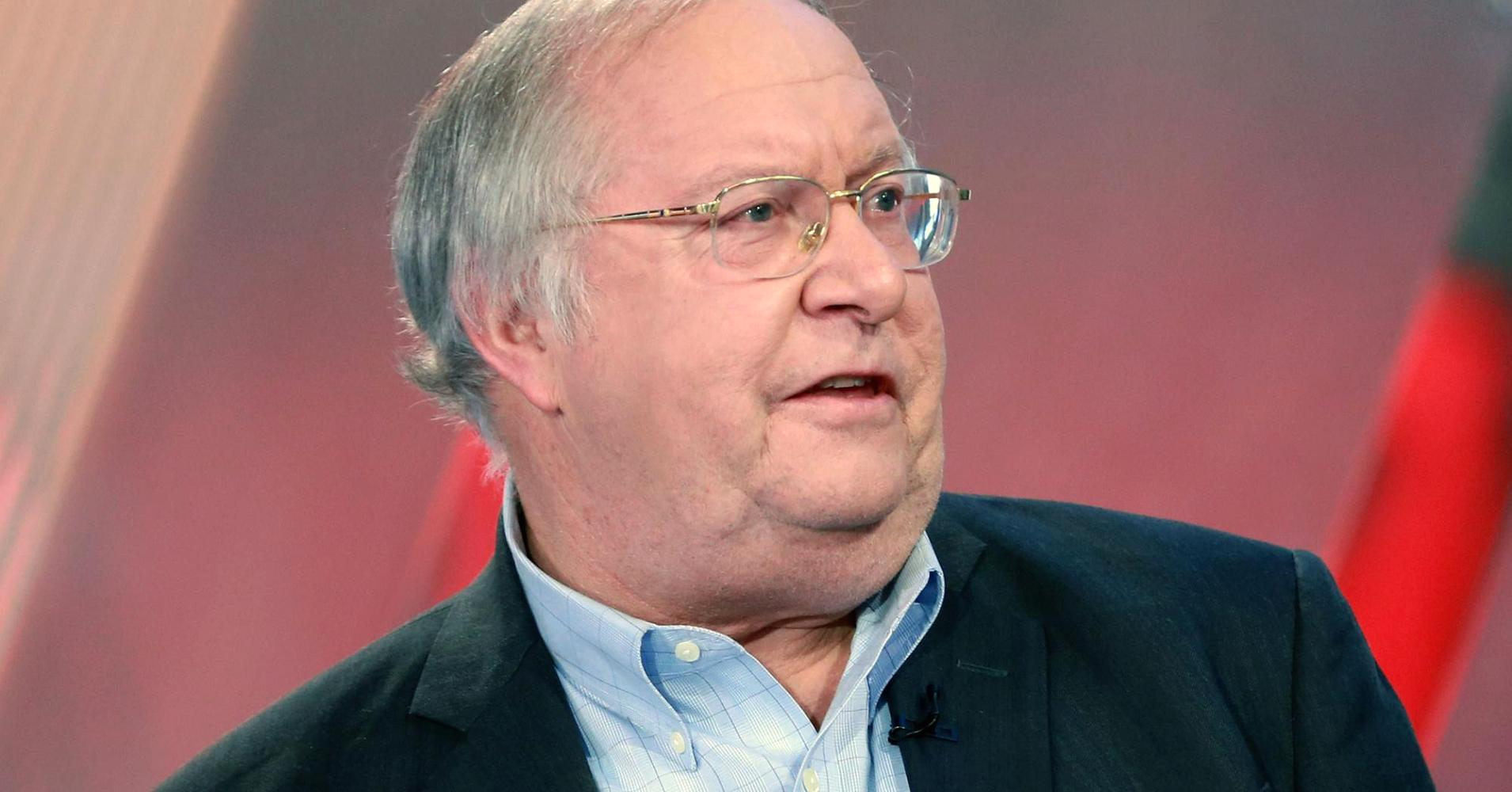

Noted hedge fund manager Bill Miller is still betting stocks will rise.

“The path of least resistance for U.S. stocks is higher,” Miller said in a blog post dated April 18. “I believe it remains so, and will until either this expansion ends, or stocks become expensive relative to bonds and cash. Both appear to be a good ways off.”

Miller founded Miller Value Partners in 2016. Previously, he managed a fund at Legg Mason that beat the S&P 500 for 15 consecutive years through 2005.

U.S. market volatility picked up dramatically in the first quarter of the year. After hitting record highs at the end of January, stocks plunged into correction in February. The major indexes have since struggled to hold gains for the year amid worries about rising interest rates, a U.S.-China trade war, prohibitive regulation on technology giants and a peak in earnings growth.

“The greater risk to the market this year, in my opinion, is not economic, it is political,” Miller said, referring primarily to upheaval within the Trump administration.

“The 10% correction already experienced seems to me to adequately discount the visible risks noted above, leaving the market poised to go up if these risks either dissipate or fail to morph into more serious troubles,” he said. Underlying market conditions, such as rising earnings estimates, strong corporate balance sheets and record profit margins, remain favorable, he said.

Earnings season is in full swing, and as of Wednesday, earnings per share for S&P 500 companies were on track to grow 22 percent for the first quarter, according to Thomson Reuters I/B/E/S. That’s up from the 18.5 percent estimate from April 1.

In January, Miller said a rise in the 10-year Treasury yield above 3 percent “will propel stocks significantly higher, as money exits bond funds for only the second year in the past 10.”

The benchmark yield topped 3 percent on Tuesday for the first time in four years.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals