The US dollar fell against major pairs on Friday despite a strong June jobs report due to the impending start of tariffs against Chinese goods and the retaliation from the Asian nation on US exports. The US economy added 213,000 jobs and wages rose 0.2 percent but it is the threat of trade war escalation that put pressure on the US currency.The Canadian dollar advanced against its southern neighbour ahead of the Bank of Canada (BoC) rate statement on Wednesday. The BoC could hike rates to keep up with American interest rates. The weekend will bring a major showdown in England as Theresa May will present a soft Brexit strategy to her party that might prompt some of the more hardline Brexiteers to quit, jeopardizing May’s position as leader of the party.

- UK Manufacturing expected to bounce back

- Bank of Canada (BoC) to hike interest rate to 1.50%

- US inflation to keep rising at 0.2% m/m

EUR Rises on Zero Tariff and Stronger Data

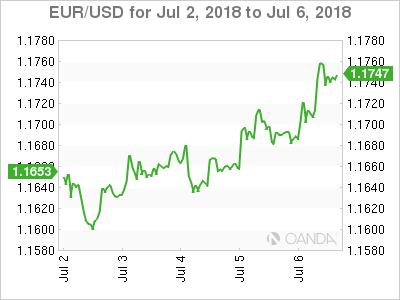

The EUR/USD gained 0.55 percent last week. The single currency is trading at 1.1738 as the USD is dragged down by a loss in confidence after the start of the tariffs on Chinese goods. The EUR had appreciated after reports pointed to a zero tariff on European autos and continued its upward trend as China announced its retaliation to the tariffs on Friday . The Trump administration is working on a $16 billion additional tariffs to be announced in the next two weeks.

German factory orders impressed on Thursday with a 2.6 percent gain and industrial production hit a 2.6 percent shocking gain with a low forecast of 0.3 percent. The USD was hit by the negative sentiment from investors as the first shots in a trade war are live. The European calendar will feature the German trade balance on Monday July 19 and the testimonies of European Central Bank (ECB) President Mario Draghi.

The U.S. Federal Reserve remains on track with two more rate hikes later in the year. US employment remains strong and even the rise in the unemployment rate translates to more people looking for jobs. The main hurdle for the dollar going forward will be geopolitics. The economy and the Fed are already priced in with global trade the biggest uncertainty.

Loonie Higher on Strong Jobs and Soft Dollar

The USD/CAD lost 0.32 percent in the last five sessions. The currency pair is trading at 1.3092 and continues to hold under the 1.31 price level after a strong jobs report in Canada could be enough for the Bank of Canada (BoC) to announce a rate hike on July 11. Uncertainty on trade after the first shot in the US-China trade war was officially fired and promptly answered, will continue to pressure the loonie. Canada is no stranger to trade spats with the US and with the fate of NAFTA still up in the air will be looking to the Trump administration in any changes to its trade strategy.

Monthly GDP at the end of June surprised to the upside and with a positive business outlook added to a strong jobs report the Canadian central bank will be looking to close the gap with the U.S. Federal Reserve funds rate. Fed members have signalled that more rate lifts are coming and two have already been priced in. The BoC is in no hurry to hike, but there is pressure to act later in the second half of the year if it decides to hold in July.

Hawkish comments from BoC Governor Stephen Poloz are taken into consideration for the meeting next week which could end up with an interest rate of 1.50 percent, 25 basis points higher than the current rate.

GBP Rises as Softer Brexit Plan Moves Forward

The GBP/USD gained 0.62 percent this week. The currency pair is trading at 1.3259 after Theresa May won the approval for her new softer Brexit strategy. The showdown with the more eurosceptic opposition is finished and now the next step will be to present a paper next week. The plan envisions a UK-EU free trade area adopting the EU rules for goods.

The pound will await the reaction from Brussels after reviewing the yet to be published document. The Bank of England (BoE) could offer some support for the GBP with a rate hike in August but only if economic conditions continue to improve. The political risk premium continues to be high as this was just a hurdle on the divorce between the UK and the EU. The GBP/USD will look to the 1.33 price level and beyond as more information is known during the week.

Market events to watch this week:

Tuesday, July 10

- 4:30am GBP GDP m/m

- 4:30am GBP Manufacturing Production m/m

Wednesday, July 11

- 10:00am CAD BOC Monetary Policy Report

- 10:00am CAD BOC Rate Statement

- 10:00am CAD Overnight Rate

- 10:30am USD Crude Oil Inventories

- 11:15am CAD BOC Press Conference

- 11:35am GBP BOE Gov Carney Speaks

Thursday, July 12

- 7:30am EUR ECB Monetary Policy Meeting Accounts

- 8:30am USD CPI m/m

- 8:30am USD Core CPI m/m

*All times EDT

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals