The core theory of Netflix’s wild run to a $175 billion valuation hasn’t been debunked with one quarter of slower growth than forecast.

But the Q2 miss might make some investors reconsider why they’re betting on Netflix in the first place.

The basic hypothesis for bulls is that Netflix is on its way massive global subscriber growth that will eat away at legacy media companies. As I wrote about here, analysts nearly universally expect Netflix subscribers to keep soaring — to 200 million and higher by 2020.

Nothing announced today undercuts that general idea. Netflix again announced significant growth, adding 5.2 million customers to 130 million global subscribers.

The problem was the company’s own internal prediction pegged that quarterly number at 6.2 million. Missing by 1 million customers is a lot, especially because Netflix has gained a reputation for beating its own estimates. Netflix also didn’t really offer a reason, other than blaming their own forecasting models. That’s why the stock is down about 14 percent in after-hours trading. Netflix, itself, called the quarterly results “not stellar” in its letter to shareholders.

If you thought Netflix would erode legacy media by outspending many of today’s players (Lionsgate, Viacom, AMC, etc.), spending $22.5 billion per year on content by 2022 like Goldman Sachs reportedly predicted, nothing announced today changes that thesis.

As Daniel Ives from GBH Insights wrote in a note to clients, “We believe this is a speed bump rather than the start of a negative sub trend for Netflix, as the streaming market and content arms race continues to be a major tailwind for the company over the next 12 to 18 months.” Ives has a target of $500 a share on the stock.

The problem is Netflix’s huge content spend is aided by its valuation. When you increase spending and your stock rises, that’s a sign to keep increasing spending.

When your stock starts moving the other direction over a sustained period of time, maybe you start pulling back on those gaudy spending predictions.

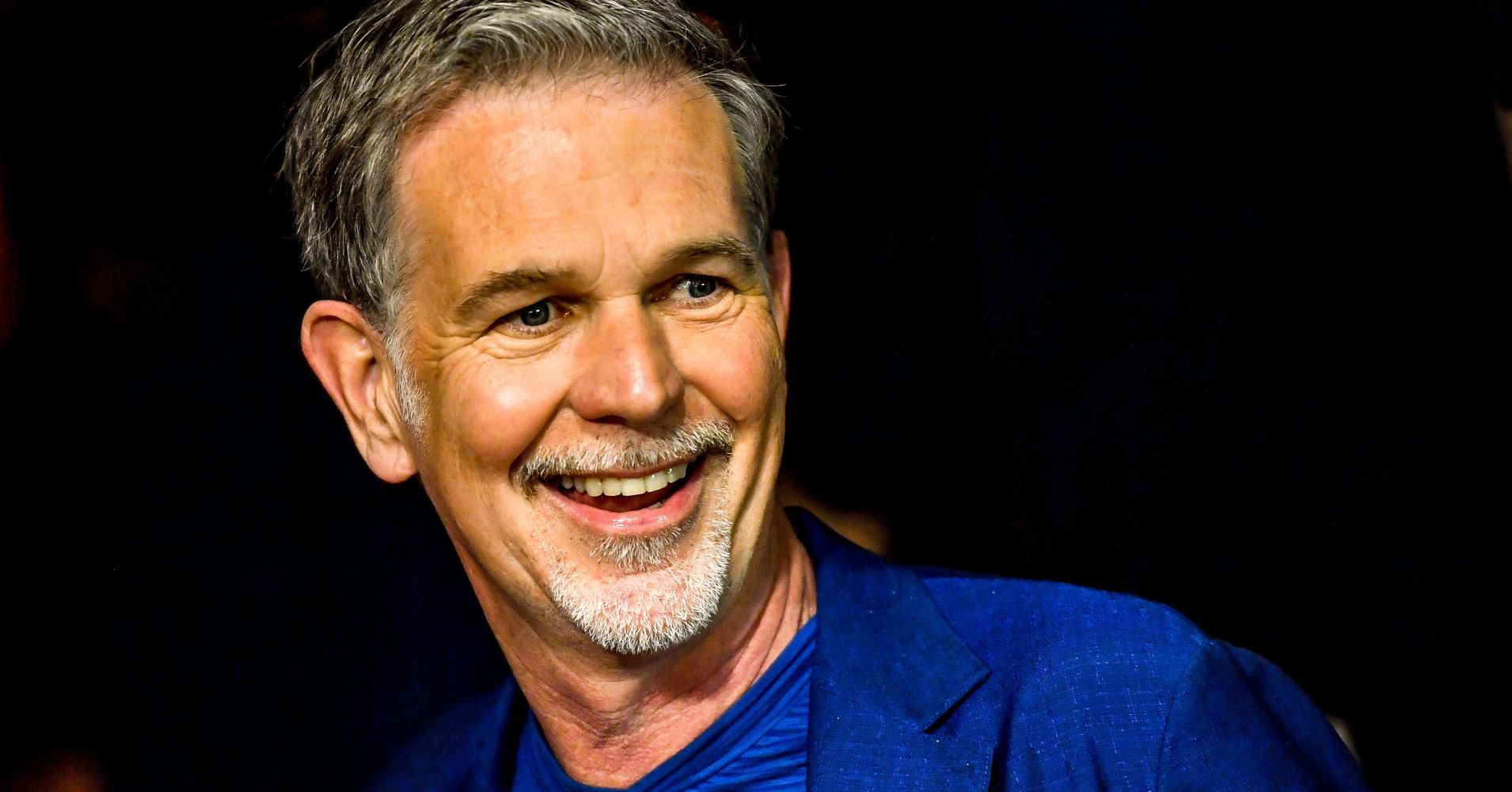

Nothing today yet suggests Netflix has changed its long-term focus — and CEO Reed Hastings’ attention to his company’s long-term focus is unwavering. He’s even posted it on the company’s website.

But maintaining a high valuation certainly helps accelerate the strategy. If the valuation starts to shrink, the entire thesis could come under question.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals