While it appeared that there was a breakthrough in EU-US trade negotiation, the news provide no lift to Dollar nor Euro. Both are trading mixed in Asian session. Indeed, Dollar is the weakest one for the week so far, followed by Euro as the second weakest. On the other hand, renewed selloff in JGB, with 10 year JGB yield hitting as high as 0.098, gives the Japanese Yen a lift. But Even though Canadian Dollar pares back some gains, it’s trading as the strongest one for the week. It’s clear that Canada is a beneficiary if US holds off auto tariffs.

In other markets, US indices closed with solid gain overnight. DOW rose 0.68% to 25414.10, resumed the rise from 23997.21 and broke 25402.83 resistance. It’s on track to next resistance at 25800.35. S&P 500 rose 0.91% to 2846.07. NASDAQ made another record close at 7932.24, up 1.17%. US treasury yield pared back some gains as 10 year yield dipped -0.013. But we’ll see if it will follow Japanese yield higher again. Gold is engaging in consolidative trading at around 1230. With 1238.00 resistance intact, more decline is expected in near term to 1200 handle.

Technically, USD/JPY’s break of 110.74 overnight indicates resumptions of fall from 113.17. Deeper decline would be seen to 109.90 fibonacci level next. USD/CAD also resumed the correction from 1.3385 for channel support at 1.2094. EUR/AUD, AUD/USD and EUR/AUD are engaging in sideway trading in familiar range.

EU-US trade war temporarily averted as Trump made major concession

European Commission President Jean-Claude Juncker’s meeting with US President Donald Trump seemed to have achieved a breakthrough that could avoid a full-blown EU-US trade war. A rather positive joint statement was issued pledging to work towards “zero tariffs, zero non-tariff barriers, and zero subsidies on non-auto industrial goods”. This is taken well generally by both sides.

While the auto tariffs were not mentioned in the joint statement, Juncker later said that the Trump made a “major concession” for holding off on further tariffs, including autos, as long as the negotiations continue. Juncker said he expected Trump to follow through on it. Also, he noted that Trump agreed to reassess the measures in the steel and aluminum sector.

On the other hand, Trump hailed that “a breakthrough has been quickly made that nobody thought possible!” He also told reports that EU is going to start to “buy a lot of soybeans”. Trump also said “they’re going to be a massive buyer of LNG… and we have plenty of it”.

EU and US in joint position against China’s unfair practices

One thing to note is that now EU and US seemed to be aligned themselves against China. The statement noted that both sides agreed to join forces against “unfair global trade practices”. And specifically, they the practices include “intellectual property theft, forced technology transfer, industrial subsidies, distortions created by state owned enterprises, and overcapacity.” That’s exactly talking about China.

Statement well received, but scepticism remains

The joint statement of Juncker and Trump is well received by both sides in general. The Alliance of Automobile manufacturers said the announcement “demonstrates that bilateral negotiations are a more effective approach to resolving trade barriers, not increasing tariffs.” German Economy Minister Peter Altmaier tweeted that “breakthrough achieved that can avoid trade war and save millions of jobs! Great for global economy.”

But Eric Schweitzer, president of the German Chambers of Industry and Commerce appeared to be a bit skeptical. He said “the proposed solutions move in the right direction, but a significant portion of scepticism remains.” He emphasized that “only united as Europeans do we have sufficient economic and political weight to effectively represent our interests.” And Schweitzer warned that “without strong European answers, there is a danger that only we will make concessions and in response face new unreasonable demands from the USA.”

Mexico and Canada targeting to speed up NAFTA negotiations

Canadian Dollar seemed to be benefited from the EU-US trade talks too. Trump’s softened stance on auto tariffs is a positive to Canada, as well as NAFTA talks too. Canadian Foreign Minister Chrystia Freeland said after meeting with Mexican Economy Minister Ildefonso Guajardo that “Canada’s very clear desire is to move the NAFTA negotiations back into higher gear now that we are past the Mexican election”

Guajardo said that “in the next few months and definitely before the election process in the United States, we are trying to constructively advance this negotiation.” He is also optimistic that “there is the possibility of finding a safe landing zone.”

Nonetheless, it should be noted that while the US would want to pursue bilateral agreements with Canada and Mexico, the latter two insist on trilateral agreement. Guajardo said “the essence of this agreement is trilateral, and it will continue being trilateral.” Incoming Mexican Foreign Minister Marcelo Ebrard also said NAFTA “can be modernized but we’re not thinking about it having a different nature to that of today.”

ECB meeting unlikely to be inspirational

ECB meeting is the major focus of today. But it’s unlikely to bring anything inspirational to the markets. No monetary policy change is expected today. The central bank has been managing market expectations rather well. It’s planning to taper the asset purchase program after September, and stop it after December. Interest rates will stay at present level at least through Summer 2019. The question is on whether ECB President Mario Draghi would clarify what exactly he means by Summer. But it’s unlikely as the words are seen as a balance between precision and flexibility.

Some suggested readings on ECB:

On the data front

Australia import price index rose 3.2% qoq in Q2, export price index rose 1.9% qoq. German Gfk consumer confidence is a feature in European session. Later in the day, US will release trade balance, whole sale inventories and durable goods orders.

USD/CAD Daily Outlook

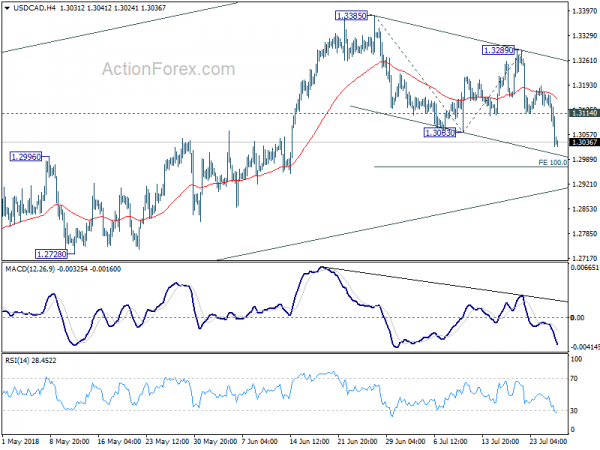

Daily Pivots: (S1) 1.2992; (P) 1.3080; (R1) 1.3135; More…

USD/CAD drops to as low as 1.3023 so far as the corrective fall from 1.3385 resumes. Intraday bias is back on the downside for 100% projection of 1.3385 to 1.3063 from 1.3289 at 1.2967 and possibly below. But still, we’d expect strong support from rising channel line (now at 1.2903) to contain downside and bring rebound. On the upside, above is the first sign of bottoming and will turn bias back to the upside for 1.3289 resistance. Overall, the larger rally from 1.2061 is still expected to resume later.

In the bigger picture, as long as channel support (now at 1.2903) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Import Price Index Q/Q Q2 | 3.20% | 1.90% | 2.10% | |

| 01:30 | AUD | Export Price Index Q/Q Q2 | 1.90% | 3.90% | 4.90% | |

| 06:00 | EUR | German GfK Consumer Confidence Aug | 10.8 | 10.7 | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (JUL 21) | 221K | 207K | ||

| 12:30 | USD | Trade Balance Jun | -64.8B | |||

| 12:30 | USD | Wholesale Inventories M/M Jun P | 0.30% | 0.60% | ||

| 12:30 | USD | Durable Goods Orders Jun P | 2.50% | -0.40% | ||

| 12:30 | USD | Durables Ex Transportation Jun P | 0.30% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 20B | 46B | ||

| 14:30 | USD | Crude Oil Inventories | -3.4M | 5.8M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals