Political turmoil in Australia takes the headline over from the US as the Aussie dives broadly today. While two former aides of Trump are likely going to jail soon, special prosecutor Robert Mueller’s investigation will take long to complete. However, Australia could have the seventh Prime Minister in a decade in a matter of weeks, or even days. Meanwhile, the greenback is now trying to pare back its earlier loss as another round of tariffs on China kicks in. The low-level trade talks in Washington are not expected to yield any result. FOMC minutes released overnight indicated Fed is on course for September hike, which is Dollar positive too.

Meanwhile, New Zealand Dollar is back under pressure as its recovery faded, Euro follow s the third weakest for today together with Sterling. Eurozone PMIs and ECB meeting accounts will be watched today. Swiss Franc, on the other hand, is trading as the second strongest for today, next to Dollar.

In other markets, US stocks closed mixed overnight. DOW lost -0.34% but NASDAQ gained 0.38%. S&P 500 didn’t challenge a record high again and closed down -0.04%. 10 year yield also closed lower by -0.021 at 2.823. Asian markets are mixed too. At the time of writing, Nikkei is up 0.18% while Singapore Strait Times is up 1.46%. But Hong Kong HSI is down -0.72% and China Shanghai SSE is down -0.34%. Gold continues to lose upside momentum despite breaching 1200 yesterday. It’s now back pressing 1190, with 1187.4 minor support insight.

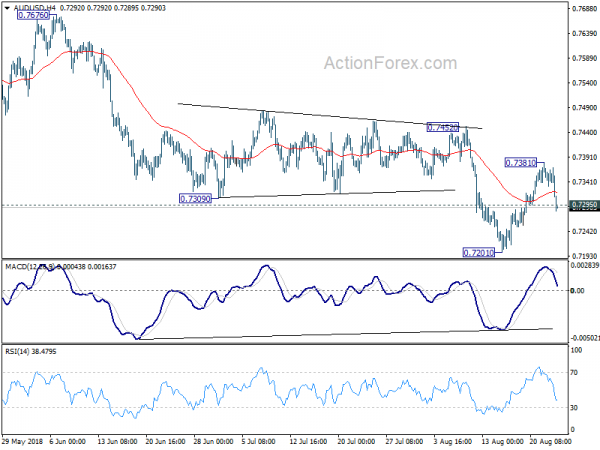

Technically, today’s focus will be on whether Dollar has completed its pull back. AUD/USD”s break of 0.7295 minor support already indicates completion of rebound from 0.7201. Equivalent support at 1.1493 in EUR/USD and 1.2811 in GBP/USD will be watched. Also, if Gold breaks 1187.4, it will also mark the completion of rebound from 1160.

FOMC minutes show Fed is on track for rate hike in September

The minutes of the July 31-August 1 FOMC minutes revealed nothing that the markets didn’t know. Fed is going to raise the fed fund rate again in September, by 25bps to 2.00-2.25%. The minutes noted that “, any participants suggested that if incoming data continued to support their current economic outlook, it would likely soon be appropriate to take another step in removing policy accommodation.”

Stimulus remove is going to continue gradually as “participants generally expected that further gradual increases in the target range for the federal funds rate would be consistent with a sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term.”

Risks for economic forecasts are “balanced”. On the upside, ” household spending and business investment could expand faster over the next few years than the staff projected, supported in part by the tax cuts enacted last year”. On the downside, “trade policies could move in a direction that would have significant negative effects on economic growth”

Flattening of yield curve is a concern among some policy makers. “Several participants cited statistical evidence for the United States that inversions of the yield curve have often preceded recessions”. But, “other participants emphasized that inferring economic causality from statistical correlations was not appropriate.”

More on FOMC minutes: FOMC to Continue Rate Hike Despite Trump’s Criticism

US tariffs on $16B in Chinese goods kick in, as low-level conversations continue

A new round of US tariffs on Chinese imports has just started today. The US began collecting 25% tariffs on 279 lines of Chinese goods, totalling USD 16B in values. They add to the tariffs on USD 34B of Chinese imports which are already in effect. China is expected to start its retaliation tariffs soon.

At the same time, a rather low level Chinese delegation, led by Vice Commerce Minister Wang Shouwen started talks with his equivalent in Washington yesterday. Chinese Foreign Ministry spokesman Lu Kang yesterday that that “We hope that everyone can calmly sit down together and have earnest discussions toward an outcome that is beneficial to both sides.”

White House Press Secretary Sarah Sanders told reporters yesterday that “these conversations are continuing. I don’t have any announcements on them … Certainly what we’d like to see is better trade deals for the United States.”

No further comments were provided by the Treasury, the USTR office, the US Commerce Department and the Chinese Embassy.

No breakthrough in Mexico-US bilateral NAFTA talks, but Canada optimistic

The bilateral NAFTA meeting between Mexico and the US ended without breakthrough yesterday. Jesus Seade, designated chief negotiator of Mexican President-elect Andres Manuel Lopez Obrador, told reporters told reports that “We are already looking at all the issues. We might close this, not in a matter of hours, but these days. We still have next week.” Mexican Economy Minister Ildefonso Guajardo said talks will resume on Thursday.

Canada has been rejected from the supposed trilateral negotiation. But its Foreign Minister Chrystia Freeland still expressed optimism. She was in “very close contact” with her counterparts. And, she added “we are encouraged by the optimism that both countries have, and we are optimistic as well.” There are some concerns that Canada will face strong-arm tactics once the other two sides reach an agreement. But Freeland said “Canada will very much have a voice in the finalization of all of this.”

Australian Dollar tumbles broadly on domestic political turmoil

Australian Dollar is sold off sharply on domestic political turmoil which could eventually bring in the seventh prime minister in a decade. The government also adjourned the lower house of parliament until September 10 for the leading Liberal party to clear up its own mess.

Still Prime Minister Malcolm Turnbull survived a leadership challenge by seven votes earlier this week. But three of Turnbull’s key ministers changed they mind, including Finance Minister Mathias Cormann. Challenger, former Home Affairs Minister Peter Dutton called for another leadership vote today, which Turnbull is widely expected to fail.

In a crisis press conference, Turnbull said he would only step aside if rivals gather enough signatures. But in that case, the ballot could happen as early as mid-Friday. It’s reported that Treasurer Scott Morrison is prepared stand in take up Dutton’s challenge, to prevent the the Liberal party from turning further to the right.

Opposition Labor leader Bill Shorten criticized that the “cannibalistic behavior” over the Liberal leadership was eating the government alive.

Japan PMI manufacturing: Weaker international sales weighed on business confidence

Japan PMI manufacturing rose 0.2 to 52.5 in August, slightly above expectation of 52.4. Markit noted in the release that “input and output price inflation at multi-year highs.” While overall demand improves, “export orders fail to rise for a third straight month”.

Joe Hayes, Economist at IHS Markit, said that the growth cycle in Japan’s manufacturing sector extended to two years, “the longest uninterrupted stretch of expansion since the global financial crisis”. But declining export orders suggested the expansion was “underpinned by strength in the domestic market.”

Meanwhile, “weaker international sales weighed on business confidence, with panellists citing potential trade conflicts as a key risk to their outlook over the coming year.”

Looking ahead

Eurozone events are the main focuses today, including PMIs and ECB accounts. UK will release CBI reported sales. Later in the day, US will release jobless claims, house price index, PMIs and new home sales.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7335; (P) 0.7352; (R1) 0.7371; More…

AUD/USD’s sharp decline and break of 0.7295 minor support suggests that rebound from 0.7201 has completed at 0.7381 already. Intraday bias is turned back to the downside for retesting 0.7201 short term bottom. Firm break there will resume larger down trend from 0.8135. In case of anther recovery as consolidation from 0.7201 extends, we’d expect upside to be limited by 0.7425 resistance to bring larger down trend resumption eventually.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). But we’ll look at downside momentum to assess at a later stage. On the upside, break of 0.7452 resistance, however, will indicate medium term bottoming, on bullish convergence condition in daily MACD. In that case, a correction should be seen first, with stronger rebound would be seen to 38.2% retracement of 0.8135 to 0.7201 at 0.7558. The down trend from 0.8135 will resume after the correction completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | PMI Manufacturing Aug P | 52.5 | 52.4 | 52.3 | |

| 07:00 | EUR | France Manufacturing PMI Aug P | 53.5 | 53.3 | ||

| 07:00 | EUR | France Services PMI Aug P | 55.1 | 54.9 | ||

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 56.6 | 56.9 | ||

| 07:30 | EUR | Germany Services PMI Aug P | 54.4 | 54.1 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 55.1 | 55.1 | ||

| 08:00 | EUR | Eurozone Services PMI Aug P | 54.4 | 54.2 | ||

| 10:00 | GBP | CBI Realized Sales Aug | 13 | 20 | ||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (AUG 18) | 215K | 212K | ||

| 13:00 | USD | House Price Index M/M Jun | 0.30% | 0.20% | ||

| 13:45 | USD | Manufacturing PMI Aug P | 55.1 | 55.3 | ||

| 13:45 | USD | Services PMI Aug P | 55.9 | 56 | ||

| 14:00 | USD | New Home Sales Jul | 651K | 631K | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug A | -1 | -1 | ||

| 14:30 | USD | Natural Gas Storage | 47B | 33B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals