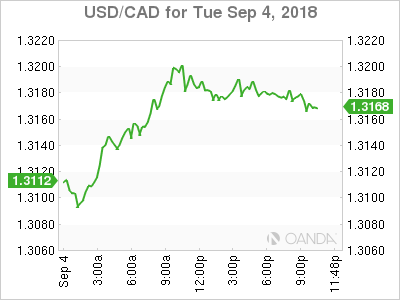

Canadian Dollar Falls as NAFTA 2.0 Agreement Remain Elusive

The USD/CAD rose 0.66 percent on Tuesday. The currency pair is trading at 1.3178 ahead of the release of the Bank of Canada (BoC) monetary policy decision on Wednesday. That same day the US-Canada trade negotiations are set to restart after failing to reach a deal last week. Coming back from the Labour day holiday in both Canada and the United States the comments from US President Trump during there weekend depreciated the loonie. Trump tweeted that there is no political necessity to keep Canada in the new NAFTA deal. The US reached an agreement with Mexico and it was widely expected that Canada would join that trade deal that will eventually replace NAFTA.

With a very short time for negotiation after Canada was cut out of the bilateral talks between the US and Mexico it is no surprise that a deal was not reached in the arbitrary deadline, but the market was optimistic about both sides getting to work after the long weekend. The CAD fell to a six week low awaiting the restart of negotiations.

The Bank of Canada (BoC) is not expected to lift interest rates tomorrow. The Canadian benchmark rate stands at 1.50 after a 25 basis point rate hike in July. Canadian fundamentals were softer in August making the case for a rate hike less likely. Trade uncertainty has also spiked even as a deal between the US, Mexico and Canada is the closest it has been since the start of the NAFTA renegotiations. The October policy meeting has risen in probability as there will be more facts around the negotiation and also more economic data to validate the BoC tightening pace.

Peso Lower as US Trade Talks Set to Resume with Canada

The USD/MXN gained on Tuesday. The currency pair is trading at 19.3678 and is in an upward trend that could erase all the peso gains after the Mexican elections. Political uncertainty as a party of the left took a lead in the polls and never let up put the currency above the 20 peso price level. Once Andres Manuel Lopez Obrador was the clear winner of the elections the peso quickly started to appreciate. The Mexican presidential transition gave US negotiators an opportunity to push for a bilateral deal and in a short time a US-Mexico trade agreement was signed. Mexican diplomats kept Canada in the conversation, if not the room as the US preferred the bilateral approach.

Now trade negotiations have hit a rough patch with Canada after failing to reach a fast agreement last week. The two teams will meet in Washington with emerging markets under pressure as trade concerns are on the rise and the appetite for risk diminishes. The Mexican peso is using up its goodwill due to the US-Mexico trade deal and could get dragged lower along other EM currencies.

Sterling Gets Carney Boost as Governor May Extend Term

The GBP/USD gained on Tuesday. The currency pair is trading at 1.2858 after Bank of England (BoE) Governor Mark Carney hinted that he might stay beyond June 2019. The five year term that started in 2013 has already been extended by one year to deal with Brexit uncertainty and today’s comments from Governor Carney were positive for the pound. After achieving rockstar status as the head of the Bank of Canada (BoC) Carney was appointed as the first non UK born Governor due to his track record on policy making during turbulent times. Carney’s comments today show that he is willing to stay until the end of the Brexit process and insure a smooth transition. Earlier that date was around the March 29,2019 Brexit deadline, but could now be extended by one or two years.

Brexit concerns are on the rise as after encouraging words by the EU’s chief negotiator Michel Barnier last week, the realities of the divorce are becoming more clear. The Irish border continue to be a hard item on the agenda and lobbying efforts from UK Prime Minister Theresa May have done little to provide encouraging news. Today’s remarks from the BoE Governor ends the uncertainty who will be at the helm during the aftermath of the separation.

Brexit regret appears to keep gaining momentum and two polls this week put it around 2.6 million people who voted for the divorce are having second thoughts. The political pressure at home and abroad will continue to comedown from all sides on Theresa May’s and could be the end of her political career.

Gold Lower as US Dollar Rises on Risk Aversion

Gold fell on Tuesday as the US dollar soared against major pairs. The yellow metal dropped below the $1,200 price level as US fundamentals firmed after the positive manufacturing data confirms the steady pace of the American economy. Trade war risk remains on the radar as additional US tariffs on China are set to kick in this week and weekend comments from President Trump did not help the US-Canada trade negotiations.

The market is worried about the potential side-effects of a full blown trade war on global growth. The tough stance on trade by the Trump administration has made the US dollar the main destination as investors shed their exposures to a protectionist scenario and buy into the greenback.

Iran and Weather Keep Crude Bid

Crude prices spiked on Tuesday after supply concerns followed the emergency evacuation of two oil platforms in the Gulf of Mexico. Oil came down to levels seen before the weather related disruption as the storm’s true impact will not be known in the short term. The US Bureau of Safety and Environmental Enforcement reported earlier that only 9.2% of Gulf of Mexico oil production would be affected by Tropical Storm Gordon.

Due to the Labour day holiday the Energy Information Administration (EIA) will release its crude oil inventories on Thursday at 11:00 am, instead of its regular schedule of Wednesday at 10:30 am.

Trade disputes have been oil negative this year as higher tariffs could have a negative impact on global growth estimates and hit demand for energy. Supply disruptions on the other hand have kept crude rising as the Iran sanctions, weather and other geopolitical supply concerns are balancing out the forecasted rise in production by OPEC members.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals