The forex markets are relatively directionless today, except overwhelming weakness in New Zealand Dollar. Sterling recovers broadly today on rumor that the EU is considering to offer a major Brexit concession to the UK. But there is so far no detail on the deal. Oversold condition also helps the pound gains some footing. But it’s clearly not out of the woods yet. The next move in Sterling could depend on UK GDP to be released tomorrow. Swiss Franc is following as the second strongest one for today so far, with some help from softness in European stocks. Kiwi remains the worst performing one on dovish RBNZ rate decision. Australian Dollar reversed earlier gains and is trading as the second weakest. Dollar and Euro are mixed.

In other markets, European indices are mixed for the moment. DAX is fluctuating between gain and loss. DAX is down -0.27% while FTSE is down -0.7%. Earlier in Asia, major indices closed mixed. China Shanghai SSE closed up 1.83% at 2794.38, can’t hold on to 2800 handle. Hong Kong HSI rebounded 0.88%. But Nikkei and Singapore Strait Times are down -0.2% and -0.4% respectively. WTI crude breached 67 earlier today but is so far holding on this level. Gold continues to gyrate in tight range around 1210.

Technically, a focus is 128.49 in EUR/JPY in today’s session. Break will resume recent fall from 131.97 for 127.13 support level. 0.9920 in USD/CHF is another level to watch and a break there could drag the pair back towards 0.9866 support. Break of 0.8984 in EUR/GBP will also indicate temporary toping and bring retreat.

US initial jobless claims dropped to 213k, PPI missed expectations

US initial jobless claims dropped -6k to 213k in the week ended August 4. The four week moving average of initial claims dropped 0.5k to 214.25k. Continuing claims rose 29k to 1.755m. Four-week moving average of continuing claims rose 3k to 1.74525m.

Headline PPI rose 0.0% mom, 0.3% yoy in July, missed expectation of 0.3% mom, 3.4% yoy. Core PPI rose 0.1% mom, 2.7% yoy, below expectation of 0.3% mom, 2.8% yoy.

From Canada housing starts dropped to 206k in July, below expectation of 281k. New housing price index rose 0.1% mom in June., above expectation of 0.0% mom.

ECB : Eurozone risk broadly balanced, but global downside risks intensified

In ECB’s Monthly Economic Bulletin, the central bank noted that latest economic indicators suggest “ongoing solid growth”. There is an “easing” as a pull-back from the “high-pace” of growth last year. And that is “related mainly to a weakening of external trade”. Overall, risks surrounding the Eurozone growth outlook “can still be assessed as broadly balanced”. Meanwhile wage growth data points to a “continued upward lift” from Q2 2016 trough”. Both mark and survey-based measure of long-term inflation expectations remained “broadly unchanged”.

Externally, ECB noted that indicators signal a “steady growth momentum” in Q2. But at the same time, downside risks to global economy “have intensified. That was due to “actions and threats regarding trade tariff increases by the United States and possible retaliation by the affected countries.” Also, global trade indicators recorded a “loss in momentum.

77% economists expect no BoJ stimulus exit until 2020 or later

According to a Reuters poll, 73% of economists surveyed expected that BoJ will not start unwinding stimulus until 2020 or later. That’s nearly double of 37% last month. Around one third said BoJ’s July announcement as a small step on crafting the exit strategy. BoJ explicitly talked about allowing 10 year JGB yield to move between -0.1% and 0.1%. 77% of economists believed that would help bond market functioning.

On the economy, economists projected core CPI, excluding sales tax hike impact, to rise 0.9% in the fiscal year to March 2019, same as the prior fiscal year. That’ notably lower than BoJ’s own forecasts of 1.1% in fiscal 2019 and fiscal 2019. Economists also saw Japan GDP to grow 1.1% this fiscal year and then slow to 0.8% next.

RBNZ kept OCR unchanged at 1.75, overall more dovish than expected

RBNZ’s announcement comes in more dovish than anticipated. While leaving the Official Cash Rate (OCR) unchanged at 1.75%, the members pushed backward expectations for the next interest rate adjustment. OCR is expected to be kept low, “but for longer”, through 2019 and into 2020. RBNZ also reiterated that the next move “could be up or down”.

According to the new Monetary Policy Statement (MPS), RBNZ is now conditioning a full 25bps hike to 2.00% in December quarter of 2020. That’s notably later than March quarter in 2020 as in May MPS. GDP growth forecasts were revised down to 2.7% in 2018 (2.8% in May MPS), 2.6% in 2019 (3.1%), 3.4% in 2020 (3.3%) and 3.2% in 2021 (3.1%). CPI forecasts were kept unchanged at 1.1% in 2018, 1.6% in 2019, 1.8% in 2020, and 2.0% in 2021. More in RBNZ Delays Timing for Rate Change and Inflation to Reach +2%, Kiwi Slumps

Elsewhere

Released from China, CPI accelerated to 2.1% yoy in July, up from 1.9% yoy, above expectation of 2.0% yoy. PPI slowed to 4.6% yoy, down from 4.7% yoy, matched expectations. Released from Japan, M2 rose 3.0% yoy in July, below expectation of 3.1% yoy. Machine orders dropped sharply by -8.8% mom in June versus expectation of -0.8% mom. Machine tool orders rose 13.0% yoy in July.

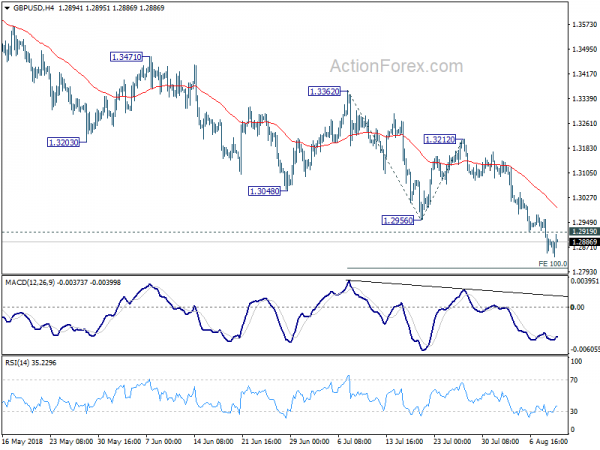

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2838; (P) 1.2899; (R1) 1.2946; More…

GBP/USD is losing some downside momentum as seen in 4 hour MACD. But with 1.2919 minor resistance intact, intraday bias stays on the downside. Current fall should extend to 100% projection of 1.3362 to 1.2956 from 1.3212 at 1.2806 first. Break will target 161.8% projection at 1.2555 next. On the upside, above 1.2919 minor resistance will turn bias neutral and bring consolidation. But upside should be limited well below 1.3212 resistance to bring fall resumption.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4141). Fall from 1.4376 has met 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 already. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3212 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:01 | GBP | RICS House Price Balance Jul | 4% | 4% | 2% | 3% |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jul | 3.00% | 3.10% | 3.20% | 3.10% |

| 23:50 | JPY | Machine Orders M/M Jun | -8.80% | -0.80% | -3.70% | |

| 01:30 | CNY | CPI Y/Y Jul | 2.10% | 2.00% | 1.90% | |

| 01:30 | CNY | PPI Y/Y Jul | 4.60% | 4.60% | 4.70% | |

| 05:45 | CHF | Unemployment Rate Jul | 2.60% | 2.60% | 2.60% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Jul P | 13.00% | 11.40% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:15 | CAD | Housing Starts Jul | 206K | 218K | 248K | |

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.10% | 0.00% | 0.00% | |

| 12:30 | USD | Initial Jobless Claims (AUG 4) | 213K | 217K | 218K | 219K |

| 12:30 | USD | PPI M/M Jul | 0.00% | 0.30% | 0.30% | |

| 12:30 | USD | PPI Y/Y Jul | 3.30% | 3.40% | 3.40% | |

| 12:30 | USD | PPI Core M/M Jul | 0.10% | 0.30% | 0.30% | |

| 12:30 | USD | PPI Core Y/Y Jul | 2.70% | 2.80% | 2.80% | |

| 14:00 | USD | Wholesale Inventories M/M Jun F | 0.00% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 49B | 35B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals