Yen regains some ground today as global markets, except US, are back in risk averse mode. Another day of selloff in the Turkish Lira is a reason for the selloff in European stocks. USD/TRY hits as high as 6.839 today and is currently up 4.76 %, 7.00 handle is within touching distance. Weakness in Chinese stocks and Asia is another factors weighing down sentiments. The US is making progress in trade negotiations with Mexico, Canada and the EU. But China as an outsider to the allies is left behind. Swiss Franc is following as the second strongest for today, Dollar as the third strongest.

Commodity currencies are generally under pressured. New Zealand Dollar was sold off earlier today on terribly bad business confidence data. Canadian Dollar also suffers some selling after Q2 GDP miss. USD/CAD surges on the back on contrasts in US and Canadian Dollar. However, it should be emphasized that 2.9% annualized growth is never a bad number for Canada. BoC is going to hike again, just a matter of September or October. And both Trump and Canadian Prime Minister Justin Trudeau expressed optimism that a trade deal can be concluded this week. So, we’d suggest not to be too bearish on Canadian Dollar.

In other markets, major European indices are all in red, with FTSE down -0.76%, DAX down -0.74% and CAC down -0.57%. EU showed friendly hands to UK on Brexit negotiation. It also indicated that auto tariffs can be scrapped if US does the same. But these positive factors are seemingly not enough to offset worries over Turkey. Earlier today Nikkei closed up 0.09%, Hong Kong HSI down -0.89%, China Shanghai SSE down -1.14% and Singapore Strait Times down -0.56%. Gold continues to trade in tight range above 1200 handle as consolidation extends.

US PCE inflation accelerated, jobless claims stay low, Canada GDP missed

US personal income rose 0.3% in July, spending rose 0.4%, both matched expectations. Headline PCE accelerated to 2.3% yoy, up from 2.2% yoy and beat expectation of 2.2%. PCE core also accelerated to 2.0% yoy, up from 1.9% yoy and matched expectation of 2.0% yoy. Core inflation now formally meet Fed’s target.

Initial jobless claims rose 3k to 213k in the week ended August 25, below expectation of 214k. Four-week moving average dropped -1.5k to 212.25k. That’s the lowest level since December 13, 1969. Continuing claims dropped -20k to 1.708m in the week ended August 18. Four-week moving average of continuing claims dropped -4.5k to 1.73125m.

Canada data was slightly less impressive. GDP rose 0.0% mom in June versus expectation of 0.2% mom. For Q2, GDP grew 2.9% annualized, slightly below expectation of 3.0%. Exports was the main driver to Q2’s growth, up 2.9%. Consumer spending growth also rose 0.6%. However, there was deceleration in business investments, contraction in inventories and imports. The set of data doesn’t add any additional reason for BoC to hike in September instead of October.

EU Malmström willing to scrap auto tariffs if US does the same

EU Trade Commissioner for Trade Cecilia Malmström told the European Parliament’s trade committee that they are willing to scrap auto tariffs in the negotiation with the US. She noted “we said that we are ready from the EU side to go to zero tariffs on all industrial goods, of course if the U.S. does the same, so it would be on a reciprocal basis.”

And, “we are willing to bring down even our car tariffs down to zero … if the U.S. does the same,” she said, adding that “it would be good for us economically, and for them.”

But she also emphasized that it’s not about “restarting TTIP” but aiming for “a more limited trade agreement.” And more importantly, “agriculture would not be in the agreement, nor public procurement as it looks to today.”

Eurozone economic sentiment dropped for the eighth straight month

Eurozone economic sentiment dropped -0.5 to 111.6 in August, down from 112.1 and below expectation of 112.2. That’s also the eighth straight month of deterioration. Industrial confidence dropped to 5.5, down from 5.8 and below expectation of 5.5. Services confidence dropped to 14.7, down from 15.3 and below expectation of 15.2. Consumer confidence was finalized at -1.9.

Eurostats noted that “the decrease in the euro-area sentiment indicator resulted from a marked deterioration of confidence among consumers and a milder decrease in the services sector, which were only partly offset by increases in the retail trade and construction sectors.” Meanwhile, “confidence in the industry sector remained broadly stable”.

Also, the sentiment indicator was virtually unchanged in Germany, which was down by -0.1. But notable decreases are seen in France (-1.3), Italy (-0.8), Spain (-0.7) and the Netherlands (-0.5).

Business climate indicator dropped to 1.22, down from 1.29 and missed expectation of 1.25.

Also released in European session, German CPI was unchanged at 2.0% yoy in August. Unemployment dropped -8k in August, matched expectation. Unemployment rate was unchanged at 5.2%. UK Mortgage approvals was unchanged at 65k in July. M4 money supply rose 0.9% mom in July.

EU Barnier: Irish border the most sensitive point but a solution is possible

EU chief Brexit negotiator Michel Barnier talked to German broadcaster Deutschlandfunk with a more neutral tone on Brexit today. He said that EU should be prepared for every outcome, and “that includes the no-deal scenario”. He also mentioned that the issue of Irish border was the “most sensitive point” of the negotiations. But he also noted that it is “possible” to have a solution.

Barnier said yesterday that the EU is “prepared to offer Britain a partnership such as there never has been with any other third country.” That’s taken as a sign of commitment to a deal.

Separately, it’s reported that EU officials are considering an unscheduled summit in November to conclude Brexit negotiations. It’s actually not news as the October summit is too tight while December one is too late to finalize all the parliamentary approvals.

Suggested reading on Brexit: The Real Meaning of “No Deal” Brexit

Swiss KOF dropped to 100.3, growth to hover around 10 year average

Swiss KOF Economic Barometer dropped 1.4 pts to 100.3 in August, below expectation of 101.2. KOF noted that it “pints to a level that is only marginally above its long-term average.” And, “in the near future Swiss growth should hover around its average over the last ten years.”

Also, it’s noted that “the strongest contributions to this negative result come from manufacturing, followed by the indicators from the exporting sector.” On the other hand, “the indicators related to private consumption give a positive signal. “. Financial and construction sectors were practically unchanged.

New Zealand business confidence plummets, AUD/NZD rebounds on Kiwi selloff

New Zealand ANZ business confidence tumbled by a further -5 pts in August to -50. Meanwhile, Activity Outlook was unchanged at 3.8. ANZ noted that “manufacturing is now the least confident sector – likely a lagged impact from construction sector woes”. On the other hand, The services sector is the most optimistic. Also “activity sub-indicators remain weak” and “threat to near-term activity is real.”

It’s a “particularly sharp turnaround” in the manufacturing sector from being the most optimistic in April, to the most pessimistic in August. Manufacturers’ export expectations are holding up. Thus, “this weakness is an echo of construction sector pessimism”. Employment intentions “continue to ease” and are weakest in “agriculture and construction sectors”. And, “it seems increasingly inevitable that wariness amongst firms will have real impacts, in the near term at least, as investment and employment decisions are deferred.”

Also released in Asian session, New Zealand building permits dropped -10.3% mom in July. Australian building approvals dropped -5.2% mom in July, private capital expenditure dropped -2.5% qoq in Q2. Japan retail sales rose 1.5% yoy in July.

USD/JPY Mid-Day Outlook

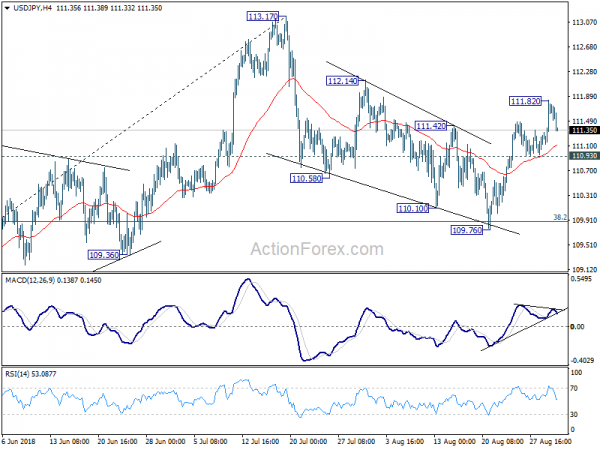

Daily Pivots: (S1) 111.23; (P) 111.53; (R1) 111.98; More…

USD/JPY retreats notably after hitting 111.82 and with 4 hour MACD crossed below signa line, intraday bias is turned neutral first. We’re holding on to the bullish case as long as 110.93 minor support holds. That is, correction from 113.17 should have completed at 109.76 already. On the upside, above 111.82 will target 112.14 resistance first. Break there should bring retest of 113.17 high. On the downside, however, break of 110.93 minor support will dampen the bullish case and turn focus back to 109.76 instead.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jul | -10.30% | -7.60% | -8.20% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | 1.50% | 1.30% | 1.80% | 1.70% |

| 01:00 | NZD | ANZ Business Confidence Aug | -50.3 | -44.9 | ||

| 01:30 | AUD | Building Approvals M/M Jul | -5.20% | -1.90% | 6.40% | |

| 07:00 | CHF | KOF Leading Indicator Aug | 100.3 | 101.2 | 101.1 | 101.7 |

| 07:55 | EUR | German Unemployment Change (000’s) Aug | -8K | -8K | -6k | |

| 07:55 | EUR | German Unemployment Claims Rate Aug | 5.20% | 5.20% | 5.20% | |

| 08:30 | GBP | Mortgage Approvals Jul | 65K | 65K | 66K | |

| 08:30 | GBP | Money Supply M4 M/M Jul | 0.90% | 0.20% | -0.30% | |

| 09:00 | EUR | Eurozone Business Climate Indicator Aug | 1.22 | 1.25 | 1.29 | |

| 09:00 | EUR | Eurozone Economic Confidence Aug | 111.6 | 112.2 | 112.1 | |

| 09:00 | EUR | Eurozone Industrial Confidence Aug | 5.5 | 5.9 | 5.8 | |

| 09:00 | EUR | Eurozone Services Confidence Aug | 14.7 | 15.2 | 15.3 | |

| 09:00 | EUR | Eurozone Consumer Confidence Aug F | -1.9 | -0.6 | -1.9 | |

| 12:00 | EUR | German CPI M/M Aug P | 0.10% | 0.10% | 0.30% | |

| 12:00 | EUR | German CPI Y/Y Aug P | 2.00% | 2.00% | 2.00% | |

| 12:30 | CAD | Quarterly GDP Annualized Q2 | 2.90% | 3.00% | 1.30% | 1.40% |

| 12:30 | CAD | GDP M/M Jun | 0.00% | 0.20% | 0.50% | |

| 12:30 | USD | Initial Jobless Claims (AUG 25) | 213K | 214K | 210K | |

| 12:30 | USD | Personal Income Jul | 0.30% | 0.30% | 0.40% | |

| 12:30 | USD | Personal Spending Jul | 0.40% | 0.40% | 0.40% | |

| 12:30 | USD | PCE Deflator M/M Jul | 0.10% | 0.10% | 0.10% | |

| 12:30 | USD | PCE Deflator Y/Y Jul | 2.30% | 2.20% | 2.20% | |

| 12:30 | USD | PCE Core M/M Jul | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | PCE Core Y/Y Jul | 2.00% | 2.00% | 1.90% | |

| 14:30 | USD | Natural Gas Storage | 58B | 48B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals