The US dollar is lower against major pairs on Wednesday. Advances in the US-Canada and Brexit negotiations eased fears of further tensions. American and Canadian negotiators restarted the NAFTA renegotiation talks today. Both parties remain optimistic on a positive outcome, but at the same time no ground is likely to be given away for free. The optimism surrounding a friendly divorce between the UK and the EU has gone through different stages since last week lead EU negotiator Michel Barnier said that a new model could be used. The rejection of the UK’s proposal is now putting the deal the EU negotiated with Canada as the top alternative.

Employment data in the United States will being to roll out with tomorrow’s release of the ADP non-farm payrolls report. The report by payment processor Automatic Data Processing (ADP) will be released at 8:15 am on Thursday, September 6. Job creation has been solid and another big gain is expected in the 180,000 to 200,000 range. After the ISM manufacturing PMI surprised to the upside on Tuesday the release of the non-manufacturing PMI at 10:00 am will be tracked by investors. Oil prices are lower on Wednesday as the market has digested the supply disruptions due to Tropical Storm Gordon with only 9 to 10 percent of total production potentially under threat. The release of the weekly crude stocks at 11:00 am will give more insight on how energy demand is faring.

- ADP Private payrolls expected to add 195,000 positions

- ISM non manufacturing PMI forecasted to improve to 56.8

- US Weekly crude inventories could again show a drawdown go 2 million barrels

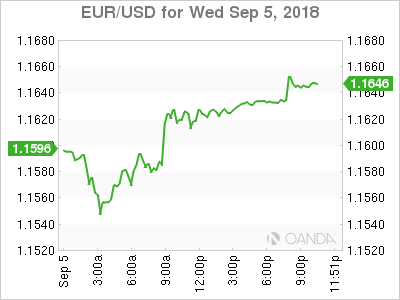

Euro Rises on German Brexit Comments

The EUR/USD gained 0.37 percent in the last 24 hours. The single currency is trading at 1.1625 after reports emerged that the UK and Germany had made progress on a Brexit deal. While details were scarce the marked sensed goodwill of German leaders that could translate into an easier trade negotiation with the EU. Trade tensions have been a major factor behind the appreciation of the US dollar. Risk aversion has risen as trade disputes could limit global growth and forcing investors to seek refuge. The US dollar has proven to be a safe haven to the detriment of major and emerging markets.

While Brexit news have been encouraging the fact remains that so far its only talk and with less than 8 months to go in negotiations a lot of work is still to be done. US-China conversations are yet to happen after a tariff war was declared and the NAFTA agreement is yet to agreed between the US and Canada using the US-Mexico deal as a template.

Oil Prices Caught Between Lagging and Leading Indicators

West Texas Intermediate fell 1.46 percent on Wednesday as Tropical Storm Gordon did not make it to a Hurricane and has moved away from energy operations in the Gulf of Mexico. Platforms in the area are now in the process of starting up again. Supply disruptions have boosted oil prices even though the market expects more production from OPEC members as the oil production cut agreed between the Organization of the Petroleum Exporting Countries (OPEC) and other major producers is due to end in 2018. The US sanctions on Iranian exports are starting to have a negative impact on supplies and even the threat of a weather related disruption was enough the get crude bid.

The eyes of energy traders will be on the weekly releases from the American Petroleum Institute and the Energy Information Administration (EIA) expecting drawdowns in crude inventories. Trade concerns have put pressure on energy prices as a new round of US tariffs on Chinese goods could be triggered this week after the comment period ends. Global demand for energy would fall as growth declines putting crude prices lower as the US dollar appreciates in that scenario. The lagging inventory data from last week could end up being supportive of higher oil prices, but as trade tensions rise oil prices would be put under downward pressure as global growth declines.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals