Dollar is set to close as the strongest one for the week, after today’s rally. Some setback is seen after import price index miss but the retreat is so far shallow. Yen is trading as one of the strongest alongside Dollar. But that’s mainly because it’s digesting some of the risk appetite triggered loss this week. Sterling is trading as the the second strongest, after New Zealand Dollar. The Pound appears to be hurt by the risk of losing a US-UK trade deal because of the business friendly softer Brexit plan.

In other markets, Gold breaches 1236.66 key support level and stays soft. There is no noticeable momentum for a rebound yet. WTI continues to stay steadily in tight range above 70 handle. Risk appetite is strong today with FTSE trading up 0.37% at the time of writing, DAX Is up 0.34% and CAC is up 0.38%. US futures, though, point to a flat open. But we’ll see if NASDAQ can extend the record run.

US import price dropped -0.4% mom in June, below expectation of 0.1% mom. Released in European session. Swiss PPI rose 0.2% mom, 0.3% yoy in June.

Real-life Trump toned down in front of May

As Trump is meeting UK Prime Minister Theresa May at the Chequers today, he toned down the abbrasive self again, as he used to with others. He said “we really have a very good relationship” and “today we are talking trade and we are talking military.”

That came just after he blasted May’s “business-friendly” Brexit plan in an interview with the Sun. Trump warned that the “soft” approach of May’s Brexit plan would “definitely affect trade with the United States, unfortunately in a negative way”. And, “if they do that I would say that that would probably end a major trade relationship with the United States.”

Trump also disclosed that he tried to interfere with the relationship between UK and EU. “I would have done it much differently,” Trump told The Sun. “I actually told Theresa May how to do it but she didn’t agree, she didn’t listen to me. . . . I think what is going on is very unfortunate.”

BoE Cunliffe: A little stodginess needed in medium term, but it’s not a stopped approach

BoE Deputy Governor Jon Cunliffe said in a speech today that the current overshoot in inflation, headline CPI at 2.4%, is “entirely due to imported inflationary pressure.”. That has come “primarily from the post referendum depreciation in sterling plus some more recent pressure from the increase in oil prices.” But the inflationary pressure form Sterling is “already passed its peak”.

The key question now is “how much inflation is domestic economic pressures likely to generate over the next couple of years”. Cunliffe noted that “domestic inflation pressures, while strengthening a little are not yet established at levels consistent with inflation at target”. Pay growth has established itself in the range of 2.5-3.0%. But “the latest readings do not signal strongly that pay growth will make the next step to establish itself firmly in 3% territory in line with the May forecast”.

And there remains a case for a little ‘stodginess’ yet in the medium term. Though, he also emphasized that “such an approach is not, however, a stopped approach.”

New Zealand BusinessNZ PMI dropped to 52.8 and production dipped again

New Zealand BusinessNZ Performance of Manufacturing Index dropped to 52.8 in June, down from 54.4. BusinessNZ’s executive director for manufacturing Catherine Beard said that the slow-down in expansion was mainly due to ongoing drops in a key sub-index. She pointed out that “production (51.8) experienced another decrease in expansion levels for June, which meant it was down to its lowest point since January 2017.” Nonetheless, “on a positive note, the other key sub-index of New Orders (57.1) remained in healthy territory, which at least should feed through to production levels in the coming months.”

China overall trade surplus shrank -24.5% in first half, surplus with US rose 13.9%

In USD term, China trade surplus widened to USD 41.6B in June, up from May’s USD 24.9B and beat expectation of USD 27.2B. Exports jumped 11.3% yoy to USD 216.7B while import rose 14.1% to USD 175.1B.

In CNY term, trade surplus widened to CNY 261.9B, up from May’s CNY 156.5B and beat expectation of CNY 187.0B. Exports rose 3.1% yoy to CNY 1377.7B while imports rose 6.0% yoy to CNY 1115.8B

From January to June:

Total trade rose 16% to USD 2205.8B. Exports rose 12.8% to USD 1172.7B. Imports rose 19.9% to USD 1033.1B. Trade surplus dropped -24.5% to USD 139.6B.

Total trade with EU rose 13.0% to USD 322.6B. Export to EU rose 11.7% to USD 191.8B. Imports from EU rose 15.0% to USD 130.8B. Trade surplus with EU grew 3.8% to USD 61.0B

Total trade with US rose 13.1% to USD 301B. Export to US rose 13.6% to USD 217.8B. Imports from US rose 11.8% to USD 84.0B. Trade surplus with US rose 13.9% to USD 133.8B.

Total trade with Australia rose 11..5% to USD 74.1B. Export to Australia rose 17.3% to USD 21.7B. Import from Australia rose 9.3% to USD 52.4B. Trade deficit with Australia rose 3.7% to USD -30.7B.

USD/CHF Mid-Day Outlook

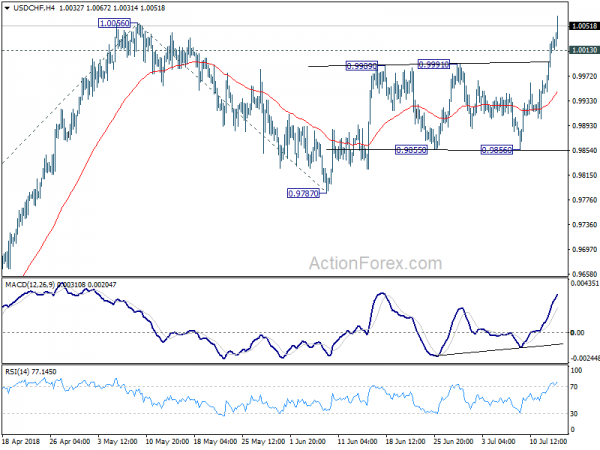

Daily Pivots: (S1) 0.9967; (P) 0.9997; (R1) 1.0055; More…

USD/CHF’s rally continues to as high as 1.0067 so far today. Break of 1.0056 high suggests that whole up trend from 0.9186 is resuming. Intraday bias stays on the upside for 61.8% projection of 0.9186 to 1.0056 from 0.9787 at 1.0325, which is close to 1.0342 key resistance. On the downside, below 1.0013 minor support will turn intraday bias neutral first. But downside of retreat should be contained well above 4 hour 55 EMA (now at 0.9947) to bring another rally.

In the bigger picture, rise from 0.9186 is seen as a leg inside the long term range pattern. After drawing support from 55 day EMA, it’s now resuming for 1.0342 key resistance. For now, we’d still cautious on strong resistance from there to limit upside. Meanwhile, break of 0.9787 support is needed to signal completion of the rise. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing PMI Jun | 52.8 | 54.5 | 54.4 | |

| 03:01 | CNY | Trade Balance (USD) Jun | 41.6B | 27.5B | 24.9B | |

| 03:01 | CNY | Trade Balance (CNY) Jun | 262B | 165B | 156B | |

| 04:30 | JPY | Industrial Production M/M May F | -0.20% | -0.20% | -0.20% | |

| 07:15 | CHF | Producer & Import Prices M/M Jun | 0.20% | 0.10% | 0.20% | |

| 07:15 | CHF | Producer & Import Prices Y/Y Jun | 3.50% | 3.20% | 3.20% | |

| 12:30 | USD | Import Price Index M/M Jun | -0.40% | 0.10% | 0.60% | |

| 14:00 | USD | U. of Mich. Sentiment Jul P | 98.2 | 98.2 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals