The forex markets are rather steady in Asian session today. Dollar is paring some gains and trades slightly lower. But it remains the strongest one for the week together with Canadian Dollar. New Zealand Dollar, however, trades broadly lower as markets expect that RBNZ could be slightly dovish in the upcoming rate decision. Taking about central banks, RBA left cash rate unchanged at 1.50% as widely expected. The announcement is shrugged off by the Australian Dollar as it provides nothing new.

In other markets, US equities ended higher overnight with DOW up 0.16% to 25502.18, S&P 500 up 0.35% to 2850.40. NASDAQ’s rebound was very impressive as it gained 0.61% to 7859.68. Despite the sharp pull back in late July, NASDAQ is now heading back to 7933.31 record high. US treasury yields extended decline with 10 year yield closed down -0.015 at 2.938.

In Asia, China’s Shanghai SSE is trading up 1.56% at the time of writing, at 2747.38. It looks like there is a chance for SSE to defend 2700 handle again. Hong Kong HSI follows and is up 1.0%. Nikkei is up 0.61% while Singapore Strait Times is up 1.55%. Gold is back at 1210 as yesterday’s sell-off slowed, but outlook stays bearish for a take on 1200 handle. WTI crude oil stays in range below 70, and there is no committed buying to push it above this 70 handle.

Technically, outlook in Dollar is mixed. EUR/USD is on course for testing 1.1507 key support even though intraday downside momentum is diminishing. GBP/USD is also staying bearish after yesterday’s break of 1.2956 low. But elsewhere, there is no apparent strength in the greenback yet. AUD/USD is bounded in consolidation. USD/JPY and USD/CAD are mixed and could head lower before bottoming. Meanwhile, EUR/JPY and GBP/JPY declines slowed. But the lack of any notable strengthen in recovery affirms near term bearish outlook in both crosses.

Aussie steady after RBA kept cash rate unchanged at 1.50%

RBA kept cash rate unchanged at 1.50%. The accompanying statement is largely unchanged from the prior one. Central forecasts for the Australian economy “remains unchanged”. GDP growth is expected to be “a bit above 3%” in both 2018 and 209. Household consumption remains an uncertainty for the outlook. That’s primarily due to slow growth in income while debt levels are high. Also, RBA noted that drought has led to “difficult conditions in parts of the farm sector”.

Latest inflation data were in line with RBA’s expectations. Inflation is projected to be higher the than current 2.1% in 2019 and 2020. Nonetheless, there could be an interim dip to 1.75% in September quarter this year due to “once-off declines in some administered prices”. Labor market outlook “remains positive” and further decline in unemployment rate is expected over the next few years to around 5%. But wage growth remains slow even though the pace has troughed.

Australian Dollar is steady after the release and focus will turn to Friday’s Monetary Policy Statement.

Kiwi soft ahead of RBNZ rate decision

New Zealand Dollar trades generally lower ahead of RBNZ rate decision on Thursday. The central bank is widely expected to leave the OCR unchanged at 1.75% and deliver a neutral to slightly dovish policy statement. Since the June meeting, data showed that economic growth moderated while inflation picked up. In the job market, the unemployment rate climbed higher to 4.5% in 2Q18.

We expect policymakers to look through the improvement in inflation data and maintain accommodative monetary policy at least until late 2019. The central bank will likely reiterate that the next move in the OCR could be “up or down”. On the updated economic forecasts, we expect the central bank to downgrade the GDP growth projection in light of recent slowdown.

More in RBNZ Preview – Policy Rate On Hold, Overall Tone Neutral or Slightly Dovish.

Confidence on UK PM May’s Brexit negotiation plunged to new low

According to the latest monthly Brexit Confidence Tracker by ORB International, confidence on Prime Minister Theresa May regarding Brexit negotiation plunged again to new low in August. There was clear deterioration after the high profile Chequers meeting, which resulted in one white paper and two resignations of key cabinet ministers in Boris Johnson and David Davis.

Only 24% of respondents said they approve of the way May’s government is handling Brexit negotiation. That compares to 40% back in April On the other hand, disapproval surged to 76%.

Meanwhile, only 22% are confidence that May will get the right Brexit deal. 60% believed that May won’t. And the percentage of “don’t know” also dropped 2% to 17%.

Japan real wages grew at fastest pace since 1997

Japan nominal labor cash earnings rose strongly by 3.6% yoy in June versus expectation of 1.7% yoy. Real wages grew 2.8% yoy, the fastest pace in 21 years since January 1997. Looking at the details, regular pay grew 1.5% yoy. One-off payment including bonuses jumped an impressive 7.0% yoy. Overtime pay also rose 3.5% yoy, a notable acceleration of 2.0% yoy in May. The set of data should be welcomed by BoJ. Nonetheless, persistent strength is needed to eventually change the “social mode” of deflation mind set, which suppresses inflation pressures. Also from Japan, overall household spending dropped -1.2% yoy in June, matched expectations.

Elsewhere, UK BRC retail sales monitor rose 0.5% yoy in July, below expectation of 1.3% yoy. Australia AiG performance of construction index rose to 52.0 in July, up from 50.6.

Looking ahead

German trade balance and industrial production will be featured in European session. Swiss will release foreign currency reserves. UK will release Halifax house price. Later in the day Canada will release Ivey PMI.

AUD/USD Daily Outlook

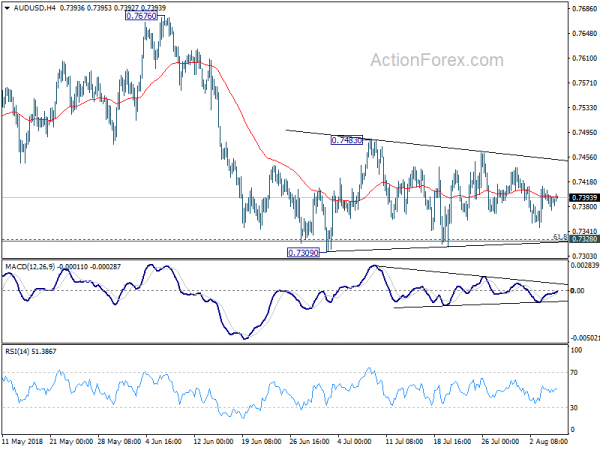

Daily Pivots: (S1) 0.7373; (P) 0.7390; (R1) 0.7405; More…

AUD/USD is still bounded in consolidation from 0.7309. Intraday bias remains neutral and more sideway trading could be seen. On the downside, break of 0.7309 and sustained trading below 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326) will extend the fall from 0.8135 to 0.7158 support next. On the upside, above 0.7483 resistance will bring stronger rebound. But upside should be limited below 0.7676 resistance to bring larger fall resumption eventually.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move that should be completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. This will now remain the favored case as long as 0.7676 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 52 | 50.6 | ||

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jul | 0.50% | 1.30% | 1.10% | |

| 23:30 | JPY | Overall Household Spending Y/Y Jun | -1.20% | -1.20% | -3.90% | |

| 0:00 | JPY | Labor Cash Earnings Y/Y Jun | 3.60% | 1.70% | 2.10% | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 5:00 | JPY | Leading Index Jun P | 105.2 | 105.4 | 106.9 | |

| 6:00 | EUR | German Trade Balance Jun | 21.4B | 20.3B | ||

| 6:00 | EUR | German Industrial Production M/M Jun | -0.50% | 2.60% | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) Jul | 749B | |||

| 7:30 | GBP | Halifax House Prices M/M Jul | 0.20% | 0.30% | ||

| 14:00 | CAD | Ivey PMI Jul | 64.2 | 63.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals