Trade war is back into the spot light today, sparkled by Trump’s Bloomberg interview with hostile comments on EU and China. Investor sentiments are clearly weighed down. At the time of writing, FTSE is down -0.58%, DAX down -0.75% and CAC down -1.04%. That followed broad based selling in Asian, with HK HSI down -0.98%, Shanghai SSE down -0.46%. Nikkei, though, was resilient and closed just down -0.02%.

Naturally, Yen and Swiss Franc are the strongest ones today on risk aversion. Dollar follows as the third strongest one, as it’s always stronger when trade tensions rises. Commodity currencies are broadly pressured with steep selling seen in Canadian Dollar in early US session.

Let’s not forget that today’s the the dead for Canada-US trade talk that Trump unilaterally, forcefully imposed. Words from officials have been positive on the talks up till yesterday. But a news report emerged today saying that the negotiations have turned sour. And a deal couldn’t be met by the end of the day. Let’s see.

EU responds strongly to Trump’s regrettable trade war rhetorics

Trump’s hostile rhetorics against the EU seem to have draw strong reactions from the latter. European Commission President Jean-Claude Juncker points to the “ceasefire agreement” with Trump made just a month ago, and said he hoped Trump will refrain from imposing auto tariffs. However, Juncker warned that the EU won’t let others dictate its own trade policies. And, if Trump violates the deal impose auto tariffs, the EU will “also do that”.

ECB Governing Council member Olli Rehn also urged Trump to stop the “regrettable” trade war rhetoric. And he warned that US exit from the WTO could damage international order. And he hit on Trump’s ungrounded claims and said ECB is certainly not manipulating the Euro. Rehn also defended China and said the Yuan is weaker because of trade war threat.

Another ECB Governing Council member Ewald Nowotny also said “the economic policy of the United States is currently one of the substantial risks to the global economy.” And he warned that unpredictable trade and economic policy, biased rulings in U.S. courts and the dominant role of the Dollar were bad for Europe. He added that there was an increasing interest for Europe “to free oneself from a one-sided dominance.”

In a Bloomberg interview, Trump rejected EU’s offer to scrap auto tariffs on cars if US does the same. He said “it’s not good enough” and added that “Their consumer habits are to buy their cars, not to buy our cars.” He also added that EU is “almost as bad as China, just smaller.”

UK Raab stubbornly optimistic on a Brexit deal

UK Brexit Minister Dominic Raab and EU chief negotiator Michel Barnier are going to have a marathon six-hour session today. Raab said that he was “stubbornly optimistic” to reach a deal with the EU. He added that “valuable progress” was made but there is clearly “more work to do. And, he is “confident, if not more confident, now that a Brexit deal can be reached”.

Barnier, on the other hand, emphasized that with “no backstop” no the Irish border, “there’s no deal”. And he urged that “operational backstop is a matter of some urgency”. He also reiterated the upbeat comment that the future partnership with the UK is “unprecedented”. And he’s optimistic that a deal could be reached by October.

Turkish Lira lifted mildly as Turkey raised tax on foreign currency savings

Turkish Lira is given a mild lift after the government announce to raise tax of foreign currency savings while scrapping tax on Lira savings. The decision was published in the Official Gazette today. Withholding tax on foreign currency savings of up to six months was increased from current 18% to 20%. On the other hand, withholding tax on Lira savings of more than one year was lowered from 10% to 0%.

Lira was sold off this week on deepening worries on Turkish banks. Fitch warned that “Turkish banks are particularly exposed to refinancing risk, given their reliance on external funding.” Moody’s also said “there is a heightened risk of a downside funding scenario, where a deterioration in investor sentiment limits access to market funding.”

On the data front

Canada IPPI dropped -0.2% mom in July, RMPI rose 0.7%. Eurozone CPI slowed to 2.0% yoy in August, core CPI also dropped to 1.0% yoy. Eurozone unemployment rate was unchanged at 8.2% in July. UK Gfk consumer confidence improved to -7 in August, up from -10 and beat expectation of -11. Japan industrial production dropped -0.1% mom in July versus expectation of 0.3% mom. Housing starts dropped -0.7% yoy versus expectation of 0.4.3% yoy. Unemployment rate rose 0.1% to 2.5% versus expectation of 2.4%. Tokyo CPU core rose to 0.9% yoy in August versus expectation of 0.8% yoy. China official PMI manufacturing rose 0.1 to 51.3 in August, above expectation of 51.0. Official non-manufacturing PMI rose 0.2 to 54.2, above expectation of 53.8.

USD/CAD Mid-Day Outlook

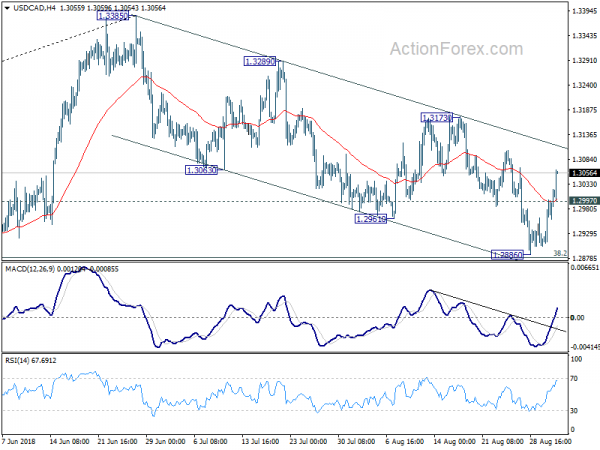

Daily Pivots: (S1) 1.2922; (P) 1.2961; (R1) 1.3021; More…

USD/CAD’s rebound from 1.2886 short term bottom accelerates to as high as 1.3062 so far in early US session. Intraday bias remains on the upside for short term channel resistance (now at 1.3116). Note again that the pair is staying in near term falling channel, and thus, there is no indication of bullish reversal yet. On the downside, below 1.2997 minor support will turn bias back to the downside for 1.2879 fibonacci level. However, sustained break the of the channel resistance will be the first sign of bullish reversal and bring stronger rise to 1.3173 resistance for confirmation.

In the bigger picture, the break of channel support (now at 1.2988), argues that rise from 1.2246, as well as that from 1.2061, has completed at 1.3385. Focus is back on 38.2% retracement of 1.2061 to 1.3385 at 1.2879. Decisive break there will affirm the case of medium term reversal and target 61.8% retracement at 1.2567 and below. That will also put key long term support at 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048 into focus. On the upside, break of 1.3173 resistance will revive the bullish case and target 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Aug | -7 | -11 | -10 | |

| 23:30 | JPY | Jobless Rate Jul | 2.50% | 2.40% | 2.40% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Aug | 0.90% | 0.80% | 0.80% | |

| 23:50 | JPY | Industrial Production M/M Jul P | -0.10% | 0.30% | -1.80% | |

| 01:00 | CNY | Manufacturing PMI Aug | 51.3 | 51 | 51.2 | |

| 01:00 | CNY | Non-manufacturing PMI Aug | 54.2 | 53.8 | 54 | |

| 01:30 | AUD | Private Sector Credit M/M Jul | 0.40% | 0.30% | 0.30% | |

| 05:00 | JPY | Housing Starts Y/Y Jul | -0.70% | -4.30% | -7.10% | |

| 09:00 | EUR | Eurozone Unemployment Rate Jul | 8.20% | 8.20% | 8.30% | 8.20% |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Aug | 2.00% | 2.10% | 2.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug A | 1.00% | 1.10% | 1.10% | |

| 12:30 | CAD | Industrial Product Price M/M Jul | -0.20% | 0.00% | 0.50% | |

| 12:30 | CAD | Raw Materials Price Index M/M Jul | 0.70% | -0.30% | 0.50% | |

| 13:45 | USD | Chicago PMI Aug | 64 | 65.5 | ||

| 14:00 | USD | U. of Mich. Sentiment Aug F | 95.8 | 95.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals