Deutsche Bank upgraded Citigroup shares to buy from hold, noting the stock could get a boost from beaten-down levels given upcoming stress test results and a better business environment.

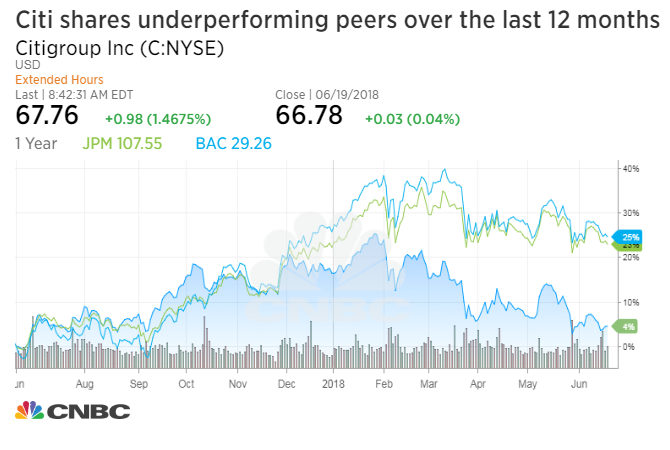

Citi shares are down 17 percent from their 52-week high hit in late January, underperforming Bank of America and J.P. Morgan Chase by 9 percent over this period, research analyst Matt O’Connor and his team said in a Tuesday report.

Several events ahead could help Citi, the analysts said.

First, results from annual Federal Reserve stress tests that are due June 21 and 28 “should be positive” for Citi.

Second, macroeconomic negatives such as rising U.S. rates and a stronger U.S. dollar may abate.

Third, there have been some “positive” developments in Citi’s U.S. credit card business around partnerships with Sears and Costco.

In addition, “expectations on cost efforts have been lowered enough that we don’t see further disappointment.”

Citi is scheduled to release second quarter results before the open on July 13.

The analysts also noted a “very positive” backdrop for Citi in fixed income trading, a category in which the company ranks second. The bank has also been “gaining momentum” in equities trading, the report said.

Citi also has “one of the biggest capital return stories among big banks,” since management’s plan to return at least $20 billion in capital a year in the near future represents 12 percent of the bank’s market cap, the analysts said.

“Given the recent sell off in C shares and low valuation, the buybacks should matter more than they did,” they said.

Shares of Citi rose 1.5 percent in premarket trading Wednesday.

Goldman Sachs and Wells Fargo remain the Deutsche Bank analysts’ top picks. For Goldman, they expect investment banking fees to rise roughly 10 percent year-on-year, and trading to increase about 20 percent “with strength in FICC.” Wells Fargo’s financial situation makes the bank “well positioned” for the upcoming “CCAR” stress test, the report said.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals