Euro continues to trade as the strongest one for today as boosted by the EU leader’s agreement on immigration. While the common hasn’t been the star this month, it’s indeed up against all but Dollar. European stocks investors are also happy with the result. At the time of writing, DAX and CAC are trading up more than 1% while FTSE is up around 0.6%. Additional support is seen for the common currency as Eurozone headline inflation accelerated to ECB’s target of 2%. Sterling, is trading as the second strongest one, with help from upward revision in the final Q1 GDP reading.

Dollar, on the other hand, is not getting much support from stronger than expected inflation data. It’s trading as the second weakest one for today, following Yen. The pre-quarter-end rebound in global stocks is set to continue into US session as DOW futures suggest. In other markets, WTI crude oil is holding firm above 73 handle. Gold continues to defend 1250 handle, with help of retreat in Dollar.

US core inflation accelerated to 2.3%, Canada GDP beat expectations

Inflation data released from the US are rather solid. Headline PCE accelerated to 2.3% yoy in May, up from 2.0% yoy and beat expectation of 2.0% yoy. Core PCE also jumped to 2.0% yoy, up from 1.8% yoy and beat expectation of 1.8% yoy. Personal income rose 0.4% in May, matched expectation. Personal spending, though rose 0.2%, below expectation of 0.4%. The data support Fed’s projection of two more rate hike this year, in September and December.

Canada GDP rose 0.1% mom in April, above expectation of 0.0% mom. IPPI rose 1.0% mom in May while RMPI rose 3.8% mom. BoC Governor Stephen Poloz has made himself very clear this week. Economic models suggested that there should be a rate hike soon. But models are just part of the equation for the decision. Trade tensions and impacts of higher interest rates on household are factors to consider too. To us, it’s 50/50 for BoC to hike in July.

Euro stays strong on EU migration deal and inflation data

Euro jumps broadly today on news that the 28 EU leaders have agreed on the conclusions of the EU summit, including migration. There were some concerns earlier as Italy threatened to block all agreement if they requests on migration were not met. German Chancellor Angela Merkel, who’s under political pressure domestically, said that “overall, after an intensive discussion on the most challenging theme for the European Union, namely migration, it is a good signal that we agreed a common text.”

Italy’s Interior Minister Matteo Salvini, a known anti immigrant leader of the League, said he’s pleased with EU’s agreement on immigration. He said today that “I’m satisfied and proud of our government’s results in Brussels.” And, “finally Europe has been forced to discuss an Italian proposal… (and) finally Italy is no longer isolated and has returned to being a protagonist.”

Eurozone CPI rose to 2.0% yoy in June, up from 1.9% yoy and met expectation. CPI core, slowed to 1.0% yoy, down from 1.1% yoy, matched expectation. German unemployment dropped -15k in June. German unemployment rate was unchanged at 5.2% in June.

Sterling lifted by GDP upward revision.

Sterling jumps notably after GDP upward revision. Q1 GDP growth is finalized at 0.2% qoq, revised up from 0.1% qoq. Services made the largest contribution by growing 0.2%. The 0.1% growth in production was offset by the -0.1% contraction in construction. Among services, business and finance services jumped 0.6%, government and other services rose 0.3%. Distribution, hotels and restaurants increased by 0.1%. Transport, storage and communication increased by 0.1%

Also from the UK, mortgage approvals rose to 64.5k in May. M4 dropped -0.4% mom in May. Index of services rose 0.2% 3mo3m in April. Current account deficit narrowed to GBP -17.7B in Q1.GFK consumer confidence dropped to -9 in June.

Swiss KOF Economic Barometer to 101.7, clear contribution from exports

Swiss KOF Economic Barometer rose 1.7 to 101.7 in June, above expectation of 101.0. It’s also back above long-term average at 100.0. KOF said it indicates a “slightly above-average development” in Switzerland. But still, the “tailwind for the Swiss economy is no longer as strong as during winter.”

Exports made a “particularly clear contribution” to the improvement. There were also “positive developments in domestic demand, with increase in “propensity to consume”. In manufacturing and construction, the indicators for order backlogs, inventory reserves and intermediate goods purchasing point to a more positive development. Within manufacturing, however, “signs of developments in the near future are mixed.”

Released earlier

On the data front, New Zealand building permits rose 7.1% mom in May. Japan unemployment rate dropped to fresh 25 year low at 2.2%, down from 2.5%. Tokyo CPI accelerated more than expected to 0.7% yoy in June. Industrial production dropped -0.2% mom in May. Housing starts rose 1.3% yoy in May. Consumer confidence dropped to 43.7 in June.

EUR/USD Mid-Day Outlook

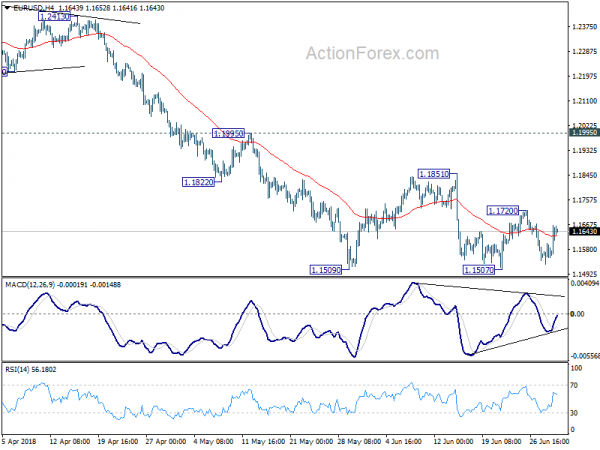

Daily Pivots: (S1) 1.1531; (P) 1.1566 (R1) 1.1604; More…..

At this point, EUR/USD is staying in range of 1.1507/1851 and intraday bias remains neutral. Outlook remains unchanged too. Further recovery could be seen but we’d expect strong resistance by 1.1851 to limit upside. Larger decline from 1.2555 is expected to resume sooner or later. Firm break of 1.1507 will send EUR/USD through 50% retracement of 1.0339 to 1.2555 at 1.1447 to 61.8% retracement at 1.1186.

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M May | 7.10% | -3.70% | -3.60% | |

| 23:01 | GBP | GfK Consumer Confidence Jun | -9 | -7 | -7 | |

| 23:30 | JPY | Jobless Rate May | 2.20% | 2.50% | 2.50% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Jun | 0.70% | 0.60% | 0.50% | |

| 23:50 | JPY | Industrial Production M/M May P | -0.20% | -1.10% | 0.50% | |

| 05:00 | JPY | Housing Starts Y/Y May | 1.30% | -6.00% | 0.30% | |

| 05:00 | JPY | Consumer Confidence Jun | 43.7 | 43.9 | 43.8 | |

| 07:00 | CHF | KOF Leading Indicator Jun | 101.7 | 101 | 100 | |

| 07:55 | EUR | German Unemployment Change (000’s) Jun | -15K | -8K | -11k | |

| 07:55 | EUR | German Unemployment Claims Rate Jun | 5.20% | 5.20% | 5.20% | |

| 08:30 | GBP | Mortgage Approvals May | 64.5K | 62K | 62K | |

| 08:30 | GBP | Money Supply M4 M/M May | -0.40% | 0.30% | 0.20% | |

| 08:30 | GBP | Current Account Balance (1Q) | -17.7B | -18.2B | -18.4B | |

| 08:30 | GBP | Index of Services 3M/3M Apr | 0.20% | 0.00% | 0.30% | |

| 08:30 | GBP | GDP Q/Q Q1 F | 0.20% | 0.10% | 0.10% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Jun | 2.00% | 2.00% | 1.90% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun A | 1.00% | 1.00% | 1.10% | |

| 12:30 | CAD | Industrial Product Price M/M May | 1.00% | -0.50% | 0.50% | 0.40% |

| 12:30 | CAD | Raw Materials Price Index M/M May | 3.80% | -0.60% | 0.70% | 0.80% |

| 12:30 | CAD | GDP M/M Apr | 0.10% | 0.00% | 0.30% | |

| 12:30 | USD | Personal Income May | 0.40% | 0.40% | 0.30% | 0.20% |

| 12:30 | USD | Personal Spending May | 0.20% | 0.40% | 0.60% | 0.50% |

| 12:30 | USD | PCE Deflator M/M May | 0.20% | 0.10% | 0.20% | |

| 12:30 | USD | PCE Deflator Y/Y May | 2.30% | 2.00% | 2.00% | |

| 12:30 | USD | PCE Core M/M May | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | PCE Core Y/Y May | 2.00% | 1.80% | 1.80% | |

| 13:45 | USD | Chicago PMI Jun | 60.1 | 62.7 | ||

| 14:00 | USD | U. of Mich. Sentiment Jun F | 99.2 | 99.3 | ||

| 14:30 | CAD | BOC Business Outlook Survey | ||||

| 14:30 | CAD | BOC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals