There will be a continuation of the central bank and Q2 GDP theme in the next seven days as interest rate decisions will be awaited out of Australia and New Zealand, while the United Kingdom and Japan will publish growth figures. Monthly data on trade balance and industrial output will also be in focus, along with Canadian employment and US inflation numbers.

RBA and RBNZ to stand pat again

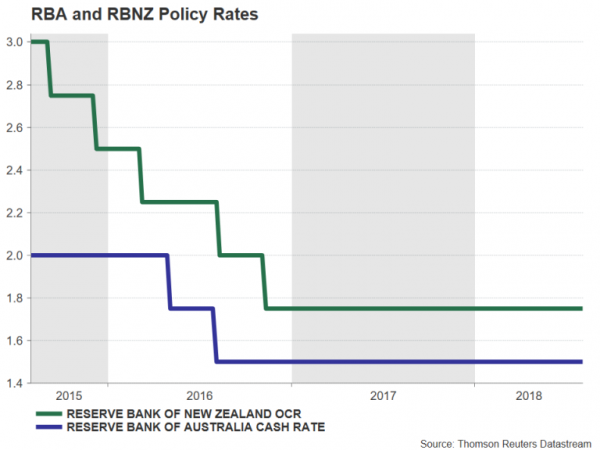

It will be the turn of the Reserve Bank of Australia and the Reserve Bank of New Zealand to set monetary policy, following decisions from other major central banks in the past two weeks. The RBA will be the first to hold its monetary policy meeting on Tuesday, with no change in rates anticipated. Although recent data from Australia have been fairly strong, there’s been no change in market expectations of how soon the RBA will raise its cash rate. Investors are not presently fully pricing a rate increase until November 2019 and the RBA is not expected to shift from its neutral stance anytime soon as inflation only moved into the Bank’s target band of 2-3% in the second quarter and wage growth remains subdued.

While the RBA will probably maintain its rosy outlook for growth, this is unlikely to provide much support to the Australian dollar, which has been under pressure this week from intensifying Sino-US trade tensions. Nevertheless, aussie traders should be on the standby next week as, apart from the RBA announcement, the Governor Philip Lowe will be taking to the podium on Wednesday, while on Friday, the Bank will publish its quarterly outlook report. In terms of data, June housing finance numbers should be watched on Wednesday.

Across the Tasman Sea, the RBNZ decision on Thursday is not expected to generate much excitement either as it too is anticipated to keep rates unchanged. However, while both the RBA and RBNZ have been bound to a neutral mode since 2016, there’s been a bit of divergence recently, with the New Zealand economy showing some unexpected weakness. The RBNZ has even said the next move in rates could be down, though for now, the broad consensus for the next move is an increase. The kiwi could be headed back towards the two-year low of $0.6686 it hit in July if the Governor Adrian Orr maintains a somewhat downbeat view of the economy in his statement, and more importantly, if the Bank lowers its economic forecasts in its quarterly monetary policy statement due the same day.

China’s exports to slow in July

Exports from China had maintained strong growth in June, rising by 11.2% year-on-year. However, the figure was skewed as exporters were front-loading shipments before the $34 billion of US tariffs came into force in July. A mild slowdown is therefore expected in July to 10% when the trade numbers are released on Wednesday. A weaker reading could upset an already fragile Chinese equity market, as well as broader global risk sentiment, as it would suggest US tariffs are hurting demand for Chinese goods. Also out of China next week are the latest producer and consumer price indicators on Thursday.

Japanese economy to return to positive growth

Japan will have a relatively busy week with the spotlight being on the first reading of second quarter GDP growth due at the end of the week. Ahead of that though, household spending and earnings numbers will be looked at on Tuesday. Recent household spending figures have been dreadful, falling during every month of 2018 so far except in January. A turnaround of 1.7% month-on-month is expected in June, which would raise hopes that the pick-up in growth that is currently underway would be sustainable. Wage growth data due the same day could also send positive signals about the economy and the outlook for consumer spending if they maintain the recent uptrend in June. On Thursday, machinery orders for June will be watched for the latest indication on business spending before attention turns to the GDP numbers on Friday.

Japan ended its two years of uninterrupted economic expansion in the first quarter of 2018 when GDP contracted by 0.6% on an annualized basis. However, growth is expected to have bounced back in the second quarter with the economy forecast to have expanded by an annualized 1.4%. Alongside the GDP figures, July corporate goods prices will also be released.

The yen could benefit from any upside surprises in the GDP report after being sold off this week following the disappointment that the Bank of Japan didn’t announce a winding down of its massive asset purchase program when it concluded its two-day policy meeting on Tuesday. A summary of opinions of that meeting will be published on Wednesday.

French and German industrial output to be European focus

It will be a quieter time for the European calendar with the main releases coming from French and German trade and industrial output figures. Starting the week though will be German industrial orders for June and the Eurozone sentix index for August on Monday. German June industrial output will follow on Tuesday together with trade data for the same month. Industrial output in Germany is forecast to have declined by 0.5% m/m in June, indicating the weak patch continued until the very end of the second quarter. France will also release trade figures on Tuesday, with industrial production numbers coming up on Friday.

The euro is unlikely to get much comfort from next week’s data as it found itself once again testing the $1.16 level this week, with any positive surprises expected to provide only a modest lift.

UK GDP to rebound in Q2

Across the English Channel, the UK’s Office for National Statistics (ONS) will publish its first estimate of second quarter growth. There will be a flurry of data releases on Friday as the GDP numbers will be accompanied by monthly indicators on industrial, manufacturing and services output, as well as trade figures for June.

Following recent changes by the ONS, the GDP data will include both quarterly and monthly series. The UK economy is forecast to have grown by 0.4% quarter-on-quarter in the three months to June, with the annual rate edging up to 1.3%. If validated, the quarterly figure would represent a moderate acceleration on the prior 0.2% rate. On a month-on-month basis, GDP is expected to have expanded by 0.2% in June.

Looking at the production sectors, industrial and manufacturing output are projected to have increased by 0.4% and 0.3% m/m, respectively, in June.

The pound could find some reassurance from Friday’s data if they confirm that the slowdown in the first quarter was temporary and that further rate increases by the Bank of England would not be totally unwarranted.

US inflation and Canadian employment eyed in North America

After an eventful week dominated by top tier data and the Fed policy meeting, dollar traders might be able to catch a break next week as the only highlight will be the July CPI report on Friday. Prior to that, producer prices will be viewed first on Thursday, where the annual rate of PPI is forecast to remain at 3.4% in July. The headline rate of CPI, meanwhile, is anticipated to hold steady at 2.9% y/y in July, with the core rate also staying unchanged at 2.3%.

North of the border, the July employment report will be Canada’s leading data point. The last jobs report showed a big jump in employment in June and has been followed by even more robust data for the Canadian economy, with everything from GDP, retail sales and inflation numbers beating expectations. Another strong set of employment figures on Friday would pave the way for one more rate hike by the Bank of Canada in the Autumn and help drive the loonie beyond this week’s 7-week peak of C$1.2971 per US dollar.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals